MONTREAL, May16, 2022(GLOBE NEWSWIRE) -- PyroGenesis Canada Inc. (http://pyrogenesis.com) (TSX: PYR) (NASDAQ: PYR) (FRA: 8PY), a high-tech company (hereinafter referred to as the “Company” or “PyroGenesis”), that designs, develops, manufactures and commercializes advanced plasma processes and sustainable solutions which are geared to reduce greenhouse gases (GHG), is pleased to announce today its financial and operational results for the first quarter ended March 31st, 2022.

“We are happy to be announcing our Q1 2022 financial results. We have posted quarterly revenues of $4.2MM,” said Mr. P. Peter Pascali, CEO and Chair of PyroGenesis. “Our backlog remains very large, above $41MM, and despite gross reported revenue being impacted this quarter slightly by accounting procedures related to international logistical and shipping challenges, our factories continue to produce at a rapid rate, both against the backlog and in anticipation for new business throughout the year.

Perhaps even more exciting, our new business development efforts have grown dramatically, with a pipeline of pitched projects within the aluminum business line alone now over several hundred million dollars.

2022 continues to build on the foundation set by the previous two years. With the successful execution and delivery of the backlog of signed contracts, the benefit of the biogas upgrading projects from Pyro Green-Gas, and exploding interest across seemingly every aspect of the aluminum industry, 2022 is scaling up to be another great year for the company.

The board and I see continued production and sales success in the months ahead; as our iron ore pelletization torches enter into on-site client install and testing, 3D powder qualification with the global aerospace company moves to the finish line, and some of our potential aluminum projects in negotiations reach a signing point, we expect the backlog to race past the $50MM mark and beyond,” concluded Mr. Pascali.

Q1 2022 results reflect the following highlights:

OUTLOOK

With 2021 having achieved many important accomplishments and milestones, 2022 has begun by maintaining the accelerated business momentum of the previous two years.

Despite the continuing challenges of the global marketplace due to Covid, plus new challenges resulting from conflict in Ukraine, as well as energy supply shortages in Europe and China impacting both the cost and output of aluminum and steel, opportunities for PyroGenesis continue to expand across the board. Led by unprecedented awareness of the Company’s capabilities across the aluminum industry after the successful commissioning of its DROSRITETM metal recovery systems at a leading Middle Eastern primary aluminum producer; along with the discovery, pursuit, and active engagement of new market prospects both upstream and downstream from the Company’s DROSRITETM systems; and major new developments within primary, secondary (recycled) and tertiary (manufacturers’ in-house casting facilities) aluminum producers who are engaging the Company in a variety of discussions and negotiations regarding metal recovery, furnace retro-fitting, and comprehensive fuel-switching initiatives. These factors, bolstered by the quickening global push towards fossil fuel reduction at both industry and government levels that further showcases the PyroGenesis advantage, allows management to expect that tailwinds into an already strong pipeline will continue throughout 2022 and beyond.

Overall Strategy

Continuing to build on its strategy to offer technology solutions that provide benefits from greenhouse gas (“GHG”) emissions reduction,

While we had previously considered our strategy to be timely, as many governments are stimulating their respective economies by promoting and funding both environmental technologies and infrastructure projects; and after 2021 proved an even greater affirmation of this approach as major industries and organizations targeted by the Company not only recommitted to their targets, but in some cases raised them significantly, 2022 has brought about more circumstances that highlight how technology solutions like those from PyroGenesis will be in even greater demand.

In particular, the conflict in Ukraine has showed once again how geopolitical influences will continue to impact the supply of metals that are already under extraordinary market demand. As the war in the Ukraine drove supply chain issues and additional sanctions on Russia, aluminum spot-prices spiked as high as 60% year over year in March 2022 – up to $3,487 a tonne, a 30-year high – on worries about supply reductions from aluminum powerhouse Rusal.

The conflict also more fully exposed the vulnerability of aluminum producers to power availability and energy price uncertainty, as current energy supply challenges being experienced by European and Asian metal producers were exacerbated during the war.

