As the airline industry reports its financial performance for yet another quarter, Delta Air Lines (DAL) has already proven that it runs a distinctly different and more financially successful business. Now that American (AAL), Delta and United (UAL) have reported their financial reports with the rest of the industry to report within days, it appears, once again, that Delta has defied analysts who have repeatedly said that global airlines would take a back seat in the return of profits to low cost and domestic airlines. Delta reported a fourth quarter 2021 adjusted net profit (excluding refinery performance, equity losses, and profit sharing) of 1.7% compared to double digit margin losses for American and United. Delta also managed to eke out a small profit in the third quarter. So how does Delta do things so differently than the rest of the airline industry? As with any business, the answer is ultimately about revenues, costs, and the balance sheet. Delta’s investor day presentation in December 2021 as well as its earnings report just a few weeks later provide insights.

DAL Revenue

Delta first and foremost sees itself as a premium air transportation provider and that self-perception has enormous implications for its strategies and also for understanding how Delta and its peers have managed differently through Covid.

Delta’s self-perception of being a premium airline, early in the pandemic, meant that the reduced amount of business travel and the dramatic reduction in the amount of international traffic required Delta to set itself apart as offering a higher quality product than its peers. For the first year of the pandemic, it meant that Delta blocked middle seats, catering to the perception of a safer cabin but also using the reduced demand to provide extra space that passengers valued and paid more for, even in a reduced fare environment. Delta’s share of the reduced business market reached historic highs according to Delta execs and it says it continues to retain many of the business passengers it gained during the depths of the pandemic. Delta execs say they have regained approximately 60% of their pre-pandemic domestic business travel revenue even though they ended seat blocking nine months ago. Pre-pandemic, Delta had a double-digit domestic yield premium to the industry and that trend appears to have expanded based on data from other airlines.

Delta’s revenue premium is attributable in part to operating a much more reliable operation than its competitors with the best on-time and cancellation rates among continental U.S. airlines for 2021. While Delta suffered from cancellation problems due to high numbers of employees testing positive for Covid at the end of December, Delta’s operation has returned to historically strong numbers. In addition, Delta is adding its premium economy section to all of its international widebody aircraft in time for summer 2022 and noted that sales of its premium services have outpaced sales of standard economy seats, indicating that there is a growing sophistication among air travelers which Delta says it is capturing.

Delta’s revenue strength is driven by its network strength. While reduced capacity opens the potential for lower cost competitors to gain share, Delta did a better job of maintaining its share in its hub markets than other U.S. airlines; although it reduced system capacity, it gave up share in connecting markets where it is easier to regain that share once business demand returns. In addition to protecting its share in its hub markets, Delta has taken advantage of JetBlue and American’s focus on building their Northeast Alliance in New York City for Delta to add capacity in Boston where Delta will dramatically reduce the capacity deficit it has had to JetBlue. At Los Angeles, Delta became the largest airline by local market revenue; even though former market leader American has re-added some capacity, Delta is likely to remain the largest airline by LAX local revenue as international demand returns.

Delta’s network is strengthened by its partnerships with more than a half dozen foreign airlines in which Delta has an equity position. While international travel has been depressed, the prospects for Delta’s international network are stronger than they were pre-pandemic. Aeromexico and Latam became Delta partners before Covid, with the former in a joint venture with Delta; both Aeromexico and Latam ended up in chapter 11 reorganization and are nearing the end of their restructuring. Both will end up with substantially lower costs which will allow them to compete with the growing number of low cost carriers in their respective markets in Mexico and South America. Delta has told the U.S. DOT that it will significantly grow its operations in Miami when its joint venture with Latam is approved, which Delta hopes will happen in 2022. In Europe, Virgin Atlantic also restructured under British laws and is expanding its network to cities that could create connections with Delta in London. Air France and KLM received substantial aid from their governments and are poised to aggressively compete with Delta for traffic competitive with other European megacarriers. In Asia, which is expected to take an additional year or more to return to pre-Covid demand levels, even excluding China, Delta and Korean Airlines’ relatively young joint venture will position them well to compete against U.S.-Japanese partnerships, esp. given Korean’s merger with former archcompetitor Asiana; the latter is just one of the Asian airlines that will fail as a result of the aggressive Covid restrictions in that region of the world.

