High Tide Inc. (NASDAQ:HITI) Q4 2021 Earnings Conference Call January 27, 20226:00 PM ET

Company Participants

Krystal Dafoe - Investor Relations

Raj Grover - President and Chief Executive Officer

Rahim Kanji - Chief Financial Officer

Conference Call Participants

Scott Fortune - ROTH Capital Partners

Andrew Semple - Echelon Capital Markets

Frederico Gomes - ATB Capital Markets

John Chu - Desjardins Capital Markets

Operator

Good evening. My name is Hannah and I will be your conference operator today. At this time, I would like to welcome everyone to the High Tide Inc. Fourth Quarter Fiscal Year 2021 Financial and Operational Results Conference Call. All lines have been placed on mute to prevent any background noise. [Operator Instructions] I will now turn the call over to your host, Krystal Dafoe with High Tide. Please proceed.

Krystal Dafoe

Thank you, Hannah. Good evening, everyone and welcome to High Tide Inc.’s quarterly earnings call. Joining me on the call today are Mr. Raj Grover, President and CEO and Rahim Kanji, CFO.

Earlier today, the company released the highlights from its financial and operational results for the fiscal fourth quarter and year ended October 31, 2021. Before we begin, I’d like to remind everyone that certain statements made on today’s call may contain forward-looking information within the meanings of applicable securities laws. Such statements may include estimates, projections, goals, forecasts, or assumptions, which are based on current expectations and are not representative of historical facts or information. We want to be clear that such forward-looking statements represent the company’s beliefs about future events, plans or objectives and are inherently uncertain and are subject to numerous risks and uncertainties that may cause the actual results or performance to differ materially from such statements.

Additional information about both the material factors and assumptions forming the basis of our forward-looking statements and risks and which could cause actual results or performance to differ materially and the material factors or assumptions that were applied to make certain conclusions, forecasts or projections in forward-looking statements on this call is contained both in a readily available document available upon request and in our regulatory filings available on SEDAR and EDGAR under the company’s profile.

High Tide does not undertake any duty to publicly announce the results of any revisions to any forward-looking statements in this call or to update or supplement any information provided in today’s call. In addition, on this call, we will refer to supplemental non-GAAP accounting measures, including adjusted EBITDA, which do not have any standardized meaning as prescribed by IFRS. We believe these non-IFRS financial measures assist management and investors in understanding and analyzing our business trends and performance. Please refer to our earnings press release for a calculation of these measures and reconciliations to the most directly comparable measures calculated and presented in accordance with IFRS. These non-IFRS measures should only be considered superior to – should not be pardon me, these non-IFRS measures should not be considered superior to as a substitute for or as an alternative to and should be considered in conjunction with the IFRS financial measures presented on the financial statements listed on SEDAR.

It is now my pleasure to introduce Mr. Raj Grover, President and CEO of High Tide. Thank you, Mr. Grover. You may now begin.

Raj Grover

Thank you, Crystal and good evening everyone. Welcome to High Tide Inc.’s unaudited financial results conference call for the fourth quarter ended October 31, 2021. I will start this call by providing an overview of our results and other key developments in the fourth quarter. Rahim will discuss the financials in depth. And after that, we will be pleased to answer any questions you may have.

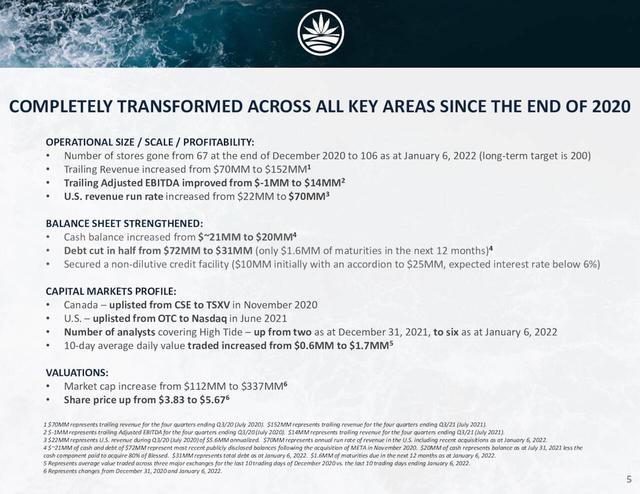

Let’s look at the headline numbers. Revenue for the quarter was $53.9 million. This was up 117% year-over-year and was up 12% sequentially to a new record. While we are very proud with our Q4 revenue number, the growth didn’t stop there, with 4 days still to go in our fiscal Q1, I am excited to share that we expect to generate over $70 million in sales in Q1, up 30% sequentially over Q4. $70 million in sales would represent the third highest quarterly level of revenue ever reported by a Canadian cannabis company and would put us on a run-rate of over $280 million. For the fiscal year ended October 31, we reported $181.1 million in sales, which was up 118% versus fiscal 2020.