All of these factors show that with global metal demand only growing (anticipated to grow by 80% by 2050), and industry carbon-reduction targets not yet on track to meet their goals, producers must find ways to improve their efficiency, and increase their yield of high-quality metal from current production – all while lowering their carbon footprint. PyroGenesis’ range of technology solutions provide just such an opportunity, with the Company’s DROSRITETM systems providing industry-leading dross recovery rates of high-quality aluminum, inline and on-site, with a lower operating expenses and lower carbon footprint than all competing technologies; meanwhile, the Company’s mainstay plasma torch offering provides another technology-driven solution for metal producers looking to reduce their reliance on a volatile natural gas supply chain (or any fossil fuel, for that matter) within any aspect of their operations that require metal melting or heating.

These same or similar pressures are affecting the global steelmaking industry, into which the Company has already sold initial torches for final pre-order trials; the Company expects similar positive outcomes as a result of these additional pressures.

For clarity, as stated many times, most of PyroGenesis’ product lines do not depend on environmental incentives (tax credits GHG certificates, environmental subsidies, etc.) to be economically viable; with the increased commitments by industry to carbon reduction, it is anticipated that the Company’s growth drivers will expand, and shareholders will see increased value.

The Company is not immune to the negative impact that COVID-19 and other external factors brought on businesses, specifically related to the work force and, more importantly, the supply chain. However, Management believes that the Company is better situated than most, and through various mitigation measures these challenges continue to be dealt with in an effective manner. The Company expects even greater improvements as the impact of COVID-19 and other external factors continues to recede after Q2 2022.

Organic Growth

Organic growth will be spurred on by (i) the natural growth of our existing offerings, which continue to be accelerated given our strong balance sheet (ii) leveraging off our insider “Golden Ticket” advantage that because of, for example, the fact that the inline, hot dross-enabled DROSRITETM system in installed inside a customer’s facility (vs. the legacy cold-dross Rotary Salt Furnace approach that is installed off-site), this allows us to see first-hand some of the additional and peripheral needs of our customers, and (iii) exploring new ways scientifically (and corresponding markets laterally) to provide unique solutions and value that helps industries deal with some of the most pressing environmental, engineering, and energy problems.

A “Golden Ticket” provides the opportunity to either, (i) cross sell other products or, ideally, (ii) identify new areas of concern that can be addressed uniquely by PyroGenesis.

Over the past several years, PyroGenesis has successfully positioned each of its business lines for rapid growth by strategically partnering with multi-billion-dollar entities. These entities have identified PyroGenesis’ offerings to be unique, in demand, and of such a commercial nature as to warrant such unique relationships. We expect that these relationships are now positioned to transition into significant revenue streams.

Aluminum Industry Process Improvement

As mentioned in previous reports, momentum with PyroGenesis’ Aluminum Industry strategy and offering continues to not just bear fruit, but to explode in opportunity in several different directions.

In 2021, the Company concluded a joint venture and a license agreement with an existing and proven technology provider. The technology is geared to uniquely handle the residues resulting from the processing of dross in the aluminum industry. We had previously announced our intention to secure this technology and would not only make our traditional DROSRITE™ offering more appealing but could also be offered as a stand-alone product. We believe that valorizing the residues and producing high end products will further define us as the go-to company for all dross related processing. This is a prime example of our “Coffee & Donuts” strategy in play. The joint venture will only relate to the new technology and, as such, PyroGenesis will not have to vet in any assets or IP (specifically not the DROSRITE™ technology).

Overall, the Company is now one of the largest and certainly the fastest growing dross recovery solutions in the world, with 11 large DROSRITE™ systems in use or slated for delivery to markets around the world, and three more LOI’s. The Company also continues to increase the price and the efficiency of its systems, and is pitching several more contracts as of the writing of this document.

During the quarter, the Company announced on February 2, receipt of a $4M purchase order for the first of three 10-ton DROSRITETM systems from an existing client, which followed the receipt of a letter of intent (LOI) from the existing client on June 07, 2021.

