For Immediate Release

Chicago, IL – May 16, 2022 – Today, Zacks Equity Research discusses The Coca-Cola Co. KO, PepsiCo Inc. PEP, Keurig Dr Pepper Inc. KDP, and Monster Beverage Corp. MNST.

Industry: Soft Drinks

Link: https://www.zacks.com/commentary/1923812/watch-these-4-soft-drink-stocks-to-get-an-insight-on-industry-trends

The Zacks Beverages – Soft Drinks industry has been witnessing continued pressure from higher supply-chain costs, including transportation and commodity costs, particularly steel and aluminum. Additionally, players are spending more on marketing and advertising to capture a share in the recovering markets. Elevated operating and other costs are likely to strain margins in the near term.

However, industry players are poised to benefit from the introduction of innovative products to suit consumers' needs like functional drinks and naturally prepared drinking options that support an active lifestyle. Industry participants have been steadfastly investing in product innovations to include healthy ingredients in beverages and introduce ready-to-drink variations. Players like The Coca-Cola Co., PepsiCo Inc., Keurig Dr Pepper Inc., and Monster Beverage Corp. are well-poised on robust innovation efforts.

About the Industry

The Zacks Beverages - Soft drinks industry comprises companies that manufacture, source, develop, market and sell non-alcoholic beverages. Soft drinks mainly include sparkling drinks, natural juices, enhanced water, sports and energy drinks, as well as dairy, and ready-to-drink tea and coffee beverages.

Notably, some industry players like PepsiCo produce and sell handy food with flavored snacks, which complement their beverage portfolio. The companies sell products through a network of wholesalers and retailers that include supermarkets, department stores, mass merchandisers, club stores and other retail outlets. Some of them also offer products via company-owned or controlled bottling, independent bottling partners and partner brand owners.

What's Shaping the Future of Beverages - Soft Drinks Industry?

Raw Material Cost Inflation and Supply Constraints: The beverage industry is plagued with higher supply-chain costs, including higher commodity input costs and transportation expenses. Raw material cost inflation, particularly steel and aluminum, has led to increases in packaging costs. The ongoing supply constraints in the aluminum can industry have been other headwinds.

The companies are also witnessing delays in the procurement of certain ingredients, both domestically and internationally, leading to shortages of some goods. The industry players have been facing freight inefficiencies as well as significant increases in domestic and international freight costs.

Logistic issues, as well as higher input costs and freight inefficiencies, have resulted in higher cost of sales and operating expenses, impacting both gross and operating margins. Most players expect commodity cost inflation and higher transportation costs to persist in 2022.

Industry Dynamics: The soft drinks industry has been witnessing transformed trends more than ever, as health-consciousness, personal well-being, natural ingredients, varied flavors and better taste experiences are changing consumers' consumption patterns. There has been an increased consciousness for an active lifestyle and healthy eating habits, which have given prominence to natural, plant-based and organic ingredients in food and beverages.

Soft drinks with no preservatives or added colors, low sugar content, and no artificial sweeteners are the clear choices nowadays. Drinks with plant extracts, natural fruit flavors and not-from-concentrate juices are also gaining popularity. Consumers are increasingly choosing "functional drinks" over their high-calorie counterparts, with a focus on ingredients like vitamins and minerals to support a balanced diet.

Such trends have led soft drink companies to innovate to meet consumers' needs, while introducing more healthy and naturally prepared drinking options. Industry players are vying to grab the market share in on-trend categories like tea, coffee, energy drinks, juices and sparkling water.

Companies are adopting more transparency toward the disclosure of ingredients to gain consumers' confidence. The industry players are also exploring ready-to-drink alcoholic beverages and CBD-infused drinks, which have been gaining popularity lately.

Evolving Trends: The increased at-home consumption trend due to the coronavirus outbreak has led to the demand for more sustainable packaging, and functional and convenient beverage formats. While the away-from-home channel is gradually opening up, industry experts believe that at-home consumption trends will continue to have a share in the overall sales of beverage companies.

Beverage companies have been witnessing robust volumes, driven by recovery across the majority of the markets, investments and the cycling of last year's pandemic-led impacts. The return of normalcy in the away-from-home channel is anticipated to be a boon for soft drink makers, as the away-from-home channel accounts for the majority of their revenues.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Beverages - Soft Drinks industry is housed within the broader Consumer Staples sector. It carries a Zacks Industry Rank #233, which places it in the bottom 8% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry's positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. In the past year, the industry's earnings estimates for 2022 have declined 2.9%.

Before we present a few stocks that you may want to consider for your portfolio, let's take a look at the industry's recent stock-market performance and valuation picture.

Industry vs. Broader Market

The Zacks Beverages – Soft Drinks industry has outperformed the S&P 500 Index and the Consumer Staples sector in a year.

The stocks in the industry have collectively gained 9% compared with the sector's growth of 0.2% and against the S&P 500's decline of 6%.

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing soft drink stocks, the industry is currently trading at 22.54X compared with the S&P 500's 17.02X and the sector's 19.84X.

Over the last five years, the industry has traded as high as 23.71X and as low as 18.52X, with a median of 22X.

4 Soft Drink Stocks to Watch

None of the stocks in the Zacks Beverages – Soft Drinks industry currently sport a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy). We have highlighted four stocks with a Zacks Rank #3 (Hold) from the same industry. You can see the complete list of today's Zacks #1 Rank stocks here.