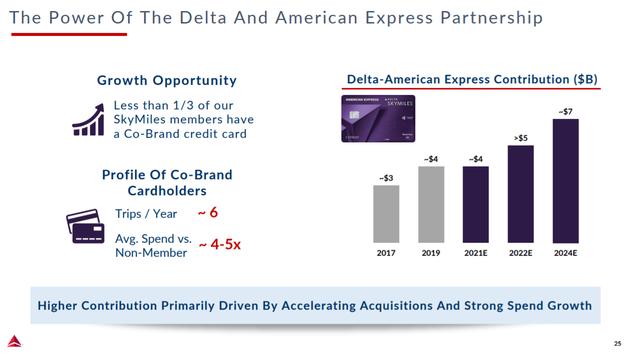

Delta’s revenue strength is not just attributable to passenger revenue. Its biggest revenue advantage is its relationship with American Express (AXP); the two are the largest partners for each other. Delta said even pre-pandemic that its relationship with Amex would deliver $7 billion in revenue to Delta each year, by far the largest loyalty partnership in the global airline industry. Because all of the big three U.S. airlines took out loans against their loyalty programs during Covid, investor disclosures validate that Delta Skymiles is the most valuable loyalty program in the world. In 2021, Amex delivered as much revenue to Delta as it did pre-Covid, putting Delta on track to generate $5 billion in revenue from its credit card partner in 2022 and on to the $7 billion target within a couple years. Delta, like other U.S. airlines, has said that new Skymiles enrollments are growing at the fastest rates ever, indicating that there are large numbers of new customers in the pipeline. At the same time, the fact that airline credit card partnership revenues are not falling is a solid endorsement by their own customers that they will return to large scale travel as existed pre-Covid. While many pundits are quick to proclaim the demise of business travel, the continued strength of its membership base says that business travelers will return and want to retain their loyalty and the associated credit card relationships that are now part of strengthening and augmenting their travel spend with the airline.

Cost management

Delta has long been considered to have better than industry average control of its costs and the pandemic provided an opportunity for them to demonstrate and expand that prowess in three key areas.

Early in the pandemic, Delta demonstrated that it would get employee costs down, in part by encouraging voluntary leaves of absence as well as via early retirements. Delta offered the most generous early retirement program in the history of the airline industry and over 17,000 Delta employees separated from the company, allowing the company to employ a much smaller workforce during the pandemic and then to hire new employees at much lower rates of pay due to lower seniority when it became time to rebuild the workforce as demand returned. Delta’s employee-related cost reduction led the industry during the pandemic and has crept back up as Delta has had to retrain reinstated employees but still is near the best in the industry. Its conservative approach to re-adding capacity until stronger business demand returns has allowed the company to defer some of the HR expenses that other companies have paid throughout the pandemic.

Delta’s second major cost reduction category has been around fleet. Pre-pandemic, Delta planned to receive new aircraft on a continual basis, reducing its fleet size using a pool of older aircraft that can be quickly retired when the inevitable bottom drops out – as it did with Covid. Delta retired approximately 400 mainline and regional jets with the majority by number being the least economical 50 passenger regional jets. Delta also retired dozens of 25-year old aircraft that were two generations old in terms of engine technology which has allowed Delta’s fuel efficiency to improve by more than five percent per year over the past two years. In addition to a number of older domestic aircraft, Delta also retired its fleet of 18 Boeing (BA) 777s. The 777 has become the least efficient aircraft per seat compared to its new generation replacements including the Airbus 350 and 330NEO which constitute all of Delta’s new widebody/international aircraft. Delta also used the downturn to buy nine gently used A350s, many of which spent more time grounded during the pandemic than they flew before it. Delta’s international fleet is now the most fuel efficient among U.S. global airlines as well as on par with DAL’s largest global competitors. Delta has more new generation widebody aircraft on order than American and United combined (other than a UAL order for A350s which has been repeatedly pushed back), making it likely that Delta will use its cost efficiency as well as its focus on premium revenue to significantly expand its international network over the next few years. Finally, Delta has identified scores of older, paid for aircraft which it can use as flex capacity, lightly using them during peak seasons and then having them available for quick retirement in the future if that becomes necessary.

