Background

These articles on valuation began as an effort to analyze the reasonableness of GMO co-founder Jeremy Grantham's claim that the US stock market is now a "full-fledged epic bubble." His January Bloomberg interview has been viewed a remarkable 2.1 million times. Here's a link to his "Last Dance" article that got the whole thing started.

My first article analyzed 70 stocks I manage. The second article examined 70 large US Growth stocks and the third looked at 70 large Value stocks.

My goal is to judge for myself whether Grantham is directionally correct, and if so, determine implications to my tolerance for risk.

Three Investment Experts and the Power of Diversification to Maximize Returns, Minimize Risk

Grantham's call has served a critical purpose: He has challenged investors to think critically about risk and return at a time of elevated valuations.

In that vein, I want to introduce this article about International (non-US) stocks by referencing the thinking of three of my favorite sources for investment wisdom: William J. Bernstein, Bob Prince, and Stan Druckenmiller.

William Bernstein

Bernstein is a retired neurosurgeon who over the past two decades has written several outstanding investment books. My favorite is his first, "The Intelligent Asset Allocator." For those of you familiar with Benjamin Graham, you will immediately recognize that Bernstein's choice of the word "Intelligent" in the title is a play on Graham's must-read 1949 investment classic, "The Intelligent Investor."

The subtitle of Bernstein's asset allocation book is: "How to build your portfolio to maximize returns and minimize risk."

One of my favorite charts in the book shows returns for the 1973-74 timeframe, when, by the way, Warren Buffett's Berkshire Hathaway, suffered -50% return. Who knew? During this tumultuous time, Precious Metals were up +122% while US Small Cap and Pacific Rim fell respectively -56% and -55%.

A decade after writing "The Intelligent Asset Allocator," Bernstein wrote "The Investor's Manifesto : Preparing for Prosperity, Armageddon, and Everything in Between."

In this book Bernstein cited four attributes associated with great investors:

- Enjoy the "process" - As some people love gardening or some other avocation, Bernstein contends that success in investing requires a passion for the process of learning how to invest well.

- "Math horsepower" - Bernstein's a "numbers guy" who claims no one can be a successful long-term investor without a strong understanding of statistics.

- "Financial history" - Successful investors have a solid grasp of the history of financial markets.

- "Emotional discipline" - And, finally, Bernstein is a strong believer that emotions play a big role in successful investing. (By the way, investors seeking more insight about the emotional element of investing won't find a better book than Daniel Kahneman's "Thinking, Fast and Slow.")

Although it is not clear where Bernstein got this number, he believes that "no more than 10%" of the population can demonstrate expertise in each of the attributes. This is quite a statement as it means that, at best, only one person in 10,000 (10% to the 4th power) possesses all four attributes. Good news is if you are reading this article, you must be among the one in 10,000...

Maybe.

Finally, Bernstein has three Principles that guide him as an investor that should serve all of us well over the long-run:

- Don't be too greedy

- Diversify as much as possible

- "Be wary of the investment industry"

Note the principle of diversification.

Bob Prince

Diversification is also a theme often articulated by Bridgewater Associates' co-CIO, Bob Prince. Most of you probably know that Bridgewater, founded by Ray Dalio 40+ years ago in his Manhattan apartment, is arguably the world's most successful hedge fund.

Prince is a powerful thinker whose insights are incredibly helpful to investors seeking alpha or seeking to preserve wealth.

Earlier this month, Prince and Greg Jensen, the other co-CIO, gave a compelling overview of the power of diversification at a time of complex central bank (monetary) and government (fiscal) policies and actions. Prince emphasizes the appeal of Asia, especially China.

My favorite recent interview with Prince is from last June when he discussed "storeholds of wealth." If interested, please listen carefully to his comments from the 14 to 17 minute marks of the interview when he highlights Bridgewater's concern that markets may be on the brink of considerable turmoil.

Stanley Druckenmiller

Druckenmiller is famous as a macro-investor who has never suffered a down-year as an investor. He speaks rather modestly about this achievement in this February 2021 interview.

If you have the time, you will want to listen to all 20 minutes of the interview. Druckenmiller starts by encouraging investors to "buckle up" because today's investment horizon is the "wildest cocktail" he has experienced since beginning his career in 1978. He follows that statement with a five-minute recitation of a fury of macroeconomic statistics that worry him. From there he discusses how his approach to asset class diversification is designed to optimize return while minimizing risk.

Turning the Valuation Microscope on Large Cap International Stocks

US investors like myself who have been long US equities for the past 10-12 years have enjoyed a wonderful run. That said, sometimes too much of a good thing can be a bad thing. In my case, my exposure to non-US equities is lower than any time in recent memory.

Having set the stage for this analysis with a brief introduction to the merits of diversification, this analysis turns the valuation microscope to 129 of 180 largest holdings in the $398 billion Vanguard Total International Stock ETF (VXUS).

The source for all data is YCharts as of February 16-18. Data used for historical comparison go back to the year 2000 or since the company went public.

Companies selected for this analysis all have a 10-year Beta as of February 2021. This means that each has traded at least for 10 years. Excluded from this analysis for lack of 10-year Beta, among others, is Alibaba Group Holding Limited (BABA). (BABA was covered in the first article of series, however.)

As before, the valuation metrics selected are:

Comparing Returns

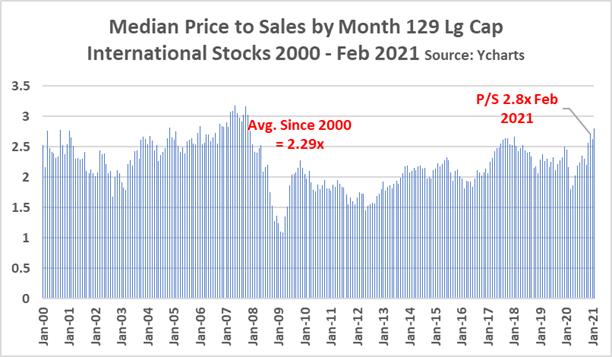

The run-chart shows the median Price to Sales (P/S) ratio of the largest 129 companies in the Vanguard Total International ETF for the past 21+ years. The current median P/S ratio for these companies is 2.8x. The average since 2000 is 2.29x.

The next chart compares the International stocks' P/S data from the prior chart to the median P/S ratios of the 70 largest companies in the Vanguard Growth ETF and the 70 largest in the Vanguard Value ETF. Here are some interesting statistical facts about the chart below:

Price to Sales Scatterplot for 129 International Stocks

As with the other two analyses, here is a scatterplot that shows:

As a reminder, the purpose of the Z-score is to help us understand if the change in P/S ratio for a company is statistically significant. Also, the scatterplot compares the P/S of each equity to its own P/S history.

The chart below reveals:

It must be noted that three International stocks are such outliers that they did not "fit" on the chart:

The chart highlights in red the symbols of 20 international large cap stocks with the highest current P/S ratios and/or highest P/S Z-scores. Among these are three companies with market caps that place them among the most valuable firms in the world:

One challenge with a scatterplot showing 126 companies is that it is impossible to highlight the symbols for the companies clustered in the "value" left quadrant of the chart. This challenge is addressed in the tables that follow; a column has been added to show the most current (February 16-18) Price to Sales for every International stock.

A Closer Examination of Current Valuations

The next step in the analysis focuses on Price/Book, Price to Earnings, Dividend Yield, 10-Year Beta, and Return on Equity. The source for the data is YCharts.

The 129 companies were then divided into six groups based on February 16-18, 2021, Price/Sales compared to the average P/S since 2000 (or since the company went public).

Color-coding is instructive yet not scientific. The codes reflect my arbitrary view of relative attractiveness of a firm's current ratio and trend. For example, if a company currently has a P/S ratio more than 100% above average, this is clearly a high number and assigned a pink (warning) code. In contrast, if a company has a Dividend Yield more than 25% of its historic average, this is a trend deemed possibly positive, and therefore, coded green.

As a simple rule of thumb, equities with more pink are viewed as potentially overvalued. These are the firms that contribute most significantly to today's high market valuations. Equities with more green are viewed as potentially undervalued by today's investors.

Based only on the color system were then given green, pink, and yellow codes in the symbol columns to reflect relative valuation.

Full disclosure: Do not put much credence in the color designations as my knowledge of the International companies is not strong enough for me to have an opinion beyond the color coding.

Group 1 Current Price to Sales Ratio >100% to 20 Yr. Average

Investors love Group 1 stocks.

Eight are identified with pink highlight in the symbol column. Over-valued? The market does not think so judging by the fact that they are up +62% over the past year. Talk about high-fliers.

Source: Ycharts as of February 19:

Note that adidas lags the group by a big margin in one-year price change. This is probably because its second quarter 2020 revenue fell to $3.94 billion from $6.2 billion a year earlier. The good news is that third quarter 2020 roared back with revenue hitting almost $7 billion, the second best quarter ever.

Group 2 Current Price to Sales Ratio +50% to 100% to 20 Yr. Average

Group 2 includes two of the greatest engineering companies in the world, Siemens AG (OTCPK:SIEGY) and ABB Ltd. (ABB).

It also includes Diageo plc (NYSE:DEO)., the wonderful (in more ways than one) spirits company. In their January 2021 earnings call presentation, DEO reported that N. America organic net sales were up +12% in contrast to declines of -10% in Europe/Turkey, flat in Africa, -1% in Latin America/Caribbean, and -3% Asia Pacific. In the prior half year, N. America revenue was just about flat year-over-year compared to -23% to -40% declines in other regions of the world. It appears I am not the only North American who likes Diageo.

Group 3 Current Price to Sales Ratio +25% to 50% to 20 Yr. Average

In Group 3 is BHP Group Ltd. (BHP), the Australian diversified mining company. Its shares are up +48% during the past year. Despite the run-up, its dividend yield is over 3%.

The telecom companies outside the US look interesting as potential storeholds of value. Recently Berkshire Hathaway (BRK.A) (BRK.B) made a big investment in Verizon Communications Inc. (VZ).

Telecom opportunities outside the US include KDDI Corp (OTCPK:KDDIY), Japan's second largest wireless operator. Its current P/S ratio compared to 20-year history is up +26 which is almost identical to the change for Verizon. Also, like Verizon, KDDI has a solid dividend and impressive double-digit ROE. Finally, the 10-year Beta for the two telecom companies is just about identical (.40 for KDDI and .38 for VZ).

Here's a curious fact about Group 3's Royal Dutch Shell plc (RDS.A) and Group 4's Total SE (TOT): They have current P/S ratios of .88 and 1.01 respectively compared to Exxon Mobil Corp (XOM) at 1.25 and Chevron Corp (CVX) at 1.90.

Also note that candy-maker Nestle S.A. (OTCPK:NSRGY) has a current dividend -20% below its 20-year history. On the plus side, its 10-year Beta is .50.

Group 4 Current Price to Sales Ratio +1% to 25% to 20 Yr. Average

The big story on Group 4 is that it includes four of the Big 5 Canadian banks. All five look intriguing.

Canadian Imperial Bank of Commerce (CM) has the second lowest current dividend yield (3.67%) which seems a bit odd since it has the lowest ROE (10%) of the five banks. I would have thought the bank with the lowest ROE would have a higher dividend yield.

The highest ROE belongs to Royal Bank of Canada (RY) at 15%. But note that the ROE Z-score shows a -1.47, suggesting the current ROE is a big drop from historical average.

Group 4 also includes The Unilever Group (UL) which I bought back in May for $48.67 after reading this Seeking Alpha article. Last week I acquired more shares at $54.50 after creating the chart below and seeing Unilever's 10-year Beta of .60, stellar ROE of 37%, and comparative valuation metrics that seem reasonable. The 3.4% dividend is a plus, too.

Group 5 Current Price to Sales Ratio -1% to -25% to 20 Yr. Average

Another stock I picked up last week after creating the charts in this analysis is Sanofi (SNY), the French pharmaceutical company. Note all the green.

Full disclosure: Bayerische Motoren Werke Aktiengesellschaft (OTCPK:BMWYY), aka car-maker BMW, is not really among VXUS's top 180 holdings. I chose to include BMW in the data analysis out of a desire to find an excuse to buy shares in a company that is difficult for a car enthusiast to not admire and enjoy. I will need to do more homework before buying shares which will include further study of this February Seeking Alpha article that provided some helpful insights into the company's sustainability progress as well as comparative stats with peers.

Group 6 Current Price to Sales Ratio

Groups 5 and 6 hold several UK firms which probably speaks volumes about the performance of UK stocks recently compared companies headquartered elsewhere.

My contrarian instincts are drawn to British companies given all the bad news of late about UK. Here are Group 5 and 6 firms with P/S ratios less than -15% of historic averages:

Also in Group 6 is another telecom firm, Deutsche Telekom AG ADR (OTCQX:DTEGY) which has a decent ROE and 10-year BETA as well as valuations that look ok. But the dividend looks low when compared to what other telecom firms around the world pay.

Canadian insurer, Manulife Financial Corporation (MFC), got on my radar last month after reading this bullish article. The writer has an options strategy for acquiring shares that seems to make sense.

Caveats

Summarizing some points made in the three prior articles:

In addition, investors need to be aware of unique risks associated with American Depository Receipts, commonly referred to as ADRs. Here are links to a Schwab article and a Fidelity article describing risks associated with international investing and ADRs specifically.

Also, investors in International firms need to be alert to the risk of double-paying on taxable income from dividends paid by non-US firms. This article offers insight about this risk and how to avoid it.

Final Thoughts, Plan of Action

These four articles about relative valuations have been a joy to research. I appreciate Jeremy Grantham motivating me to kick the tires on my current holdings.

One drawback, by the way of being a long-term buy-and-hold shareholder, is that it is very difficult for me to sell shares in my big winners. While plenty of Seeking Alpha readers hold fast to the belief that winners should not be sold, I am not so sure if I sacrifice the diversification needed to optimize return and minimize risk.

Having now done at least a superficial examination of the valuations of over 300 global large cap stocks, I can state definitively that Grantham has data on his side. Growth stocks look pricey. Value is not cheap. International looks more interesting than it has in the recent past.

As a "market of stocks," I am especially keen on finding those equities that Bob Prince defines as "storeholds of wealth."

Based on the numbers in the charts and tables above, I draw a few observations that require a lot more consideration and analysis:

To the Seeking Alpha community: Please let me know your views on which non-US firms constitute as "storehold of wealth."