Let's take a look.

Coca-Cola: The soft drink behemoth is poised to gain from strategic transformation and ongoing worldwide recovery. The streamlining of portfolio and accelerating investments to expand the digital presence position the company for growth in the long term. It has been witnessing a splurge in e-commerce, with the growth rate of the channel doubling in many countries. It is strengthening consumer connections and piloting numerous digital-enabled initiatives through fulfillment methods to capture online demand for at-home consumption.

The company has been gaining from increased consumer mobility and the reopening of economies in several parts, leading to the reopening of the away-from-home channel. The improvement in the away-from-home volume is expected to result in a strong price/mix and margin acceleration across the company. The Zacks Consensus Estimate for its 2022 earnings has moved up 0.8% in the past 30 days. The company's shares have gained 17.9% in the past year.

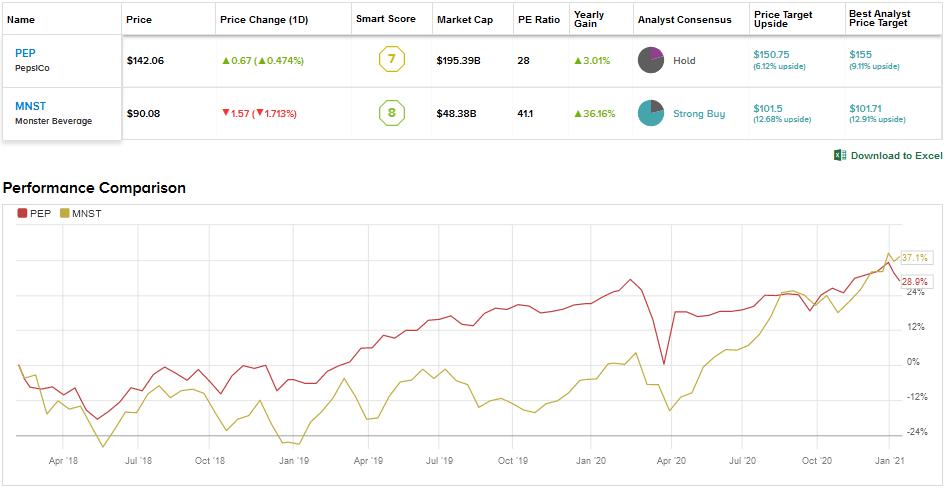

PepsiCo: The stock of this Purchase, NY-based leading soft-drink company has risen 16.5% in the past year. Resilience and strength in the global snacks and foods business, as well as growth in the beverage category, have been aiding the company. It is poised to benefit from investments in brands, go-to-market systems, supply chain, manufacturing capacity and digital capabilities to build competitive advantages.

Within the snacks/food business, Frito-Lay remains focused on offering more choices to meet customers' changing needs and preferences. Some of these are expanding variety pack offerings, continuous flavor and brand innovation, and introducing healthier snacking alternatives.

In the beverage category, PepsiCo expects strong growth and market share gains for energy drinks, driven by the increased depth and breadth of its portfolio, and improved distribution capabilities. The company continues to invest in its Zero Sugar products and other functional beverages in the carbonated and non-carbonated categories to offer more choices to consumers. The consensus estimate for the company's 2022 EPS has moved down 0.4% in the past 30 days.

Keurig Dr Pepper: Packaged Beverages and Coffee Systems businesses have been driving sales for this beverage and coffee company based in the United States and Canada. Robust market share gains and in-market performances across categories and brands have been the growth drivers. The Packaged Beverages segment is witnessing improved volume/mix due to an increase in at-home consumption trends and strong market share growth.

The company expects increased household penetration across hot and cold beverage portfolios to continue. Its market share growth is being supported by efficient marketing and product innovation strategies. The company is also investing in boosting distribution platforms and e-commerce operations. Shares of this producer, distributor and seller of a range of non-alcoholic ready-to-drink beverages have gained 2.3% in the past year. The consensus estimate for its 2022 EPS has been unchanged in the past 30 days.

Monster Beverage: The leading marketer and distributor of energy drinks and alternative beverages based in Corona, CA, remains committed to product launches and innovation to boost growth. Management is optimistic about strength in the energy drinks category, with the Monster Energy brand growing significantly.

It remains on track to launch a number of additional products and product lines in domestic and international markets this year. Product launches across the Monster family are expected to drive the company's overall top and bottom lines in the coming quarters.

Management doesn't expect any material impact of the COVID-19 pandemic on the functioning of its co-packers and bottlers/distributors, who manufacture and distribute products, respectively. The company has declined 7% in the past year. The Zacks Consensus Estimate for its 2022 earnings has declined 4.3% in the past seven days.

Why Haven't You Looked at Zacks' Top Stocks?

Our 5 best-performing strategies have blown away the S&P's impressive +28.8% gain in 2021. Amazingly, they soared +40.3%, +48.2%, +67.6%, +94.4%, and +95.3%. Today you can access their live picks without cost or obligation.

See Stocks Free >>

Join us on Facebook: https://www.facebook.com/ZacksInvestmentResearch/

Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

https://www.zacks.com

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performancefor information about the performance numbers displayed in this press release.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>Click to get this free report

CocaCola Company The (KO): Free Stock Analysis Report

PepsiCo, Inc. (PEP): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.