Andreessen Horowitz (a16z), a prominent venture capital firm investing heavily in the web3 sector, has published its first “State of Crypto” report exploring current trends in the market.

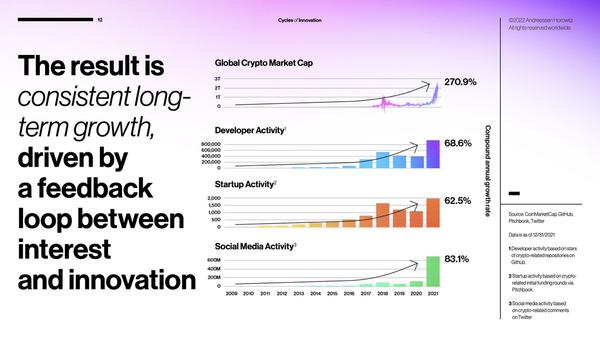

The overarching takeaway from the report is that web3 and the crypto market develop in cycles.

As prices climb, interest in the sector grows to the point where it can no longer be sustained. Following a (usually steep) falloff in prices, innovators develop new projects that revive optimism in the sector, and the cycle repeats.

A16z’s data analysts said that instead of following prices and the market religiously, it is “better to build” towards web3 to realise its potential.

Even with crypto’s volatile cycles, it still offers real-world benefits to billions. In emerging economies like Brazil and Nigeria, decentralised finance (DeFi) offers financial inclusion to many of the 1.7 billion people globally who don’t have access to a bank account.

In fact, the report found that, if ranked against other US banks in terms of assets under management, DeFi would represent the 31st largest bank in the country.

What’s more, interest in DeFi is outpacing interest in traditional banking at a staggering rate, leaving it possibly only a matter of years before DeFi could overtake banks like American Express, HSBC, and Morgan Stanley.

A16z also touched on how specific blockchain networks compare with one another.

In this regard, Ethereum remains the dominant blockchain by a significant stretch, thanks mostly to its early start and huge community of developers.

With nearly 4,000 active developers, the Ethereum network outpaces both its runners-up, Solana (with 1,000) and Bitcoin (with 500), by a clear margin.

Ethereum’s monopoly share of development helps to explain why its users are so willing to pay more than £12 million in fees per day – on average – just to use the blockchain.

“Ethereum’s popularity is also a double-edged sword. Because Ethereum has historically prized decentralisation over scaling, other blockchains have been able to swoop in and attract users with promises of better performance and lower fees (some might argue they do so at the expense of security),” the report stated.

Gazing out onto the horizon, a16z compared current web3 adoption to the early PC and Internet wave of the ‘90s and 2000s.

The report follows the same trajectory the Internet took in growing from fifty million users in 1995 to one billion by 2005.

If the same rate of adoption occurred for Ethereum, which currently has anywhere between seven to fifty million active users, the blockchain would see one billion users by 2031.

“In other words, you’re still early. Much remains to be done. Let’s keep building,” a blog post on the report’s key takeaways concluded.

Images used are from a16z.

Want to learn more about blockchain from industry leaders? Check out Blockchain Expo taking place in Amsterdam, California and London.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: a16z, cryptocurrency, defi, market research, Web3