AT&T’s (NYSE:T) latest quarterly results did not inspire confidence. Shares of the world’s biggest telecommunications company fell 10% following the latest financial results that showed a further decline in the company’s wireless business. T stock opened at $24.06 on Jan. 27.

That AT&T’s streaming platform, HBO Max, performed better than expected in the quarter seemed to provide little comfort to investors who have grown impatient with the stagnant performance of T stock. In the last 12 months, AT&T’s share price has declined 17% to $24.72, bringing its total decline over the past five years to 41% and making the stock a perennial laggard among technology securities.

AT&T’s Q4 Financials

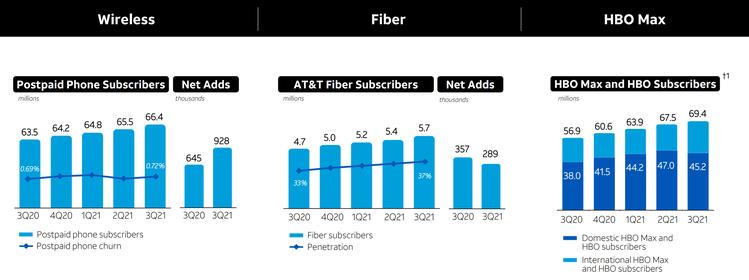

For the fourth quarter of last year, AT&T reported that its revenue at Warner Media, which operates premium TV channel HBO and streaming service HBO Max, rose 15.4% to $9.9 billion. HBO and HBO Max together added 4.3 million subscribers during the quarter, drawing viewers with new movies such as Dune and the newest seasons of popular television shows such as Succession.

AT&T’s total revenue came in at $41 billion in the quarter, beating analysts’ estimates of $40.4 billion. AT&T said it earned 78 cents per share in the quarter, above analysts’ average estimate of 76 cents.

However, despite the solid results from its entertainment unit, AT&T also announced that its wireless business added fewer-than-expected subscribers who pay a monthly bill to the company. AT&T said it signed up 884,000 net new phone subscribers during Q4, which fell short of analyst estimates of 906,500 new subscribers.

The wireless subscriber numbers disappointed Wall Street. So too did the company’s forward guidance, with AT&T saying that it now expects annual earnings to be between $3.10 and $3.15 per share in 2022, which is below analysts’ average estimate of 2022 earnings per share (EPS) of $3.21.

After a brief 2% bounce higher in premarket trading, T stock fell 10% immediately following its latest quarterly results, bringing its year-to-date decline during this volatile trading month to 2%. AT&T faces stiff competition in the wireless space from rivals such as Verizon (NYSE:VZ) and T-Mobile (NASDAQ:TMUS) as the telecommunications companies race to expand their fifth generation (5G) wireless networks.

Just days before its latest earnings, Verizon reported that it had added a better-than-expected 558,000 net new wireless subscribers in the fourth quarter. AT&T has forecast 2022 capital expenditures of $20 billion, the majority of which will be spent on its wireless technology and infrastructure.

Autres problèmes avec le stock T

Looking beyond the latest print, there are other issues holding back T stock. These include AT&T merging its WarnerMedia subsidiary with Discovery (NASDAQ:DISCA) to create an new company called “Warner Bros. Discovery.” AT&T plans to spin off 71% of those shares to AT&T shareholders. Also, AT&T’s DirectTV unit has been sold to a private equity firm.

These changes, which will be finalized this year, will leave AT&T with no more media assets. Moving forward, AT&T plans to focus almost exclusively on its struggling wireless business. That the wireless numbers fell short of expectations in the fourth quarter has led many analysts and investors to further question this strategy.

Additionally, the divestiture of the media assets will result in AT&T cutting its dividend payout by 50%, a move that has angered long-term shareholders who have stood by the Dallas, Texas-based company through thick and thin. AT&T’s annual dividend yield of 8.47% has been one of the main reasons to buy and hold the stock. With the quarterly payout now being halved, many investors have decided to throw in the towel.

Et tandis que les actions de T avaient semblé se stabiliser ces derniers mois, conduisant certains analystes tels que Jim Cramer de CNBC à appeler un fond du cours de l'action, ces pronostics semblent désormais prématurés.

AT&T stock has underperformed for years now. And while there continues to be hope that a turnaround is imminent, the reality is that the telecommunications company is in the midst of a transition that is likely to continue for the majority of 2022. Until the spin off of its media assets is finalized and AT&T is able to focus 100% on its wireless business, the company’s share price is likely to remain depressed.

For this reason, investors should wait for AT&T’s transition to be completed before taking a position in the venerable company. Right now, T stock is not a buy.

À la date de publication, Joel Baglole n'a tenu (directement ou indirectement) aucune position dans les titres mentionnés dans cet article.Les opinions exprimées dans cet article sont celles de l'écrivain, sous réserve des directives de publication InvestorPlace.com.

Joel Baglole est journaliste en affaires depuis 20 ans.Il a passé cinq ans en tant que journaliste du personnel au Wall Street Journal, et a également écrit pour le Washington Post et les journaux de Toronto Star, ainsi que des sites Web financiers tels que The Motley Fool et Investopedia.