Delta’s final area of cost management has been via its fuel strategies, the key to which was its decision more than ten years ago to stop hedging fuel and instead to buy a refinery in Pennsylvania that has been specifically re-tuned to maximize jet fuel production; the remaining products from the refinery are sold in the local market or exchanged for jet fuel that provide the majority of Delta’s domestic jet fuel needs. Early in Delta’s refinery strategy, Delta gained an ongoing fuel cost advantage of 5 cents/gallon or more to its competitors which adds up quickly for a company that used four billion gallons of jet fuel per year. Low fuel prices in the late 2010s reduced the advantages of the refinery and then reduced refinery volume during the pandemic contributed to increased fuel costs per gallon for Delta. Now that global energy demand is returning and fuel prices are rising, the refinery is once again contributing significant cost advantages to Delta. On a per gallon basis, the refinery reduced Delta’s fuel cost by 15% compared to United and 11% compared to American after low single digit percentage savings in the fourth quarter. On an annualized basis, Delta could spend a half billion dollars less on an annual basis than its two most direct global competitors and the value of Delta’s refinery strategy could grow if fuel prices continue to increase.

Balance Sheet and Valuation

Covid-19 could have decimated the U.S. airline industry, but the U.S. government responded aggressively to ensure that an industry meltdown such as followed 9/11 didn’t occur in the Covid era – and every U.S. airline has survived the Covid era and is in fairly healthy shape even though the Covid era has dragged on much longer than anyone anticipated. While there will always be debates about the amount of government aid to the airline industry and how it was used, a new paradigm of managing crises that hits the airline industry was established – and it is likely that it will be used again should another major crisis hit the airline industry as inevitably happens. There is little appetite for allowing further consolidation of the U.S. airline industry, esp. among the big four carriers.

Government aid was intended to prevent large scale employee furloughs and to ensure that the airline industry would be ready to resume service when demand returned. Both of those goals were accomplished and criticism of how Delta met each of those goals is legitimate, just as it is for other airlines.

Two years into the pandemic, a couple of financial realities about Delta are apparent. First, despite aggressively cost-cutting, Delta is built to generate far more revenue that it did even in the fourth quarter which results in higher unit costs than Delta wants. Delta’s international network needs to generate much more revenue and its domestic system needs to see more high value travelers in order to close the gap between the 30% reduction in revenue and the 8% reduction in operating expenses in the fourth quarter.

Second, Delta entered the pandemic with one of the lowest cash margins in the industry, confident in its ability to draw down credit should the need arise. Credit markets were locked up for weeks and it was only because of government macroeconomic help that airlines like DAL and LUV which entered the pandemic with enormous borrowing capacity were able to start converting credit to cash. Delta will maintain higher levels of cash going forward which will increase borrowing costs even though Delta’s interest expenses are still well below American and United.

Third, Delta’s balance sheet, like that of every other airline, was hammered by the prolonged pandemic and it will take years to repair it. It is notable that a significant portion of DAL’s long-term debt has moved to current period debt this year; other competitors will take longer to start paying down their debt driven by their relatively lower levels of profitability and slower timeline to eliminate losses. Delta paid down $10 billion in debt after its merger with Northwest Airlines during the Great Recession and it clearly learned lessons that it will apply to how it accelerates its balance sheet restructuring which includes its intention to regain an investment grade credit rating.

Fourth, it is clear that Delta is operating its business better than its peers – and not just by a little bit. When there is a 10 point difference in profit margins between a company and its most direct competitors, it is obvious that there are fundamental differences in how those businesses are being operated – which takes us to the final reality….

Airline equities have traded pretty much in lockstep throughout the pandemic. Sure, relative valuations have remained but there has been very little difference in the movement between airlines even though there has been considerable difference in the financial metrics generated by different airlines. At some point, and I believe it will be happening very soon, investors, including the large institutional investors that own most U.S. airline equities, will begin to show a preference for companies that have demonstrated they can adapt. Delta Air Lines is working hard to prove that the positive financial performance gap between itself and its competitors will grow wider as the industry recovers.

DAL stock has been stuck at less than $45 for most of the past six months even as federal government aid to the airline industry ended and it becomes more and more apparent how each company performs on its own and without the “guardrails” that supported the industry for 18 months. And yet, DAL’s guidance and its track record of profitability, rare in the industry, says DAL should be much closer to Wall Street’s consensus price target of $51 than its current price in the upper $30s. Indeed, DAL’s current Wall Street analyst rating is higher than nearly all of the rest of the U.S. airline industry including all of its big four peers (AAL, LUV and UAL).

Almost two years ago, I wrote on Seeking Alpha that Delta would execute the industry’s strongest Covid recovery plan. As the pandemic itself passes the two year mark, it is clear that Delta is returning to profitability faster than nearly the rest of the U.S. and global airline industry. Delta’s pre-Covid strategies are intact while it has used the Covid era to enhance its revenue generation, cost reduction, and balance sheet improvement. DAL stock is certain to rise faster than its peers as Delta’s profitability returns faster and to a greater degree.