CAPE TOWN, South Africa--(BUSINESS WIRE)--Naspers Limited (JSE: NPN) delivered a strong performance in the six months ending 30 September 2021, growing ecommerce revenues 52%. The group stepped up investment to further accelerate growth across its increasingly valuable internet businesses.

Bob van Dijk, Group CEO, Prosus and Naspers, commented:

“In the first half of the year, our internet businesses delivered solid growth compounding a strong performance for the same period last year. Our progress is reflected in the increasing value attributed to our ecommerce portfolio and, to capture the significant opportunity ahead, we stepped up investment in our core segments of Food Delivery, Edtech, Payments and Fintech, and Classifieds. Naspers companies now serve more than two billion customers and we continue to build innovative products that make a difference in people’s lives.”

Group performance3 4

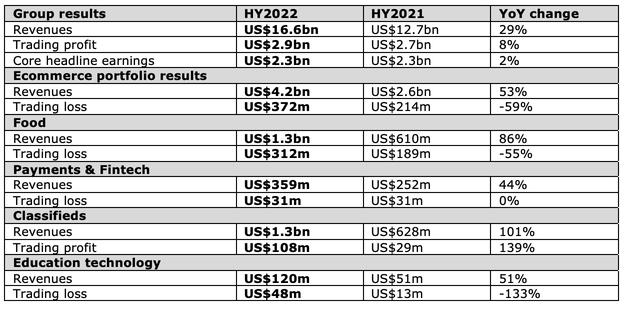

Group results | HY2022 | HY2021 | YoY change |

Revenues | US$17.2bn | US$13.0bn | 29% |

Trading profit | US$2.9bn | US$2.7bn | 9% |

Core headline earnings | US$1.5bn | US$1.6bn | -4% |

Ecommerce portfolio results | |||

Revenues | US$4.6bn | US$2.8bn | 52% |

Trading loss | US$374m | US$220m | -51% |

Food | |||

Revenues | US$1.3bn | US$610m | 86% |

Trading loss | US$312m | US$189m | -55% |

Payments & Fintech | |||

Revenues | US$359m | US$252m | 44% |

Trading loss | US$31m | US$31m | 0% |

Classifieds | |||

Revenues | US$1.3bn | US$635m | 100% |

Trading profit | US$108m | US$33m | 133% |

Education technology | |||

Revenues | US$120m | US$51m | 51% |

Trading loss | US$48m | US$13m | -133% |

1 Naspers ecommerce portfolio consists of all Naspers internet investments, excluding Tencent and VK/mail.ru.

2 The estimated market valuation is calculated as at 30 September 2021 using a combination of: (i) prevailing share prices for stakes in listed assets; (ii) valuation estimates derived from the average of sell-side analysts for stakes in unlisted assets; and (iii) post-money valuations on transactions of unlisted assets where analyst consensus is not available.

3 Group results shown on economic-interest basis (i.e., including a proportionate consolidation of the contribution from associates and joint ventures). Growth percentages shown in local currency terms, adjusted for acquisitions and disposals.

4 To reconcile revenue on an economic interest basis, with total consolidated revenue, see note 6, on page 28 of the Naspers condensed consolidated interim financial statements for the six months ended 30 September 2021.

Basil Sgourdos, Group CFO, Prosus and Naspers, commented:

“We have made good progress on several fronts in the first six months of the year. Our ecommerce portfolio continues to grow at pace and we are focused on investing behind that growth to build momentum and capture the significant opportunity we see ahead. To this effect, and as an indication of how we are scaling our businesses, we delivered 44% growth in our established and consolidated profitable businesses resulting in increased cash generation to the centre. At the same time as investing for growth, we continued to crystalise returns for shareholders during the period through a US$5bn share-repurchase programme. We also made an important capital structure change, completing the voluntary share exchange offer. Prosus and Naspers are now better sized on their respective stock exchanges. We have set a solid foundation for the group’s future growth.”

Ecommerce portfolio growing rapidly and increasing in value

Ecommerce revenues grew 52% to US$4.6bn versus a strong performance for the same period last year, and outpacing revenue growth at Tencent. This performance was led by 100% growth in Classifieds, 86% growth in Food Delivery, 51% growth in Edtech, and 44% growth in Payments and Fintech.

Analyst consensus estimates of the value of the ecommerce portfolio (excluding Tencent and VK/mail.ru) are increasing and is now approaching US$50bn. This substantial value appreciation translates to a 22% internal rate of return (IRR) on the US$22 billion invested over the last decade. A detailed breakdown of the net asset value of the Naspers portfolio is on the Naspers website here.