Steel Industry Process Improvement

With steelmaking being one of the most carbon-emission intensive industries in the world, estimated to be responsible for between 7 to 12 per cent of all global fossil fuel and greenhouse gas emissions, that industry continues to be under intense pressure, including huge financial penalties, to find emission reductions.

This pressure on the steel-making industry allows PyroGenesis to expect demand for its upstream, iron ore pelletization solution to increase significantly, as steelmakers look to all aspects of the production lifecycle for carbon reduction opportunities.

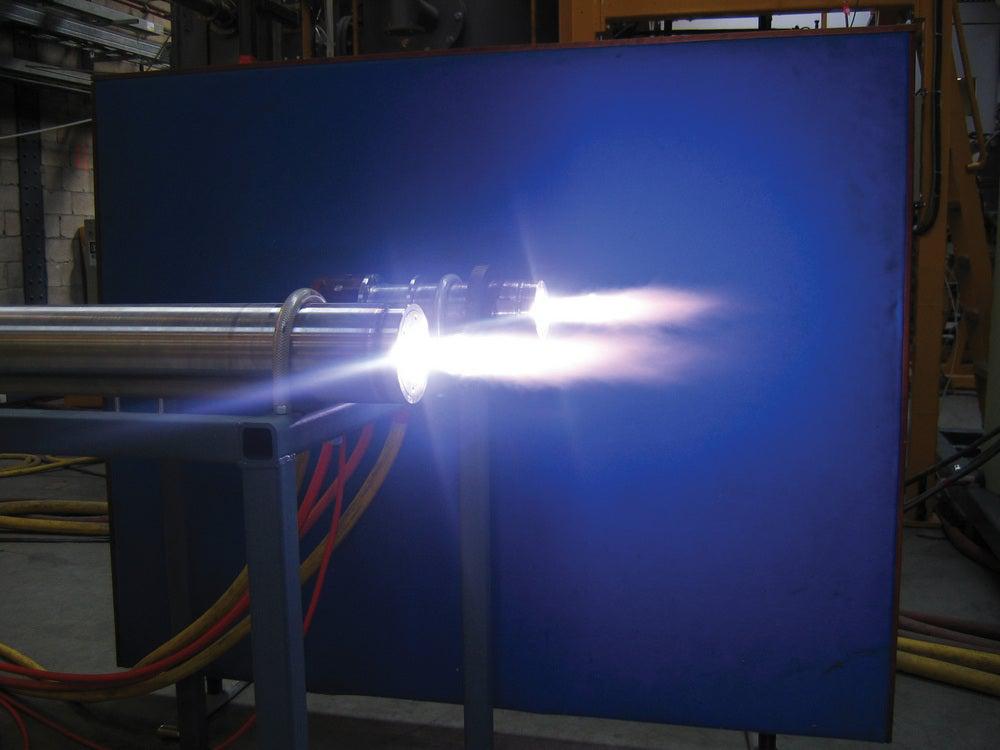

Serious consideration is being given to replacing large numbers of the fossil fuel burners in iron ore pelletization with PyroGenesis’ proprietary and patented plasma torches. To date, everything is proceeding as expected. Initial discussions with potential customers have evolved into confirmation stages, computer simulations, business case development, and initial torch orders for in-factory testing with two of the largest steelmaking and mining companies in the world. As these torches are tested in live settings over the coming months, the company expects a resulting roll-out program to replace many, if not all, fossil fuel burners with PyroGenesis’ plasma torches in the customers’ iron ore pelletization furnaces – a technology process for which PyroGenesis, as the patent holder, commands a significant competitive advantage.

During the quarter, the company announced on January 27 the scheduling of a factory acceptance test (FAT) for plasma torches for its “client A”, a multi-billion dollar international producer of iron ore. Subsequently, on February 8, the Company announced the completion of said FAT, and further announced that the torch system would be shipped to the Client’s facility, with scheduled arrival on or about the end of Q2 2022.

On February 1, the Company provided a cost estimate for 36 plasma torches to that same Client A. The estimate was accordingly provided, at an estimated value of $95-115 million. The range is an estimate due to certain uncertainties which will be more clearly defined in due course.

PyroGenesis expects that the previously mentioned government initiatives, geared to stimulating their respective economies by promoting and funding environmental technologies and infrastructure projects, will only serve to increase interest in PyroGenesis’ plasma torch offerings to other companies in this space. While potential clients seeking government support for large initiatives may draw out the onset of large contracts, the sheer number of potential customers, and the fact that the Company will engage with many of them in different stages at different times, will help to ensure a long, overlapping pipeline of potential projects.

In addition, PyroGenesis is proactively targeting other industries which are experiencing significant pressure to reduce GHGs, and which utilize fossil fuel burners as well, such as the cement, aluminum, and automotive industries.

Plasma Torches for Emerging / Niche Markets

Separately, the Company also offers plasma torches to emerging / niche markets where there is a high probability of on-going sales from successful implementation.

One such example is when, during the quarter, on February 7, the Company announced that it had signed a $273,000 contract with a European research centre, to manufacture and deliver a 50Kw methane plasma torch, which will be used by the client to develop a process to convert hydrocarbons, including methane (a greenhouse gas), into useful chemicals such as olefins (e.g. ethylene, propylene, etc.), thereby significantly reducing GHGs.

For each new market, the Company will also benefit from providing proprietary spare parts and service, which generates significant recurring revenue, thus complementing the Company’s long-term strategy to build a recurring revenue model.

Additive Manufacturing (Metal Powders for 3D Printing)

With respect to additive manufacturing, we continue to expect to see significant year over year improvements in our 3D metal powders offering as our NexGen™ facility, which incorporates all the previously disclosed benefits (increased production rates and lower capital & operating expenditures), is now officially on-line and operational.

Of note, a major tier-one global aerospace company has already entered into an agreement with the Company to formally qualify its powder, at considerable expense to the global aerospace company, with a view towards having the Company become a supplier.

There are additional major top tier aerospace companies and OEMs, in both Europe and North America, eagerly awaiting powders from this new state-of-the-art production line, and we are currently in the process of supplying sample powders to them for analysis.

The Company expects that such developments will continue and will translate into significant improvements in contributions to revenue by this segment in the mid-long term.

HPQ/PUREVAP™

With respect to HPQ, the goal is to continue to expand our role as HPQ’s technology provider for the game changing family of silicon processes which we are developing exclusively for HPQ and its wholly owned subsidiaries HPQ Nano Silicon Powders Inc. and HPQ Silica Polvere Inc., namely:

Government participation in a $5.3MM funding of the fumed silica project confirms our expectation that 2022 should be a year in which significant developments occur on all these fronts.

Land Based Units/Environmental

The Company did not previously aggressively target the Company’s land-based/environmental solutions during the period where the Company’s other offerings, such as in steelmaking and aluminum industry process improvement, were accelerating.

However, during 2021, interest in the Company’s capabilities in this arena was renewed. Besides the interest in niche torch applications mentioned above (ex. medical waste), PyroGenesis’ plasma-based solutions have generated interest in processing a waste stream that has recently been classified as hazardous. Management believes that, in a current bidding process, its solution is the technology of choice. If successful, this will represent a significant positioning of PyroGenesis plasma-based solutions not only for this specific product line but, when taken in conjunction with the historic success with its offering on US Aircraft carriers, the land based/environmental segment in general.

Growth through Synergistic Mergers and Acquisitions

As previously disclosed, the Company is conservatively considering synergistic merger and acquisition strategies to augment its growth, and the Company has been very actively involved in pursuing several opportunities to support this strategy. In so doing, the focus has been on private companies exclusively which (i) primarily leverage the Company’s Golden Ticket advantage, or (ii) could uniquely benefit from the Company’s engineering advantage and/or international relationships.

During 2021, the Company acquired AirScience Technologies Inc. (“AST”), a company with experience in biogas upgrading. PyroGenesis believes that AST’s experience in biogas upgrading, combined with PyroGenesis’ engineering and multidisciplinary skills, as well as its proven record of meeting the exacting demands of multibillion-dollar companies and the US military, positions the combination well to address the opportunities arising from this growing need to generate renewable natural gas.

The acquisition of AST also provides potential synergies with PyroGenesis’ land-based waste destruction offerings which, if successful, will significantly increase their value to the market. AST’s technology complements PyroGenesis’ existing offerings and further strengthens PyroGenesis’ position as an emerging leader in GHG solutions for sustainable long-term growth.

Our objective is to strengthen AST’s operations and quality control systems, over the course of the next 12-15 months, while at the same time increasing the backlog of signed contracts and successfully delivering on existing contracts thus positioning AST as a significant and credible player in the marketplace. Once established, we will evaluate our options to accelerate the rollout of these solutions.

Additional Opportunities - Plasma Torches:

Within the Plasma Torch line of business, the Company continues to consider options to leverage its plasma expertise and continue to review torch technologies that could complement existing offerings, leverage off their unique relationships, or explore new opportunities. In early stage discussion across many sectors and many potential customers, no additional details are available at this time.

CONCLUSION

In conclusion, PyroGenesis sees 2022 as a platform from which decades of exponential growth will stem.

The Company plans to take advantage of its unique position in its main business offerings to accelerate growth, with a particular emphasis on offerings geared to aggressively reducing GHG emissions and the world’s carbon footprint, while finding and offering solutions to pressing environmental, engineering, and energy challenges.

Financial Summary

Revenues

PyroGenesis recorded revenue of $4,206,762 in the first quarter of 2022 (“Q1, 2022”), representing a decrease of 33% compared with $6,264,503 recorded in the first quarter of 2021 (“Q1, 2021”).

Revenues recorded in the first quarter of 2022 were generated from:

| (i) | DROSRITE™ related sales of $900,079 (2021 Q1 - $2,740,725) |

| (ii) | PUREVAP™ related sales of $441,605 (2021 Q1 - $625,086) |

| (iii) | torch related sales of $1,041,709 (2021 Q1 - $195,221) |

| (iv) | development and support related to systems supplied to the U.S. Navy of $745,260 (2021 Q1 - $2,586,021) |

| (v) | Biogas upgrading and pollution controls of $990,045 (2021 Q1 - $Nil) |

| (vi) | other sales and services of $88,064 (2021 - $117,450) |

Cost of Sales and Services and Gross Margins

Cost of sales and services before amortization of intangible assets was $2,936,280 in Q1 2022, representing a decrease of 29% compared with $4,114,713 in Q1 2021, primarily due to a decrease in direct materials and manufacturing overhead of $1,784,445, offset by the increase of $606,659 in employee compensation, subcontracting, and foreign exchange charge on materials.

In Q1 2022, employee compensation, subcontracting, and foreign exchange charge on materials increased to $1,695,707 (Q1 2021 - $1,089,048). The gross margin for Q1 2022 was $1,051,723 or 25% of revenue compared to a gross margin of $2,143,010 or 34.2% of revenue for Q1 2021. As a result of the type of contracts being executed, the nature of the project activity, as well as the composition of the cost of sales and services, as the mix between labour, materials and subcontracts may be significantly different. In addition, due to the nature of these long-term contracts, the Company has not necessarily passed on to the customer, the increased cost of sales which was attributable to inflation, if any.

Investment tax credits related to qualifying projects from the provincial government were $10,498 (2021 - $26,649). The Company also recorded for the three months ended March 31, 2022, $1,829 (2021 - $1,183) of the investment tax credits against cost of sales and services, $1,168 (2021 - $17,967) against research and development expenses and $7,500 (2021 - $7,500) against selling general and administrative expenses.

The amortization of intangible assets of $218,759 in Q1 2022 compared to $6,780 for Q1 2021 relates mainly to the intangible assets in connection with the Pyro Green-Gas acquisition, patents and deferred development costs. These expenses are non-cash items and will be amortized over the duration of their expected lives.

Selling, General and Administrative Expenses

Included within Selling, General and Administrative expenses (“SG&A”) are costs associated with corporate administration, business development, project proposals, operations administration, investor relations and employee training.

SG&A expenses for Q1 2022 excluding the costs associated with share-based compensation (a non-cash item in which options vest principally over a four-year period), were $3,942,738 representing an increase of 41% compared with $2,803,095 reported for Q1 2021.

The increase in SG&A expenses in Q1 2022 over the same period in 2021 is mainly attributable to the net effect of:

| (i) | an increase of 37% in employee compensation due primarily to additional head count, |

| (ii) | a decrease of 33% for professional fees, primarily due to a decrease in accounting fees, legal fees, and listing fees. |

| (iii) | an increase of 47% in office and general expenses, is due to an increase in stationary and office and computer related expenses, |

| (iv) | travel costs increased by 267%, due to an increase in travel abroad, |

| (v) | depreciation on property and equipment increased by 87% due to higher amounts of property and equipment being depreciated, |

| (vi) | depreciation on right of use assets increased by 63% due to higher amounts of right of use assets being depreciated, |

| (vii) | Investment tax credits were the same year to year, |

| (viii) | government grants increased by 100% due to higher levels of activities supported by such grants, |

| (ix) | other expenses increased by 317%, primarily due to an increase in insurance. |

Separately, share based payments increased by 81% in Q1 2022 over the same period in 2021 as a result of the stock options granted in 2020, 2021 and 2022. This was directly impacted by the vesting structure of the stock option plan with options vesting between 10% and 100% on the grant date requiring an immediate recognition of that cost.

Research and Development (“R&D”) Costs

The Company incurred $482,432 of R&D costs, net of government grants, on internal projects in Q1 2022, an increase of 69% as compared with $286,307 in Q1 2021. The increase in Q1 2022 is primarily related to an increase in employee compensation, materials and equipment and other expenses and a decrease in investment tax credits and government grants recognized.

In addition to internally funded R&D projects, the Company also incurred R&D expenditures during the execution of client funded projects. These expenses are eligible for Scientific Research and experimental Development (“SR&ED”) tax credits. SR&ED tax credits on client funded projects are applied against cost of sales and services (see “Cost of Sales” above).

Financial Expenses

Finance expenses for Q1 2022 totaled $183,900 as compared with $53,087 for Q1 2021, representing an increase of 246% year-over-year. The increase in finance expenses in Q1 2022, is primarily attributable to higher interest and accretion due on the business combination.

Strategic Investments

The adjustment to fair market value of strategic investments for Q1 2022 resulted in a gain of $1,176,755 compared to a gain in the amount of $5,634,722 in Q1 2021. The decrease is primarily attributable to the decreased market share value of common shares and warrants owned by the Company of HPQ Silicon Resources Inc.

Comprehensive (Loss) Income

The comprehensive loss for Q1 2022 of $4,069,119 compared to an income of $3,712,903, in Q1 2021, represents a decrease of 210% year-over-year. The decrease in income of $7,782,022 in the comprehensive loss in Q1 2022 is primarily attributable to the factors described above, which have been summarized as follows:

| (i) | a decrease in product and service-related revenue of $2,057,741 arising in Q1 2022, |

| (ii) | a decrease in cost of sales and services of $966,454, primarily due to a decrease in direct materials and manufacturing overhead & other, and an increase in employee compensation, subcontracting, foreign exchange charge on materials, investment tax credits, and amortization of intangible assets, |

| (iii) | an increase in SG&A expenses of $1,139,643 arising in Q1 2022 primarily due to an increase in employee compensation, professional fees, office and general, travel, depreciation in property and equipment, depreciation ROU assets, government grants, other expenses and share based expenses, |

| (iv) | an increase in R&D expenses of $196,126 primarily due to an increase in subcontracting, material and equipment and other expenses, |

| (v) | an increase in financial expenses of $130,813 in Q1 2022 primarily due to interest on lease liabilities, interest accretion on balance due on business combination and other interest expenses, |

| (vi) | a decrease in fair value adjustment of strategic investments of $4,588,780 in Q1 2022. |