Gross margin for the year was $64 million, or 35% of revenue compared to $30.8 million and 37% of revenue in fiscal 2020. Gross margin of 33% in Q4 ticked below the 35% generated in Q3. This was largely due to the launch of the discount club model for our retail stores. However, in dollar terms, gross margin increased to a record $17.6 million in Q4, up 5% sequentially. Adjusted EBITDA for Q4 2021 was $1.6 million. The preparation of the launch of the discount club model as well as the impact it had during the 12 days in the quarter where it had gone live resulted in EBITDA being only slightly higher than the $1.5 million generated in Q3.

It has been 4 months since our last quarterly results conference call. And we have been incredibly busy. We acquired two CBD companies, Blessed, one of the top CBD brands in the UK and NuLeaf Naturals, a market leader in the production and distribution of premium cannabinoid wellness products based in Denver, Colorado. We also announced the anticipated acquisition of Bud Room Inc., a cannabis retail store in Ottawa, along with its Fastendr technology, which allows shoppers to use customized kiosks and smart locker technology for operational efficiency, including lower overhead and labor costs and provides a differentiated and enhanced customer experience.

We look forward to closing the Bud Room transaction next week and rolling out the Fastendr technology nationwide. But the most impactful initiative since our last quarterly call came on October 20 when after doing a number of successful pilots as an intro, while at MJBizCon in Las Vegas, we announced the launch of our innovative discount club model, which includes four key components. First, unbeatable prices, we highlighted how the illicit market is still represented over 40% of the country’s cannabis sector and that data from multiple sources as well as our own data showed that over 70% of Canadian cannabis consumers are extremely price sensitive. Our discount club model offers everyday low prices and price matching versus advertised prices. Therefore, we are unbeatable in this area.

Second, consumption accessories. Unlike cannabis, where retailers are generally paying the same price for the same assortment, High Tide designs, manufacturers and retails over 75% of the 5,000 SKUs of consumption accessories we sell. Our vertical integration in the consumption accessories category has given us a key strategic advantage, which is totally unique among North American cannabis retailers. We can offer our unique and proprietary accessories at rock bottom prices and still earn meaningfully higher gross margins than selling cannabis. The number of accessories we sell weekly has quadrupled since April. The one-stop shop concept is working. Customers come to our stores for accessories and come back regularly to buy cannabis. Given both lingering supply chain issues and our desire to best cater to our retail customers, we have essentially phased out wholesale in Canada so that customers can find a wide selection of exclusive accessories at Canna Cabana.

Third, incorporating our loyalty plan. For every SKU of cannabis and accessories, our stores show a market price that these goods typically – what these goods typically go in for the – at the market and a member price, which is significantly lower. But in order to get the member price you need to be a member of our Cabana Club loyalty program. Since introducing this concept 3 months ago, membership in the program has exploded from 245,000 to over 379,000 members today, that’s 55% growth, which is well over 1,000 new signups a day. Our members used to represent over 50% of our daily transactions in our stores. They now represent over 90% of our daily transactions. This is a tremendous achievement realized quite quickly and in our opinion best demonstrates how our innovative discount club model is catching on. We have clearly created a large block of very loyal customers, which is exactly what you want as a retailer. We expect that our loyalty plan membership will continue to increase and we see a bat to eventually getting to 750,000 members across Canada. We also believe that there is a significant monetization opportunity when you have a block of members that size and we have already identified pathways for monetization when the time is right.

Fourth is our own brands. As previously disclosed, we are working with Heritage Cannabis Holdings and Loosh to produce our Cabana Cannabis Co. branded shatter and gummies respectively. We are now working with various provincial boards to get these products approved and expect them to hit our store shelves within 60 days. We also now own 3 top tier CBD brands in FAB, Blessed and NuLeaf and we are working with licensed producers to bring these brands to Canada so that they are made available for sale in our stores. Not only will offering our own white label and own CBD brands help with our margins, it will also help with our discount club model as these products will only be available at preferential prices in our stores similarly to how many successful major retailers have their own house brands.

As you can see that while price is a major factor in our discount club, it’s about much more than just that. We took a broader, more holistic approach to leverage our strengths and points of differentiation. And I am very pleased to say that it’s working tremendously well. You will recall that when we announced the launch of this concept, we cautioned that based on the success of the three trials that we underwent last year, it would likely take several months until we feel the full impact of the discount club model. Given the time that has passed so far, we are very excited about how things are tracking. We had already started seeing an uptick in same-store sales as they were up 7% in Q4 versus Q3 2021, but things really started accelerating since we launched the discount club model.

Let’s look at the month of November, the first full month of the discount club model and the last month for which Stats Can data is available and compare it to our same-store sales. Nationally according to Stats Can, cannabis sales across the country went down 3% in November, including new store openings. In contrast, while the market was down on a same-store basis, our stores posted a 5% gain in November versus October outperforming the market by 8%. In Ontario, the largest market and where the land grab is most important, we did even better. We posted same-store sales growth of 10% in November versus October, while the entire province generated only a 2% increase in total, including adding new stores.

Then as expected things accelerated even further in December, our national same-store sales were significantly higher than the 8% of data service published. Across the country, our same-store sales were up 22% in December versus November, while Ontario was up a tremendous 27%. In fact, every single one of our 100 stores, over our 100 stores posted a gain in same-store sales in December versus November. An incredible accomplishment and more proof that as expected, the word of the discount club model is getting out and customers are increasingly coming to our stores.

We have also seen our new stores ramp up much faster than before we introduced the discount club model. Specifically, we are now seeing new stores get to maturity in just over 3 months, while it would take almost 5 months previously. So, there is no doubt that we are off to a great start on the discount club model. It is unique, it is differentiated and it leverages our points of strength to help us dominate an otherwise difficult market, which should lead to the creation of significant value for our shareholders. While there are still ways to go to feel the full benefits of the model, we are very encouraged on how things are tracking so far. The rest of the business also continues to perform quite well. With the recent acquisitions of Blessed and NuLeaf, our global CBD business is on a run-rate of $48 million and this whole line of business did not exist a year ago for us. It’s only been 2 months since the NuLeaf acquisition closed and we are already working on some immediate term synergies, such as co-packing oils for FAB and creating multi-cannabinoid softgels. Blessed also continues to perform very well.

Our strategy is differentiated as well as CBD and accessories e-commerce businesses allow us to acquire potential future THC customers. Today, these businesses are also contributing positively to our revenue and EBITDA right now. Data sales are an underappreciated part of our business. With so much going on, I think people don’t realize the contribution it makes to our bottom line. Data sales in Q4 were $4.2 million, up from $3.8 million in Q3 2021. This is an exceptionally high margin line of business for us and multiple industry stakeholders remain very interested in obtaining our data due to our internationally diversified ecosystem. Based on the demand we are seeing, we expect our data sales to continue to climb in Q1 and beyond.

In conclusion, while it might be trying times in the cannabis capital markets, we are once again continuing to execute on our business. Our discount club model is tangibly delivering. Our CBD and accessory businesses continue to perform and add to our consolidated EBITDA and we are forecasting being at over $280 million revenue run-rate at the end of fiscal Q1. Things are looking up for High Tide, thanks to the tireless work of our team. Everyday I get more and more confident about how things are progressing.

With that, I will now turn the call over to Rahim Kanji, our CFO to discuss our financial results.

Rahim Kanji

Thank you, Raj and good evening everyone. Let’s dig into these results. Note as previously outlined, our results are presented on an unaudited basis. In the fourth fiscal quarter ended October 31, 2021, the company recorded consolidated revenue of $53.9 million, representing an increase of 117% year-over-year and 12% sequentially. Revenue earned in the U.S. was $10.6 million, up 10% versus Q3 2021. Note that, NuLeaf is the biggest acquisition in our history closed after the end of the fiscal year. NuLeaf generated $19.4 million for the 12 months ended September 2021. For the fiscal year ended October 31, 2021, High Tide generated revenue in the U.S. of $29.7 million, which was up 109% from $14.3 million in fiscal 2020. Our current revenue run-rate in the U.S. is approximately $70 million and total revenue run-rate outside of Canada is approximately $80 million. Retail revenue was $52.4 million in the fourth fiscal quarter of 2021, up 13% due to stores rebuilt organically as well as partial contributions from acquisitions of 1 store in Regina and [indiscernible] and Blessed.

Revenue from our wholesale segment was $1.4 million in the fourth fiscal quarter of 2021, representing its lowest level in three quarters. This segment continued to suffer from supply chain and logistical challenges, while at the same time, we shifted our focus to retail to make sure that our customers benefit from our proprietary accessories. Our consolidated gross profit was $17.6 million in the fourth fiscal quarter of 2021 or 33% of revenue down from 35% generated in the fiscal third quarter of 2021. The last third of the quarter in particular were impacted by the launch of our discount club model, which by design calls for higher volumes at the expense of lower margins.

Looking at our expenses, salary wages and benefits held at 15% of revenue, the same proportion it has been for several quarters. However, general and administration expenses decreased to 8% of revenue from 11% in Q3, which included some one-time expenses associated with the NASDAQ listing. Going down to the bottom line, the company generated $1.6 million in adjusted EBITDA in Q4, just above the $1.5 million generated in Q3. As mentioned, the launch of the discount club model was in October 20, 2021 and we advised that based on the trials we have done that it would take several months for the impact to be fully felt. On Day 1, there is an immediate hit to revenue and margin. But as volume builds, we expect to be well ahead of where we were prior to October 20 in terms of dollar gross margin and does EBITDA. We calculated that the EBITDA impact of lower gross margins inherent in the discount club model in the last 12 days of the quarter was between $350,000 and $400,000.

Similarly, as we look into Q1 again, the immediate impact of the financials is to put short-term pressure on margins given the reduction in selling prices. However, as outlined by Raj, we are very happy with the sales trajectory we are seeing due to the nature of our diversified ecosystem and our ancillary brand portfolio. So to be clear, we are not just competing on price. Given where things sit currently, we continue to feel we will be ahead of where we are on a dollar gross margin basis in the coming months as the sheer strength of volumes offsets the cut in gross margin percentages.

Note that the fourth quarter of 2020 was impacted by impairment losses of $2.9 million related to 2 operating stores Yonge Street in Toronto and Mayor Magrath in Lethbridge, which were among the first to open in their respective cities at the onset of legalization and 3 non-operating stores. The 2 operating stores naturally saw declines in sales over time as competition increased.

Our balance sheet remained strong. Total principal value of our debt is $31.4 million, with only $5.6 million due in the upcoming 12 months. While the capital markets remain very challenged across the cannabis sector, we believe we are well positioned given the strength of our operations. The fact that most of our debt is long-term and our at-the-market facility which can allow us to raise capital on a low cost basis opportunistically if so desired. We have only raised approximately $800,000 on this facility to-date. As part of the conditions relating to our non-dilutive debt facility, we are required to raise a total of at least $1 million through the at-the-market facility in the first calendar quarter of this year.

Additionally, largely due to implementing our discount club model and related changes to our near-term EBITDA as it stands currently, we are not able to draw more than $4 million we have already obtained on the line and we will be required to pay it back by May 1. This repayment is already included in the $5.6 million due in the next 12 months. At this point, we anticipate that we will be in line with all related covenants to resume the drawing on the debt facility at the end of fiscal Q4 2022 or potentially sooner. Additionally, I believe these tougher times in the market highlight the value of our strategy, where we only acquire EBITDA positive companies, which are now contributing to our overall results and helping offset the weakness in the competitive Canadian bricks and mortar market.

The global pandemic has had many impacts on our business. First, due to supply chain and logistical challenges, our non-core wholesale business has been greatly impacted. On the bricks and mortar side, COVID has frequently led to longer timeframes to obtain building permits and thus opening new stores. As well, our existing stores have been affected by a combination of government restrictions and employees having to stay home. As a snapshot I can report that today, 3 of our top earning stores in Ontario are currently operating with closures and dramatically reduced hours and/or capacity due to COVID. Our top earning store in Manitoba is operating at extremely reduced hours due to mall closure relating to COVID. Another 8 stores demonstrating high growth in Ontario and Alberta have been stalled by store closures and reduced hours due to COVID. And we have had over 20 miscellaneous store early closures or reduced hours since November 1 due to COVID across the country and these challenges are ongoing.

Staffing in our head office has also been impacted by the pandemic as well as our uplifting to the NASDAQ, which requires us to report our full year results a month sooner. As a result, work to finalize and get audit signoff relating to our income tax balances is still being completed. We anticipate that this will be finalized and our full audited financials and associated management, discussion and analysis will be filed by the deadline of next Monday. We do not anticipate any material changes to financial results discussed today or outlined in our press release with the exception of income taxes, net loss and comprehensive loss. Despite all these changes, we continue to move forward as an organization and deliver growth for our shareholders. It is testament to our high quality and hardworking team, which seems to always find a solution to such obstacles.

With that, I will now turn the call over to the operator to open the lines for the Q&A.

Question-and-Answer Session

Operator

Certainly. [Operator Instructions] The first question is from the line Scott Fortune with ROTH Capital Partners. You may proceed.

Scott Fortune

Good afternoon. Congratulations on the quarter. Yes, with – can you unpack a little bit and provide a little more color on the margin from the retail side for the overall retail industry in Canada versus High Tide and unpack margins of your different segments from your retail to e-com and CBD businesses? Can I get a sense of the margin impact as you will of the discount model here in this current quarter as you look at it kind of going forward?

Raj Grover

Sure. I think Rahim can take this question.

Rahim Kanji

Sure. Thanks, Scott. So when we look at sort of on our bricks and mortar business first, the landscape is definitely competitive at the moment and is expected to remain this way for the next 2 years. However, thanks to our innovative discount club model, although we have had to adjust our bricks and mortar gross margin downwards by average of 7%. We are already seeing same-store sales increases. New stores are ramping up at a faster pace. And with these volumes increasing, we expect to offset the margin drop in the coming months. In terms of our e-commerce gross margins, we are seeing healthy gross margins there and they have continued on as we have proprietary products on our platforms, on various platforms and then on the CBD side with our synergies that we plan to implement, we are continuing to maintain those gross margins as of right now.

Scott Fortune

Okay. And thank you – and then for a follow-up question, wanted to kind of step through kind of the store growth here. You plan on about 150 by the end of 2022 from the 109 now currently can you provide a little more color on store openings organically versus M&A and timing of British Columbia add to continue there and with your continued to focus on Ontario, just kind of how we can look at the ramp continue up to 150 stores throughout the year here. And on that side, what kind of valuations, are you seeing to – are we seeing to – or discounted valuations from the small mom-and-pop stores with the competitive landscape out there?

Raj Grovers

Hi, Scott. This is Raj. Thanks for your question, Scott. So yes, our goal is to definitely hit 150 stores, I think we will exceed 150 stores by calendar 2022, but that is at the minimum what we want to hit by the end of this year. Our focus will remain on the Ontario market, because as you know, Scott, we still have, we have around 32, 33 locations open in Ontario, but we still have room to get to 75. And we are seeing a ton of opportunities come inbound to us from the smaller operators and even some smaller regional chains. So with a blend of organic growth and M&A, we see us hitting 150 locations by the end of the year. This is also going to include our 8 locations in BC, I remain very confident that by the end of this year, again, calendar 2022 we can hit around 8 locations in British Columbia as well. We anticipate entering BC by let’s say end of March, it’s been a little bit difficult for us to grow organically in BC, because we are waiting for building permits approvals. So what we have done in the meanwhile is we have really started looking at all the independent and smaller chains that exist in BC, but as you know, Scott, BC only allows 8 locations at the moment. And I definitely want to cherry pick the best 8 locations we can and high grade our portfolio to the best of our ability. So, 150 locations to the end of the year, focus will be on Ontario, second focus will be on BC, we expect to enter BC towards the end of March with our first location at least. And then it will be a blend of both growing our portfolio through organic growth as well as M&A.

Scott Fortune

Thanks, Raj. Appreciate the color and congratulations again on the quarter.

Raj Grover

Thank you.

Operator

Thank you, Mr. Fortune. The next question is from the line of Andrew Semple with Echelon Capital Markets. You may proceed.

Andrew Semple

Hi, there. Good afternoon. Congrats on the quarter and the strong outlook for the current quarter. Just given the outlook for the first quarter, it’s clear that revenue growth is accelerating as the brick-and-mortar stores, as the strategy anticipated, great to see the sales traction there. I guess, my question would be on the EBITDA for that retail segment. Now that you have got a couple of months with some experience with the discount club strategy, would you be able to provide an estimated timeline as to when the revenue growth will begin to be net positive to the brick-and-mortar retail EBITDA?

