The current health care landscape has put a spotlight on the importance of sustaining and supporting all avenues of health care delivery and public health programs. For many states, factors such as unemployment and the economic downturn resulting from the pandemic have led to increased enrollment in safety net programs like Medicaid. At the same time, an uncertain economic landscape has meant decreased revenues and unpredictable budgets. In tandem with managing this influx in safety net program enrollment — a challenge in and of itself — states have also been dealing with the added strain that COVID-19 cases put on the health care system.

In the early months of 2020, various processes, rules and regulations at the national, state and local levels were put on hold or simplified to help increase patient capacity and health care access. Most notably for many patients were the relaxed requirements for telehealth, which enabled providers to rapidly begin offering virtual care to patients.

Related: The Telehealth Extension and Evaluation Act and what it means for you

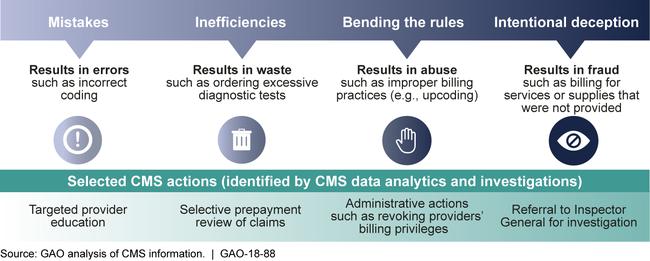

While these changes were necessary to navigate pandemic-fueled care delivery and access challenges, they also brought new complications. For example, many of the programmatic changes at hospitals and health systems involved program integrity (PI) activities and the prevention of fraud, waste and abuse (FWA). Often referred to as payment integrity in the commercial payer space, program integrity broadly refers to the function that ensures health care services are correctly billed and paid as rendered and is a crucial element in ensuring sustainability and efficiency for state agencies, the programs they provide and the individuals they serve.

In early 2020, action was taken by CMS, state departments and payers to suspend many preventative initiatives related to PI and FWA to focus available resources on care access and capacity. Some states, for example, suspended in-network hospital and emergency service reviews during the public health emergency. Unfortunately, large-scale disasters and times of momentous change, like the one we currently face, are often breeding grounds for fraud and abuse.

As the country continues to emerge from the pandemic, it is crucial to quickly and efficiently restart these programs to ensure rapid economic recovery and the protection of safety net programs. Now is the time for states to reconsider the structure, process and technologies behind such programs – starting with a few key focus areas to sustain and maintain vital program integrity activities.

Avoiding inaccuracies in coding and billing

To say billing has grown more complicated, complex and error-prone since the onslaught of COVID-19 would be an understatement. The introduction of new telemedicine codes, in addition to new coding requirements for COVID-19, has created countless new opportunities for billing inaccuracies. As with the introduction of any new code, there will be confusion around use, further compounded by increased stress for both physicians and the health care system.

Payment analytics, when leveraged as a core part of program integrity efforts, can drastically maximize cost savings and recoveries for states by ensuring payment accuracy every time. When claims are billed incorrectly, advanced payment analytics technology can help to quickly identify these inaccurate claims for avoidance or fast recovery without having to wait around for medical records.

In looking at pre and post-pay claims review and editing, for example, advanced analytics help to automate the review process so claims can be quickly checked for errors and potential instances of abuse. Not only does claims automation technology help boost accurate coding and billing processes, but it also helps states stay compliant. By mitigating improper billing issues, an automated editing process instantly verifies compliance and protects organizations from wrongful overpayment.

Payment analytics give states the insights to identify and avoid billing inaccuracies more efficiently and effectively. In turn, states are equipped to diminish the likelihood of improper payments, achieve faster recovery of overpayments and continuously contribute to the larger goal of containing health care spending and costs that threaten state program sustainability.

Detecting and preventing fraud at a time of increased vulnerabilities

Identifying, preventing and addressing Medicaid fraud and abuse cases is a daunting yet fundamentally important task – especially during the pandemic when telehealth processes and technologies were rapidly rolled out and implemented across the country.

Fraud and abuse have long thrived in telemedicine, further amplified by the expanded coverage and relaxed regulations put in place by CMS during the pandemic. Record-high industry adoption of virtual care has created an unprecedented volume of telehealth claims and a higher risk of error. From the filing of false claims to prescription drug forgery to ransomware attacks, the heightened risk for fraud and abuse has made it crucial that states double down on payment accuracy analytics to help identify patterns and abnormalities in claims that signal potential fraudulent events before the damage is done. One example of many was a high-profile telehealth pharmacy fraud case that entailed $174 million in claims paid by private insurers, Medicare and TRICARE, where patients were prescribed unnecessary, overpriced or incorrect medications.

Having a Medicaid fraud and abuse service in place provides full visibility to support effective fraud detection, such as in the example above. States must have the analytical ability to investigate the complete spectrum of care models, both fee-for-service and managed care, so nothing goes undetected. Data visualizations, for example, can help create accurate peer comparisons and identify unusual trends and outliers. Furthermore, technology can help automate and standardize this once burdensome process. Traditional program integrity audits, while effective pre-pandemic, may fall short now due to the novel increase in telehealth claims and lower reimbursement rates. For states looking to bolster program integrity efforts, automated solutions are proving extremely valuable and effective in capturing fraud and abuse related to telehealth services.

As the nation continues to navigate health care’s new normal and the era of virtual care and telehealth, bolstering program integrity efforts, including advancements in claims and billing processes, could result in millions in savings for state Medicaid programs at a time with shoring up safety net programs and containing health care costs are of the utmost importance.

Dr. Gary Call is chief medical officer at Gainwell Technologies.

Read more: