Article content

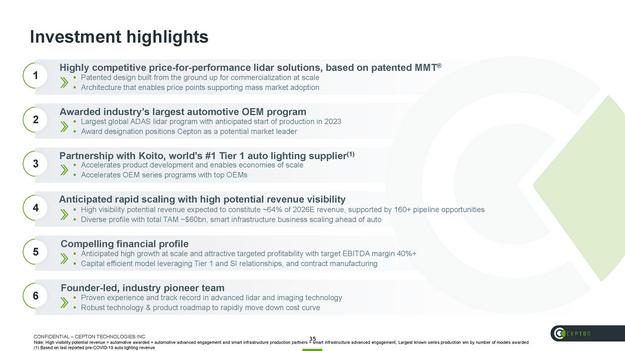

Growth Capital Acquisition Corp. (NASDAQ: GCAC) is a special purpose acquisition company, or SPAC for short, incorporated for the purpose of acquiring an operating company with an enterprise value in the range of $400 million to $1.5 billion . The blank check company found its target late in 2021 in Cepton Technologies, a pioneer in the LiDAR space that made a name for itself with an exclusive deal with General Motors integrating with GM’s vaunted Ultra Cruise ADAS (advanced driver assistance systems). The transaction to make Cepton a public entity trading on the Nasdaq under the ticker CPTN is expected to close early this quarter.

About Growth Capital Acquisition Corp.

GCAC is a Delaware blank-check company, also commonly referred to as a special purpose acquisition company, or SPAC, formed for the purpose of entering into a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses or entities in any industry or geographic region. GCAC is led by its co-CEOs, Akis Tsirigakis and George Syllantavos.