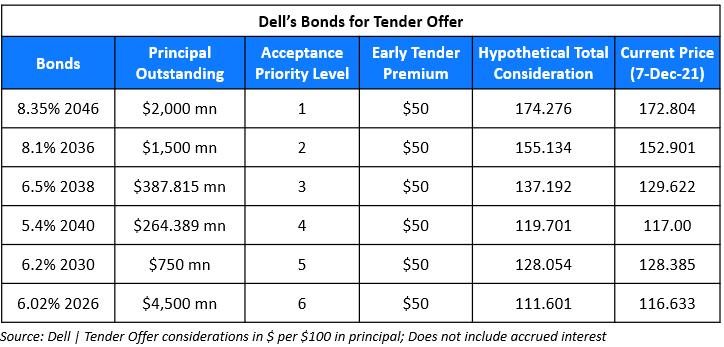

ROUND ROCK, Texas, Dec. 20, 2021 /PRNewswire/ -- Dell Technologies Inc. (NYSE: DELL) announces the pricing terms of the previously announced cash tender offers (collectively, the "Offers") by Dell Inc., its wholly-owned subsidiary ("Dell"). Dell expects to accept for purchase $1,200,000,000 in aggregate principal amount of the 8.350% Senior Notes due 2046 and $500,350,000 in aggregate principal amount of the 8.100% Senior Notes due 2036 that were validly tendered and not validly withdrawn at or before the Early Tender Deadline referenced below (excluding accrued and unpaid interest to, but not including, the applicable settlement date and excluding fees and expenses related to the Offers) from the registered holders (collectively, the "Holders") thereof. The terms upon which such purchase will be made, including the previously announced amended tender cap of $1,200.0 million in aggregate principal amount with respect to the 8.350% Senior Notes due 2046 (the "Amended Tender Cap") and the previously announced amended Maximum Tender Amount of $2,850.0 million (the "Amended Maximum Tender Amount") and order of priority (the "Acceptance Priority Levels") which are set forth in the table below, are described in the Offer to Purchase dated December 6, 2021, as amended or supplemented (the "Offer to Purchase").

The "Total Consideration" for each series per $1,000 principal amount of the debt securities identified in the table below (collectively referred to as the "Securities" and each referred to as a "series" of Securities) validly tendered and accepted for purchase pursuant to the Offers was determined by reference to the applicable fixed spread over the yield to maturity based on the bid side price of the applicable U.S. Treasury Security, in each case as set forth in the table below, and is payable to Holders of the Securities who validly tendered and did not validly withdraw their Securities at or before 5:00 p.m., New York City time, on December 17, 2021 (the "Early Tender Deadline") and whose Securities are accepted for purchase by Dell. The Reference Yields (as determined pursuant to the Offer to Purchase) listed in the table were determined at 10:00 a.m., New York City time, today, December 20, 2021, by the dealer managers who are identified below. The Total Consideration for each series of Securities includes an early tender premium of $50.00 per $1,000 principal amount of Securities validly tendered and not validly withdrawn by such Holders and accepted for purchase by Dell.

The following table sets forth certain information regarding the Securities and the Offers:

Title of Security | Issuer(s) | CUSIP Numbers | Amended Tender Cap(1) (in millions) | AcceptancePriorityLevel | ReferenceU.S.TreasurySecurity | Reference Yield | FixedSpread(basispoints) | TotalConsideration(2)(3) | AggregatePrincipalAmountTendered(4) | Aggregate Principal AmountExpectedto BeAccepted for Purchase |

8.350% Senior Notes due 2046* | Dell International L.L.C and EMC Corporation | 24703TAK2 144A: 25272KAR4 Reg S: U2526DAF6 | $1,200.0 | 1 | 2.000% UST due August 15, 2051 | 1.850% | +190 | $1,724.97 | $1,594,768,000 | $1,200,000,000 |

8.100% Senior Notes due 2036* | Dell International L.L.C and EMC Corporation | 24703TAJ5 144A: 25272KAN3 Reg S: U2526DAE9 | N/A | 2 | 1.375% UST due November 15, 2031 | 1.400% | +175 | $1,558.98 | $1,089,875,000 | $500,350,000 |

6.500% Senior Notes due 2038 | Dell Inc. | 24702RAF8 | N/A | 3 |

N/A | N/A | N/A | N/A | N/A | N/A(5) |

5.400% Senior Notes due 2040 | Dell Inc. | 24702RAM3 | N/A | 4 | N/A | N/A | N/A | N/A | N/A | N/A(5) |