Rahim Kanji

Hey, Andrew. Thank you very much for the question. I’d rather not give you that answer, Andrew, because at the moment, we are facing a ton of COVID closures. As you know, every business is experiencing that. Although regardless of everything that is going on in the market because of COVID, we still are watching same-store sales increase quite rapidly. And like we said, we are projecting to showcase over $70 million of sales for Q1 2022, which is already giving you and everybody else a very good idea on where the sales trajectory is headed. And we can see our sales volumes now, like Ontario, we can know that same-store sales were up in December by almost 27%. So, if we continue on that trajectory, I would say by next quarter, we have already balanced the loss of EBITDA that we are going to experience because of reduced margins. But our volumes are very quickly offsetting that, but then again, I want to give ourselves a few months to comfortably offset this margin drop. And I am actually more than confident now by looking at what has happened over the last 90 days that we will surely get there. Now does that happen in the next 3 months or it happens in the next 5 months? That is the only – that’s the only outstanding deliverable, but we will surely get there. It’s just the unknown of COVID and what’s happening because of our recent store closures that we are experiencing and drop in hours. A lot of our stores, in fact, dozens and dozens of our stores are operating at reduced hours. This will be short lived. We know this will be temporary. So, as soon as these things balance out, we think within the next three months to five months we will be very much be back on track on EBITDA.

Andrew Semple

Make sure that best is there, Raj. That’s quite helpful. Moving on to just want to speak to the Fastendr rollouts. Could you maybe provide some additional details on what work needs to be done at the store level to implement that technology across the portfolio? And what your kind of targeted timeline is to have that across Canada, as well as the budget that’s the integration there? How much are you budgeting for the year?

Raj Grover

Yes, absolutely. So, look, the Fastendr rollout preparations have already began in our stores. We are anticipating having five stores to seven stores completed by the end of March. We haven’t even closed the Bud Room acquisition yet. But we have already started preparing our stores for that. So, pre-wiring, all of that is already happening. And then after March, we want to grow. We want to install the Fastendr technology in at least 10 locations going forward every month. And again, we all know the challenges that we are facing due to the pandemic. But I still think that after March, we can grow it by at least 10 locations. I don’t want to share what it’s going to cost per location at this time for competitive reasons, because this technology is very new and we are first to market with it. So, I am going to keep that strategic advantage with High Tide. We are also going to sell this technology or license this technology to third-party retailers. So, it won’t be very prudent of me talking about what it’s going to cost me to roll these out. But we will disclose that to the market in the next couple of quarters coming up. By the end of this year, I definitely hope that we can have every single one of our stores converted into or have this equipment, this Fastendr technology. And then we also have inbound calls already from multiple retailers reaching out asking about this technology and asking about what is this technology going to cost for us to provide to them. So, this technology is going to provide us tremendous revenue generation opportunities, data monetization opportunities from third-party retailers. But at this time, we are short in supply of the kiosks and the smart lockers that we are prioritizing our own retail stores. So, we are going to focus on stores for this entire year. We are confident that all of High Tide stores will be converted into this technology by the end of this year. We are going to start in February itself. In fact, we have already started pre-wiring right now in our stores. And eventually we also plan to roll out a similar type of technology in our ancillary businesses. We are going to leverage the principles of this existing Fastendr technology into our ancillary businesses. And I will be able to share more with you and others in terms of this strategy in due course.

Andrew Semple

Great. That’s helpful, Raj. And maybe if I could sneak in maybe one more macro question here, we are continuing to watch the store count extend across Canada, despite the fact that it would appear on average, sales per store continues to decline for most other retailers. Just would appreciate your macro perspective on whether we begin to see that store count grow and slowdown or potentially even times out in 2022, just given the competitive pressures you and others are putting on the market?

Raj Grover

Yes, absolutely. Look, in many of the provinces we operate, such as Alberta, Saskatchewan, Manitoba, we are starting to see the pace of store count slowdown. It’s still growing. There are still increases in store counts, but it’s starting to slowdown drastically in comparison to what it was previously. Ontario is still growing quite rapidly and BC is going to continue to grow quite rapidly still for the next year, 1.5 years. But most other provinces are hitting maturity, which is a bigger change like ourselves expanding quite rapidly. But there is still a big difference in terms of the landscape mix. Currently about 75% to 80% of the stores are still owned by independent and smaller chains. And larger chains like ourselves are only 20% to 25% of the market. So, over the next couple of years, Andrew, I think the store – this mix will change. It will be a bit of upside down mix. It will take us a few years to get there, because that there is independents and smaller chains that are trying to hold on right now. But it is very unfortunate that we are going to see quite a bit of a fallout, because of some of the margin pressure that’s coming from our stores and some of the other competitors as well, on the same lines and just some of the provinces that don’t have distance requirements, like Ontario, there is going to be some of the stores that are not going to make it there and especially at the smaller chains and independent. So, we will continue to grow. I still see a clear path ahead for our discount club model, which is very unique, very differentiated. Our demand – demand for our products and our prices is constantly there. We are doing good. So, we are going to continue to expand. We will hit 150 stores by the end of this year. And I anticipate hitting over 200 stores by the end of 2023.

Andrew Semple

Thank you, Raj. Appreciate the color.

Operator

Thank you, Mr. Semple. The next question is from the line of Frederico Gomes with ATB Capital Markets. You may proceed.

Frederico Gomes

Thank you. Good evening, Raj and Rahim. Congrats on the quarter. Just a quick question on your cash position, so, you finished the last quarter with $27 million in cash and this quarter with $40 million. Just curious, does that cash balance include any amount from your new credit line. And I know that you guys didn’t file financials yet, but any color there in terms of understanding your cash use this quarter would be helpful? Thank you.

Rahim Kanji

Yes. Thanks. And we are in a healthy cash position right now that as at year end we were at $14 million cash position compared to $7 million the year before. And primarily in the quarter, our cash flow – we were cash flow positive from operations. And primarily our cash was used for working capital that was used to open new stores and also the acquisitions that we did so Blessed [indiscernible] and one store in Regina. So, it was mostly acquisition focused and expansion of our organic new stores focus.

Frederico Gomes

Okay. Thank you, Rahim. That’s helpful. And then can you talk more about Blessed CBD entering the German market. What’s the potential that you see there? And do you plan on bringing any of your other brands to Europe? Thank you.

Raj Grover

Hi, Frederico. Thanks for the question. So, on the German market, Blessed has already filed for novel food compliance. And we are expecting that approval pretty soon, which allows Blessed to operate in the European Union and Blessed CBD is getting ready to start commencing sales in Germany. We anticipate that by the end of February, we should be able to enter the German market and start commencing CBD sales to Blessed. We are also looking at some of the other opportunities on both CBD and THC side in the German market. So, that may be supplementary to the entry of Blessed CBD in Germany. And then Blessed is also planning to enter the U.S. market now that we have three top tier CBD brands. And Blessed is an extremely successful, in fact one of the top brands in the UK. We feel that Blessed will do very well in the United States. And then we can also leverage the newly facility the cGMP certified facility to start making Blessed SKUs in the United States and add to Blessed SKUs with some of the softgel manufacturing and other multi cannabinoid formulations that newly pass. So, we are going to introduce a full line of Blessed products, in fact an enhanced line of Blessed products for the U.S. market, which will happen sometime in March of 2022. But we believe that German entry will be prior to that sometime in February.

Frederico Gomes

Thank you, Raj. Congrats on the quarter again. I will hop back in queue. Thank you.

Raj Grover

Thanks.

Operator

Thank you, Mr. Gomes. The next question is from the line of John Chu with Desjardins Capital Markets? You may proceed.

John Chu

Hi guys. So, my first question is just on the sales outlook. I know it’s still pretty early with this discount retail model. But maybe just if you can point to the three pilot stores that you had, they have obviously been running longer. So, maybe give us a sense now that we have had three more additional months of data from those three pilots. What type of same-store sales growth you have been seeing month-after-month during those extra last three months or four months. And maybe that can give us more insights for the longevity of the strong same-store sales growth you are hoping for across all your other stores as well?

