Investment Thesis

Johannesburg-based company Sibanye Stillwater (NYSE:SBSW) released its six-month earnings results on August 26, 2021.

Results snapshot

Sibanye's balance sheet is particularly complicated and requires some focus and concentration to figure out what is going on. As many of you know, the company produces palladium, platinum, and rhodium in the USA (with a bit of gold and other metals) from direct mining and recycling (which generates a much lower profit margin).

In terms of revenue for Sibanye, South Africa continues to be the most significant source.

Sibanye reported record profits for H1 2021 of $1,707 million and record revenue of $6,182 million. The company's total profits climbed significantly from H1 2020.

Sibanye also came up with record-adjusted free cash flow estimated at $657 million, thanks to improved operational performance and higher commodity prices.

Investment Thesis

The investment thesis is straightforward with Sibanye Stillwater and has not changed despite a disappointing slide of the PGM prices losing their shine over the past several weeks.

The company should be considered an excellent long-term investment, and I recommend adding SBSW to your long-term premium portfolio. It is especially true now with a stock price down below $13 again.

The investment cycle in mining is long and can be extremely painful for investors who are not quick enough to recognize a top. However, the best time to buy mining businesses is when everyone hates them, which seems the case now.

SBSW can be used as a gold play, but mainly as a PGM play with palladium, platinum, and rhodium as main catalysts. Furthermore, Sibanye Stillwater is paying a dividend that is now 13.11% according to Finviz, well above the average yield in the gold industry.

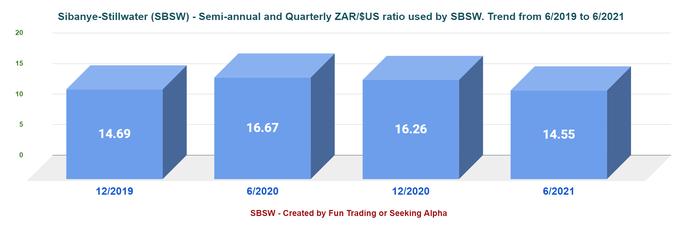

One crucial element that should be factored into your investing strategy is the currency fluctuation between the US dollar and the SA Rand ZAR. If the ratio goes lower, the results translated in US$ will be more significant.

While I consider SBSW an excellent long-term miner, it is also imperative to trade short-term LIFO a minimum of 30% of your long position to take advantage of the volatility and reduce risk.

One wild card that could hurt/boost the stock is that CEO Froneman has a strong reputation for executing high-flying deals, with a recently announced push into lithium being another case. This deal follows a similar more minor deal made in February with Finnish lithium company Keliber.

CEO Neal Froneman said in the conference call:

Stock performance

Below is the one-year chart comparison between the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX), the Aberdeen Standard Physical Palladium Shares ETF (NYSEARCA:PALL), the Aberdeen standard Phys Platinum ETF (NYSEARCA:PPLT), Sibanye Stillwater, and Impala Platinum (OTCQX:IMPUY).

We can see that SBSW has outperformed the three ETFs significantly and is now up 40% on a one-year basis. However, the slide has been brutal since May 2021.

Sibanye Stillwater ADR - H1 2021 - Balance Sheet history And Trend - The Raw Numbers

Note: The numbers below are indicated in US$.

Important: Each Sibanye Stillwater ADS represents four (4) Sibanye Stillwater Ltd. Shares. The Sibanye Stillwater ADRs trade on the New York Stock Exchange under the symbol SBSW.

| Sibanye Stillwater ADR | 12/2019 (6 months basis) | 6/2020 (6 months basis) | 12/2020 (6 months basis) | 6/2021 (6 months basis) |