6.200% Senior Notes due 2030* | Dell International L.L.C and EMC Corporation | 24703TAH9 144A: 24703DBD2 Reg S: U24724AP8 | N/A | 5 | N/A | N/A | N/A | N/A | N/A | N/A(5) |

6.020% Senior Notes due 2026* | Dell International L.L.C and EMC Corporation | 24703TAD8 144A: 25272KAK9 Reg S: U2526DAD1 | N/A | 6 | N/A | N/A | N/A | N/A | N/A | N/A(5) |

(1) | The Amended Tender Cap represents the maximum aggregate principal amount of such series of Securities that will be purchased.The Company reserves the right, but is under no obligation, to increase, decrease or eliminate the Amended Tender Cap without extending the Early Tender Deadline or the Withdrawal Deadline (as defined below), subject to applicable law. |

(2) | Includes the Early Tender Premium. |

(3) | Per $1,000 principal amount of the Securities that are tendered and accepted for purchase. |

(4) | At the Early Tender Deadline. |

(5) | The aggregate purchase price required to accept all Securities at Acceptance Priority Levels 1 and 2 that were validly tendered and not validly withdrawn by the Early Tender Deadline exceeds the Amended Maximum Tender Amount. Therefore, Dell does not expect to accept for purchase any tenders of Securities at Acceptance Priority Levels 3 through 6. |

* | Denotes a series of Securities for which the Total Consideration is determined by taking into account the par call date, instead of the maturity date, of such Securities in accordance with standard market practice. |

All payments for Securities purchased in connection with the Early Tender Deadline will also include accrued and unpaid interest on the principal amount of Securities purchased, from the last interest payment date applicable to the relevant series of Securities up to, but not including, the early settlement date, which is expected to occur on December 21, 2021.

As described in the Offer to Purchase, Securities validly tendered and not validly withdrawn at or prior to the Early Tender Deadline will be accepted for purchase in priority to other Securities validly tendered following the Early Tender Deadline even if such Securities validly tendered following the Early Tender Deadline have a higher Acceptance Priority Level than Securities validly tendered at or prior to the Early Tender Deadline. Although the Offers are scheduled to expire at 11:59 p.m., New York City time, on January 4, 2022, because the aggregate purchase price required to accept all Securities validly tendered and not validly withdrawn by the Early Tender Deadline exceeds the Amended Maximum Tender Amount, Dell does not expect to accept for purchase any tenders of Securities after the Early Tender Deadline. Any Securities tendered after the Early Tender Deadline will be promptly credited to the account of the Holder of such Securities maintained at The Depository Trust Company and otherwise returned in accordance with the Offer to Purchase.

In accordance with the terms of the Offers, the withdrawal deadline was 5:00 p.m., New York City time, on December 17, 2021 (the "Withdrawal Deadline"). As a result, tendered Securities may not be withdrawn, except in certain limited circumstances where additional withdrawal rights are required by law (as determined by Dell).

Dell reserves the absolute right, but is not obligated, subject to applicable law, to: (i) waive any and all conditions to the Offers; (ii) extend or terminate the Offers; (iii) (a) increase or decrease the Amended Maximum Tender Amount or (b) increase, decrease or eliminate the Amended Tender Cap without extending the Early Tender Deadline or the Withdrawal Deadline; or (iv) otherwise amend the Offers in any respect.

Barclays Capital Inc. and BofA Securities, Inc. are acting as the dealer managers for the Offers (together, the "Dealer Managers"). The information agent and tender agent for the Offers is Global Bondholder Services Corporation (the "Tender Agent"). Copies of the Offer to Purchase and related offer materials are available by contacting the Tender Agent by telephone at (866) 924-2200 (toll-free) or (212) 430–3774 (banks and brokers), by email at [email protected], or at https://gbsc-usa.com/registration/dell/. Questions regarding the Offers should be directed to the Liability Management Groups ofBarclays Capital Inc. at (800) 438-3242 (toll-free) or BofA Securities, Inc., at (888) 292-0070 (toll-free) or (980) 387-3907 (collect).

This press release is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell with respect to any securities. The solicitation of offers to sell the Securities is only being made pursuant to the terms of the Offer to Purchase. The offer is not being made in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. None of Dell, its affiliates and their respective board of directors, the Dealer Managers, the information and tender agent or the trustee for any series of Securities is making any recommendation as to whether or not holders should tender their Securities in connection with the Offers, and neither Dell nor any other person has authorized any person to make any such recommendation.

About Dell Technologies

Dell Technologies (NYSE:DELL) helps organizations and individuals build their digital future and transform how they work, live and play. The company provides customers with the industry's broadest and most innovative technology and services portfolio for the data era.

Copyright © 2021 Dell Inc. or its subsidiaries.All Rights Reserved. Dell Technologies, Dell, EMC and Dell EMC are trademarks of Dell Inc. or its subsidiaries.Other trademarks may be trademarks of their respective owners.

Special Note on Forward-Looking Statements:

Statements in this press release that relate to future results and events are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933 and are based on Dell Technologies' current expectations. In some cases, you can identify these statements by such forward-looking words as "anticipate," "believe," "confidence", "could," "estimate," "expect," "guidance", "intend," "may," "objective," "outlook," "plan," "project," "possible;" "potential," "should," "will," and "would," or similar words or expressions that refer to future events or outcomes.

Dell Technologies' results or events in future periods could differ materially from those expressed or implied by these forward-looking statements because of risks, uncertainties, and other factors that include, but are not limited to, the following: risks and uncertainties relating to our spin-off of VMware, Inc., including the potential effects on our business of the transaction; the effects of the COVID-19 pandemic; competitive pressures; Dell Technologies' reliance on third-party suppliers for products and components, including reliance on single-source or limited-source suppliers; Dell Technologies' ability to achieve favorable pricing from its vendors; adverse global economic conditions and instability in financial markets; Dell Technologies' execution of its growth, business and acquisition strategies; the success of Dell Technologies' cost efficiency measures; Dell Technologies' ability to manage solutions and products and services transitions in an effective manner; Dell Technologies' ability to deliver high-quality products, software, and services; cyber attacks or other data security incidents; Dell Technologies' foreign operations and ability to generate substantial non-U.S. net revenue; Dell Technologies' product, services, customer, and geographic sales mix, and seasonal sales trends; the performance of Dell Technologies' sales channel partners; access to the capital markets by Dell Technologies or its customers; material impairment of the value of goodwill or intangible assets; weak economic conditions and the effect of additional regulation on Dell Technologies' financial services activities; counterparty default risks; the loss by Dell Technologies of any contracts for ISO services and solutions and its ability to perform such contracts at their estimated costs; loss by Dell Technologies of government contracts; Dell Technologies' ability to develop and protect its proprietary intellectual property or obtain licenses to intellectual property developed by others on commercially reasonable and competitive terms; disruptions in Dell Technologies' infrastructure; Dell Technologies' ability to hedge effectively its exposure to fluctuations in foreign currency exchange rates and interest rates; expiration of tax holidays or favorable tax rate structures, or unfavorable outcomes in tax audits and other tax compliance matters; impairment of portfolio investments; unfavorable results of legal proceedings; compliance requirements of changing environmental and safety laws or other laws; the effect of armed hostilities, terrorism, natural disasters, and public health issues; Dell Technologies' dependence on the services of Michael Dell and key employees; and Dell Technologies' level of indebtedness.This list of risks, uncertainties, and other factors is not complete. Dell Technologies discusses some of these matters more fully, as well as certain risk factors that could affect Dell Technologies' business, financial condition, results of operations, and prospects, in its reports filed with the SEC, including Dell Technologies' annual report on Form 10-K for the fiscal year ended January 29, 2021, quarterly reports on Form 10-Q, and current reports on Form 8-K. These filings are available for review through the SEC's website at www.sec.gov.Any or all forward-looking statements Dell Technologies makes may turn out to be wrong and can be affected by inaccurate assumptions Dell Technologies might make or by known or unknown risks, uncertainties and other factors, including those identified in this press release. Accordingly, you should not place undue reliance on the forward-looking statements made in this press release, which speak only as of its date. Dell Technologies does not undertake to update, and expressly disclaims any duty to update, its forward-looking statements, whether as a result of circumstances or events that arise after the date they are made, new information, or otherwise.

For additional information on these and other factors that could cause Dell Technologies' actual results to materially differ from those set forth herein, please see Dell Technologies' filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

SOURCE Dell Technologies