Raj Grover

Hi, John. Thanks for the question. So, John, I am very happy with the progress we have seen so far on our discount club model. We are absolutely like our loyalty is absolute exploding. We are up sequentially on same store sales like I pointed out. Quarter-over-quarter, we were up 7%. In the month of December alone, we were up 27%. These results are better than expected for our team. And we also are looking at new locations that we are opening up. They should ramp up in approximately 19 weeks, 20 weeks. We are now seeing them ramp up in 12 weeks to 13 weeks, which has proved that customers are loving our discount club model which is basically leveraging our company’s entire retail ecosystem. We are now almost averaging over 1,000 new customer signups a day, which is extremely encouraging for me. And we have already started strategizing on how we can monetize the Cabana Club membership. But then again, I am in no hurry to do so. We also have our planned launch of the white label brands that are coming up. It’s going to further help us to enhance gross margins in our stores. But going back to the pilots, the numbers that we had put out, we had seen a 76% to 100% increase in the three different provinces where we did the pilots on the THC side of things, if I am not forgetting this, or calling out wrong numbers. And I believe on the accessories front, we have seen 186% increase in the pilot stores. Now, on the accessories side, John, we have seen a quadruple increase since we launched this in April. So, prior to April, we were selling approximately 7,500 accessories in our stores a week. We are now close to 26,000, 27,000 accessories a week, which is extremely encouraging. And now you look at we make these accessories right and we are now selling four times that original numbers. So, everything is looking extremely promising. And what we are also doing for very – be our club members, we are phasing out our hotel in Canada, which is not a core part of our business, it never was. And we are exclusively providing our proprietary branded consumption accessories to our club members. And because of the success in what we are launching, and like I said our daily signups are over 1,000 signups a day, which is looking extremely promising. I honestly did not expect the pace of signups to grow this fast. We now expect Cabana Club membership program to reach over 750,000 members sometime in the future. And look more members mean more sales. And we can see that now. So, I don’t think it’s a question mark anymore that our differentiated model discount model is working. Because of the nature of our differentiated ecosystem, we have carved out such a unique portfolio of products to our consumption accessories and the discounts that we are providing in showcasing number versus market. I think it’s already starting to take off. So, I am very hopeful that the sales trajectory will continue into the coming quarters, and it should get better and better with every single quarter. Now, COVID is raging everywhere. I am sure you are hearing about multiple industries on the same level facing the disruption in their retail stores. But despite that, I am still hopeful that we are going to see positive sales growth in every single one of our stores. So, to give you an example, John, all of our over 100 stores saw the same-store sales increase. I mean how promising is that? So, we expect that to continue. And we would be able to share more with you in the coming quarters.

John Chu

Okay, great. And then just maybe a bit more color on your 150 store goal for the end of the calendar 2022, right? So, you had 15 new stores, I think in the fourth fiscal quarter. And by my calculation, you have got about six stores thus far in Q1. Obviously, that’s the Christmas holidays and whatnot. Price had some impact. But should we model something a lot more back end loaded in terms of how you are going to get to that 150 or, and are you having any building permit issues in Ontario that might slow things down in the near-term?

Raj Grover

So, John, look, the building permit issues are very real and they are in practically every province, not just Ontario and British Columbia, but Ontario is the one that we are really, we brought like 10 leashes on our hands. We are literally waiting for building permits on a few of them, few of them already under construction. We will be announcing more in February and then even more in March. And we will get to that 150 number to a blend of M&A and organic growth. We are getting to cherry pick organic sites, other larger landlord groups are working with us. And we are really cherry picking some of the best locations. And I am not having a hard time securing locations. I am having hard time getting building permits and the number that we are putting out which is 150 stores by the end of the year, in my opinion is still conservative. We have been aggressive with our store growth. You can see that we added 48 organic locations last year throughout fiscal 2021. So, I feel that we can do the same and we are already – we are at 109 locations today. So, I don’t think it’s going to be difficult at all for us to get to 150 stores, because I feel almost half or more than half can come through M&A. We are getting approached daily, weekly by independent smaller chains, regional chains to be taken out as they are realizing that consolidation is the only way to go. And the larger chains, because our ecosystem is so diversified, we definitely have some competitive advantages. So, we have a lot of incoming flow for incoming bricks and mortar deals. So, I feel 25 stores, 30 stores could come through M&A, another 20 stores could come through organic growth or vice versa.

John Chu

Okay, great. Thank you.

Operator

Thank you, Mr. Chu. There are no additional questions waiting in the queue at this time. And with that, I would like to turn the session back over to High Tide CEO, Raj Grover for final comments.

Raj Grover

Thank you, operator and thank you to everyone for your interest and continued support for High Tide. With that, I will ask operator to close the line. Have a great evening.

Operator

That concludes today’s conference call. Thank you for your participation. You may now disconnect your line.