Classifieds – OLX Group

OLX Group delivered a strong performance versus the same period last year. In well-developed markets, such as Russia, Poland and Brazil, the group accelerated the development of new consumer propositions, such as pay-and-ship services, increasing trust and safety across its platforms and scaling its autos transactions business.

Revenues doubled to US$1.3bn and trading profit increased significantly, growing 133% to US$108m. Monthly paying listers rose 7% to 4.2m, reflecting the increased focus on monetisation in key markets.

OLX Autos delivered record volumes, with 69,000 car transactions during the period, up from 37,000 for the same period last year. Growth was strong, with revenue increasing 213% to US$605m.

In Russia, Avito delivered a strong performance, growing revenues by 67% to US$313m, with a trading profit margin of 48%.

OLX Europe performed well, with revenue rising 37% to US$230m, and OLX Brasil, our 50% joint venture with Adevinta, also grew strongly, with revenues up 40% to US$37m and improved trading profit.

Food Delivery – iFood, Swiggy and Delivery Hero

Performance in our global food delivery business remained strong. iFood, Swiggy and Delivery Hero are operating at significant scale and innovating beyond their core food delivery businesses into complementary adjacencies such as convenience and grocery delivery. Our food delivery businesses now cover more than 60 countries.

Gross merchandise value (GMV) for the Food Delivery segment grew 73%, with order growth of 70%, resulting in revenue of US$1.3bn (up 86% year-on-year). iFood, majority owned by Prosus, grew GMV by 50% and revenue by 38%. Delivery Hero recorded strong organic growth again in the first six months of its financial year to June 2021, supplemented by the Woowa acquisition. Orders and GMV increased by 83% and 86% to 1.4bn and €16.2bn, respectively.

Trading losses for the segment rose to US$312m, reflecting increased investment into adjacencies and customer acquisition costs as COVID-19 lockdowns eased, plus our stepped up stake in Delivery Hero. Operating margins in the Food Delivery segment improved meaningfully by 6 percentage points, as the business benefitted from increased scale.

Swiggy delivered a strong recovery through the first half of the financial year. The team delivered 56% growth in food delivery revenues, up 91% versus pre-COVID-19 levels. Grocery revenues grew 75% compared to March 2021.

Prosus is Delivery Hero’s largest shareholder with a 27.4% interest. On 30 September 2021, Prosus acquired an additional 2.5% interest for US$936m to offset any potential future dilution in the ordinary course of operations. We invested an additional US$274m in Swiggy during the period, taking our effective ownership to 36.3%, and in August 2021, we invested a further $120m in iFood, through Movile. Extending beyond food delivery into convenience and grocery delivery, Prosus co-led investment rounds in both Oda and Flink, in April and June 2021, respectively.

Payments & Fintech – PayU

PayU delivered solid results, serving the continuing global shift to digital payments, with total payment volume (TPV) growing 48% to US$35.3bn. PayU’s revenues grew 44% to US$359m, driven largely by a strong payments performance in our India business and resumed activity in credit. TPV in India grew 70%, to US$18.9bn and revenues increased 55% to US$133m

Our Global Payments Operations, focused mainly in Europe and Latin America, also delivered good growth. TPV grew 29% and revenues were up 27% to US$160m.

On 31 August 2021, we announced the acquisition of BillDesk in India for US$4.7bn which, subject to regulatory approval, would make the combined business a global top 10 online payments provider.

Our Payments and Fintech investments continue to perform well. Notably, in September, Remitly listed on the Nasdaq Stock Exchange with a market capitalisation of approximately US$8bn. PayU’s 23% stake and US$209m investment over the past four years represents an IRR of 86.9% as at 30 September, 2021.

Edtech

We continued to rapidly expand the scale and reach of our global Edtech business – combined, the portfolio currently serves more than 500 million users. The segment grew strongly during the period, delivering revenue growth of 51%, to US$120m in the first half of the financial year. Trading losses were US$48m versus US$13m for the same period last year, reflecting continued investment.

While we are already growing fast, we see significant further growth ahead. During the first six months of the year we added several new businesses to the portfolio including Stack Overflow, Skillsoft and GoodHabitz and we also invested further in Eruditus, Brainly, Codecademy, and SoloLearn.

As a leading global edtech investor, we have built a significant presence in enterprise education, investing behind the future of workplace learning. We reach 90% of the Fortune 100 across our corporate learning companies, including Stack Overflow, Skillsoft, GoodHabitz, Udemy and Codecademy.