| $US vs. ZAR | 14.69 | 16.67 | 16.26 | 14.55 |

| Total Revenues in $ Million | 3,386 | 3,301 | 4,439 | 6,182 |

| Basic Net Income in $ Million | 42 | 584 | 1,218 | 1,707 |

| Adjusted EBITDA $ million | 892 | 990 | 2,010 | 2,787 |

| EPS in $/share/ per ADR | 0.06/0.24 | 0.21/0.84 | 0.44/1.76 | 0.58/2.32 |

| Operating Cash flow in $ Million | 561 | 863 | 786 | 913 |

| Capital Expenditure in $ Million | 351 | 248 | 336 | 256 |

| Free Cash Flow in $ Million | 210 | 615 | 450 | 657* |

| Cash and cash equivalent $ Million | 401 | 694 | 1,378 | 1,829 |

| Borrowings including current in $ Million | 1,616 | 1,520 | 1,251 | 1,204 |

| Net debt (excluding Burnstone debt) in $ million | 1,427 | 930 | 0 | 0 |

| Shares outstanding (diluted) in Million | 685.4 | 736.7 | 708.3 | 744.7 |

| Production Au Oz | 12/2020 | 6/2020 | 12/2020 | 6/2021 |

| US 2E PGM Production | 305,202 | 297,740 | 305,327 | 298,301 |

| US recycling Oz | 431,681 | 397,472 | 442,698 | 402,872 |

| US AISC 2E/Oz Stillwater | 795 | 866 | 882 | 973 |

| SA 4E PGM | 980,343 | 630,912 | 895,459 | 894,165 |

| SA AISC 4E/Oz | 1,074 | 1,126 | 1,053 | 1,163 |

| Gold Production Au Oz | 587,908 | 403,621 | 578,939 | 518,848 |

| Average gold price $/oz | 1,432 | 1,613 | 1,850 | 1,792 |

| AISC Gold | 1,347 | 1,493 | 1,347 | 1,691 |

Source: Company release analysis.

* Estimated by Fun Trading.

Note: More historical data are available to subscribers only.

As I explained earlier, one crucial element that influences earnings is the exchange rate ZAR/$US. Below is the average historical ratio:

The Rand versus the US dollar was R14.55/US$ for 6/2021.

1 - Total Revenues were $6,182 million on June 30, 2021.

Revenues for the six months ending June 30, 2021, were $6,182 million compared to $3,301 million at the end of June 2020.

Also, Sibanye Stillwater's earnings per share are $0.58 per share (for ADR share, multiply the EPS by 4) compared to $0.21 per share in H1 2021.

Critical Highlights H1 2021:

Source: Presentation

Below is the detailed revenue per metal in H1 2021. Rhodium is now the most critical metal for Sibanye Stillwater.

2 - Free cash flow increased to $657 million on June 30, 2021.

Note: Generic free cash flow is cash from operations minus CapEx.

Yearly free cash flow is now $1,107 million, with free cash flow in H1 2021 of $657 million.

According to Nasdaq.com, the dividend is now $0.63 per ADR share payable on 9/30/2021.

3 - Debt was $1,204 million at the end of June 2021

The Cash and Cash equivalents are now $1,829 million, and LT debt, including current (excluding non-recourse debt), is $1,204 million.

The company has an excellent debt profile.

4 - H1 2021 production analysis

Sibanye Stillwater is producing Gold and PGM in both South Africa and the USA from Stillwater. It isn't an easy task.

The company operates the East Boulder and Stillwater mines in the US, which produce platinum and palladium. Also, the company is recycling platinum/palladium/rhodium.

US PGM Production 2E PGM Oz and Recycling 3E PGM Oz. ("USA")

The chart indicates the quarterly production and six months of production as well.

US Production 2E/PM was 298,301 2E Oz up from 297,740 2E Oz in 2020 and Recycling delivered 402,872 3E Oz, up 1.4% compared to 6/2020.

South African PGM Production: 4E PGM Oz and Gold Production.

The Gold production was 518,848 Au Oz, up 28.5% from 2020 (including Marikana operations) with an average price of $1,792 per Au Oz from $1,613 in 2020.

The 4E PGM production was 894,165 4E Oz, up 41.7% from 2020. It was a great performance in H1 2021.

Also, the company indicated $3,686 per Oz for the 4E PGM Price basket, up significantly from $2,002 per 4E PGM in June 2020.

Marikana operations have been successfully integrated with 13% cost reduction despite lower volumes from shaft closures and 2 years inflation.

There are three different AISCs for Sibanye Stillwater.

AISC type | 6/2021 | 6/2020 |

| AISC 2E PGM | 973 | 866 |

| AISC 4E PGM | 1,163 | 1,126 |

| AISC Gold | 1,691 | 1,493 |

5- Solid 2020 Reserve.

Source: 2020 Presentation

6 - Production guidance 2021

Source: Presentation

Technical analysis and commentary

Note: The chart is adjusted from the dividend.

SBSW forms a descending wedge pattern with resistance at $14.4 and support at $12.65. The trading LIFO strategy is to take profits between $14.35 and $16 (about 30%) and accumulate between $12.75 and $12.4.

The share price has been under pressure as platinum group metal prices have fallen out of favor. Palladium specifically drop below $2,000 recently.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!