EBITDA

The EBITDA in Q1 2022 was a $3,300,693 loss compared with an EBITDA gain of $3,950,881 for Q1 2021, representing a decrease of 184% year-over-year. The $7,251,574 decrease in the EBITDA loss in Q1 2022 compared with Q1 2021 is due to the decrease in comprehensive loss of $7,782,023, an increase in depreciation on property and equipment of $66,673, an increase in depreciation ROU assets of $64,430, an increase in amortization of intangible assets of $211,979, an increase in financial expenses of $130,812, and an increase in income taxes of $56,553.

Adjusted EBITDA loss in Q1 2022 was $1,631,063 compared with an Adjusted EBITDA gain of $4,873,221 for Q1 2021. The decrease of $6,504,284 in the Adjusted EBITDA loss in Q1 2022 is attributable to a decrease in EBITDA loss of $7,251,574, and by an increase of $747,289 in share-based payments.

The Modified EBITDA loss in Q1 2022 was $2,807,818 compared with a Modified EBITDA loss of $761,501 for Q1 2021, representing a decrease of 269%. The increase of $2,046,319 in the Modified EBITDA loss in Q1 2022 is attributable to the decrease as mentioned above in the Adjusted EBITDA of $6,504,284 and a decrease in the change of fair value of strategic investments of $4,457,967.

Liquidity

As at March 31,2022, the Company has cash and cash equivalents of $6,612,624. In addition, the accounts payable and accrued liabilities of $9,378,832 are payable within 12 months. The Company expects that its cash position will be able to finance its operations for the foreseeable future

About PyroGenesis Canada Inc.

PyroGenesis Canada Inc., a high-tech company, is a leader in the design, development, manufacture and commercialization of advanced plasma processes and sustainable solutions which reduce greenhouse gases (GHG), and are economically attractive alternatives to conventional “dirty” processes. PyroGenesis has created proprietary, patented and advanced plasma technologies that are being vetted and adopted by multiple multibillion dollar industry leaders in four massive markets: iron ore pelletization, aluminum, waste management, and additive manufacturing. With a team of experienced engineers, scientists and technicians working out of its Montreal office, and its 3,800 m2 and 2,940 m2 manufacturing facilities, PyroGenesis maintains its competitive advantage by remaining at the forefront of technology development and commercialization. The operations are ISO 9001:2015 and AS9100D certified, having been ISO certified since 1997. For more information, please visit: www.pyrogenesis.com.

This press release contains certain forward-looking statements, including, without limitation, statements containing the words "may", "plan", "will", "estimate", "continue", "anticipate", "intend", "expect", "in the process" and other similar expressions which constitute "forward- looking information" within the meaning of applicable securities laws. Forward-looking statements reflect the Corporation's current expectation and assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These forward-looking statements involve risks and uncertainties including, but not limited to, our expectations regarding the acceptance of our products by the market, our strategy to develop new products and enhance the capabilities of existing products, our strategy with respect to research and development, the impact of competitive products and pricing, new product development, and uncertainties related to the regulatory approval process. Such statements reflect the current views of the Corporation with respect to future events and are subject to certain risks and uncertainties and other risks detailed from time-to-time in the Corporation's ongoing filings with the securities regulatory authorities, which filings can be found at www.sedar.com, or at www.sec.gov. Actual results, events, and performance may differ materially. Readers are cautioned not to place undue reliance on these forward-looking statements. The Corporation undertakes no obligation to publicly update or revise any forward- looking statements either as a result of new information, future events or otherwise, except as required by applicable securities laws. Neither the Toronto Stock Exchange, its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) nor the NASDAQ Stock Market, LLC accepts responsibility for the adequacy or accuracy of this press release.

SOURCE PyroGenesis Canada Inc.

For further information please contact:

Rodayna Kafal, Vice President, IR/Comms. and Strategic BD

Phone: (514) 937-0002, E-mail: ir@pyrogenesis.com

RELATED LINK: http://www.pyrogenesis.com/