Edtech is a significant new segment in the Prosus Ecommerce portfolio. Technology is transforming the sector and radically increasing access to education and learning across the world for many millions of people.

South African businesses

Takealot

The Takealot Group, comprising Takealot.com, Mr D Food, and Superbalist continued to benefit from the shift to online. The group grew revenues by 36%, while trading losses decreased to near breakeven with a trading loss of US$2m. Mr D Food, delivered strong results with order volumes growing 88% as consumer spending shifted from restaurant dining to online delivery. Superbalist grew revenue and trading margins despite increasing competition from brick-and-mortar fashion retailers.

Media24

Building on a strong start, Media24 closed the first half of the year with exceptional results, increasing revenue by 29% and delivering a trading profit of US$9 million. This turnaround performance to profitability against the prior year’s losses was underpinned by continued strong growth in digital subscribers and advertising, print media recovering much better than expected, excellent school textbook orders, the boom in ecommerce fulfilment, and sustained growth in external media logistics revenue – supported by the leaner cost base established in 2020.

Naspers Foundry

Naspers Foundry continues to enable South Africa’s nascent and vibrant tech ecosystem. The Foundry team backs and then supports early stage tech companies in South Africa to help them achieve their full potential. In the first half of this financial year, the team has invested nearly R200m in three promising technology companies: mobility technology company WhereIsMyTransport (R42 million); the digital insurance advice platform Ctrl (R34 million); and South Africa’s first fully digital insurance platform, Naked (R120 million). These three investments take the Naspers Foundry portfolio to seven companies with a combined investment of around R400 million since its launch in 2019. With a healthy pipeline of potential investments, in the coming months, Naspers Foundry expects to announce more backing for South Africa’s tech companies of the future.

Phuthi Mahanyele-Dabengwa, CEO, South Africa:

“We see tremendous opportunity for technology to drive inclusive economic growth and increased economic participation in South Africa. Through Naspers Foundry, Naspers Labs and the Naspers Bursary programme, we are increasing the economic participation of the country’s historically disadvantaged communities and boosting South Africa’s nascent but vibrant tech ecosystem. Our investments are supporting South Africa’s digital transformation, fostering innovation, and equipping the next generation with the skills they require to help the country become a world-class investment destination.”

Our impact

Naspers is a global consumer internet group with operations and investments in multiple sectors including food delivery, edtech, online classifieds, and payments and fintech. Through the Prosus Ventures team, we also back local technology entrepreneurs who are building the next wave of tech companies in fields such as health, logistics, blockchain, and social commerce. As a global group, we are acutely aware of our responsibility to society, the planet and our many stakeholders. We believe that the biggest positive impact we can have is through our capital allocation choices as an investor and our encouragement of high ESG performance across our portfolio companies.

In South Africa, we are helping to address youth unemployment, through Naspers Labs, a development programme that provides young people with the training and skills to pursue tech careers. Since March 2021, Naspers Labs has upskilled 630 young people through its digital skills training programmes, and has placed 778 unemployed graduates in jobs in collaboration with its implementing partners. Naspers is also the largest investor in South Africa’s SME Fund, a collaboration between government, labour and business. Naspers has invested R75 million in the fund to date to support and nurture the country’s SME sector.

We believe that education can play a pivotal role in empowering and transforming communities from the inside out. Our Naspers Bursary programme, supporting 80 students each year, aims to widen access to quality higher education for the next generation of South Africans, and was launched in October of this year.

Climate Change is an urgent and existential threat to the world we all live in, and we are united in our responsibility to act decisively as we transition to a low-carbon world. As a group, we have committed to be carbon neutral by 31 March 2022 and we have made commitments to the Task Force on Climate-Related Financial Disclosures as a supporter and as a signatory of the United Nations Global Compact.

Prosus has recently achieved an inaugural score of 73 out of 100 on the Dutch Transparency Benchmark, putting the company in the top 40 of the benchmark, and in 2021 has achieved a ‘low risk’ ESG rating from Sustainalytics. In November, Prosus achieved a 69% improvement in the annual S&P assessment and was included in the Dow Jones Sustainability Europe Index, a key reference point for ESG investors. Naspers’ score increased 52% in the same assessment.

Through technology investments, we are also able to encourage entrepreneurs focused on solutions to help others. For example, assistive technologies can create barrier free access to people living with disabilities. In India, where there are more than 70 million differently abled people, the Prosus Social Impact Challenge for Accessibility (SICA) provides an annual grant and mentorship to Indian start ups with the most innovative and promising solutions in the assistive technology space. Launched in 2020, SICA 2021 is underway and we will announce the winners of this year’s programme in December 2021.

For full details of the group’s results, please visit www.naspers.com.

About Naspers

Established in 1915, Naspers has transformed itself to become a global consumer internet company and one of the largest technology investors in the world. Through Prosus, the group operates and invests globally in markets with long-term growth potential, building leading consumer internet companies that empower people and enrich communities. Prosus has its primary listing on Euronext Amsterdam and a secondary listing on the Johannesburg Stock Exchange and Naspers is the majority owner of Prosus.

In South Africa, Naspers is one of the foremost investors in the technology sector and is committed to building its internet and ecommerce companies in the country. These include Takealot, Mr D Food, Superbalist, OLX, Autotrader, Property24 and PayU, in addition to Media24, South Africa’s leading print and digital media business.

Naspers is also focused on stimulating South Africa’s local tech sector through Naspers Foundry. This is a R1.4 billion investment vehicle that invests in early-stage technology companies that seek to address big societal needs. To help address youth unemployment in impoverished communities, in 2019, Naspers launched Naspers Labs, a development programme that provides young people with the training and skills to pursue tech careers.

Naspers has a primary listing on the Johannesburg Stock Exchange (NPN.SJ) and a secondary listing on the A2X Exchange (NPN.AJ) in South Africa, and has an ADR listing on the London Stock Exchange (LSE: NPSN).

For more information, please visit www.naspers.com.

About Naspers Foundry

Naspers Foundry is a R1.4 billion early-stage business funding vehicle dedicated to growing South Africa-focused technology companies.

In 2019, Naspers Foundry invested R30 million in SweepSouth, an online home and business cleaning services platform that connects clients with trusted, reliable cleaners.

Visit www.sweepsouth.com for more information.

In May 2020, Naspers Foundry invested R100 million in Aerobotics, an agritech company that provides tree crop health and yield intelligence data to the agricultural industry using drone and satellite-enabled AI technology.

Visit www.aerobotics.com for more information.

In September 2020, Naspers Foundry closed a transaction in Food Supply Network on undisclosed terms. The independent B2B marketplace integrates ordering systems of manufacturers, distributors, and buyers (restaurants, hotels and retailers) of food products.

Visit https://foodsupply.co.za/za/ for more information.

In November 2020, Naspers Foundry invested R45 million in online learning platform, The Student Hub. The company helps overcome the constraints of limited physical infrastructure and related resources by partnering with government accredited Technical and Vocational Education and Training (“TVET”) colleges to help them deliver their courses online.

Visit https://www.thestudenthub.co.za for more information.

In June 2021, Naspers Foundry invested R42 million in mobility technology company WhereIsMyTransport. The company maps formal and informal public transport networks and uses this data and technology to improve the public transport experience for millions of consumers in high-growth megacities globally.

Visit https://www.whereismytransport.com for more information.

Naspers Foundry invested R34 million in digital short-term insurance advice platform, Ctrl in July 2021. Ctrl provides a unique tech solution to the short-term insurance industry and consumers through its platform, connecting consumers, brokers and insurers in one place. The platform enables brokers to provide insurance advice digitally and allows underserved consumers to easily compare multiple quotes, obtain advice, accept cover and manage their policies.

Visit https://www.takectrl.co.za for more information.

In August 2021, Naspers Foundry announced a R120 million investment in Naked, an artificial intelligence (AI)-driven insurtech company offering a fully digital way for consumers to insure their cars, homes, and valuables. Naked is South Africa’s first fully digital insurance platform offering comprehensive and instant cover for cars, homes, contents, and standalone items.

Visit https://naked.insure for more information.

Naspers Labs

Naspers Labs is a youth development programme designed to transform and launch South Africa’s unemployed youth into economic activity. Naspers Labs has evolved its offering to focus on digital skills and training, enabling young people to pursue tech careers.

Naspers for Good

Naspers for Good is a corporate philanthropy fund administered by a committee of employees in South Africa. Through the fund, Naspers forms partnerships with organisations that have a proven track record of delivering solutions for the most pressing challenges affecting our communities. Email causes@naspers.com for more information.

Response to Covid-19

Naspers contributed R1.5 billion of emergency aid in support of the South African government’s response to the Covid-19 pandemic. This contribution consisted of R500 million towards the Solidarity Fund, and R1 billion worth of PPE sourced and distributed to South Africa’s front-line healthcare workers. In addition, Naspers contributed R6.9 million to the Nelson Mandela Foundation’s EachOne FeedOne programme to support families who have been impacted by Covid-19 with meals for a year.