Image source: The Motley Fool.

Huntington Ingalls Industries, inc (NYSE:HII)Q3 2021 Earnings CallNov 5, 2021, 2:00 p.m. ET

Contents:

Prepared Remarks:

Operator

Ladies and gentlemen, thank you for standing by, and welcome to the Third Quarter 2021 Huntington Ingalls Industries Earnings Conference Call. [Operator Instructions]

I would now like to hand the call over to Dwayne Blake, Vice President of Investor Relations. Mr. Blake, you may begin.

Dwayne B. Blake -- Corporate Vice President of Investor Relations

Thanks. Good morning, and welcome to the Huntington Ingalls Industries Third Quarter 2021 Earnings Conference Call. With us today are Mike Petters, President and Chief Executive Officer; Chris Kastner, Executive Vice President and Chief Operating Officer; and Tom Stiehle, Executive Vice President and Chief Financial Officer.

As a reminder, statements made in today's call that are not historical fact are considered forward-looking statements and are made pursuant to the safe harbor provisions of federal securities law. Actual results may differ. Please refer to our SEC filings for a description of some of the factors that may cause actual results to vary materially from anticipated results.

Also, in the remarks today, Mike, Chris and Tom will refer to certain non-GAAP measures. Reconciliations of these metrics to the comparable GAAP measures are included in the appendix of our earnings presentation that is posted on our website. We plan to address the posted presentation slides during the call to supplement our comments. Please access our website at huntingtoningalls.com and click on the Investor Relations link to view the presentation as well as our earnings release.

With that, I'll turn the call over to our President and CEO, Mike Petters. Mike?

Mike Petters -- President and Chief Executive Officer

Thanks, Dwayne. Good morning, everyone, and thanks for joining us on today's call. This morning, we released third quarter 2021 financial results that included another quarter of consistent shipbuilding program execution. Let me share some highlights from the quarter starting on slide three of the presentation. Sales of $2.3 billion were up 1% from the third quarter of 2020 and diluted EPS was $3.65, down from $5.45 in the third quarter of 2020. New contract awards during the quarter were approximately $600 million, resulting in backlog of approximately $50 billion at the end of the quarter, of which approximately $24 billion is funded.

Shifting to activities in Washington. The federal government began the new fiscal year under a continuing resolution, which funds government operations through December 3. Now we continue to urge Congress to proceed expeditiously and remain optimistic that the defense appropriations and authorization processes will be completed in the months ahead. As bills progressed through both chambers of Congress, we continue to see bipartisan support for our programs reflected in the defense appropriations and authorization bills in the House and the Senate. We are pleased that the four defense oversight committees have shown strong support for shipbuilding to include adding a second Arleigh Burke-class destroyer, which is a Navy -- a top Navy priority for fiscal year 2022.

The appropriations bills also include language in support of a DDG 51 follow-on multiyear procurement contract in FY '23. So as I prepare to close, let me give a quick update on COVID-19. We continue to work with our customers to satisfy the requirement for federal contractors to have their workforce vaccinated against COVID-19 by December 8, 2021. At HII, we remain committed to promoting and protecting the health and safety of our employees, their families and their communities and continuing to serve our customers and the vital national security interests of our country without disruption as an essential contributor to the nation's critical infrastructure.

We view our workforce of approximately 44,000 employees as critical partners in this effort and continue to help our unvaccinated employees meet this requirement as safely and efficiently as possible. We will continue to evaluate how the vaccine mandate and delta variant impact our workforce as well as material availability from our supply chain and we expect to have more to share during the fourth quarter earnings call in February. And finally, let me recap what HII has done from a portfolio shaping perspective over the past 20 months. In short, we have done exactly what we said we would do during our February 2020 Investor Day.

First, we have positioned the Technical Solutions business in growth markets that support the constantly evolving requirements of our customers. And second, we have demonstrated the financial flexibility to pursue these critical growth opportunities while maintaining our investment-grade credit ratings and continuing to return capital to shareholders. Following the closing of the Alion transaction during the quarter, our team is laser focused on a successful integration in order to produce the financial returns we expect. We are also ensuring that our core shipbuilding programs are achieving key production milestones in order to generate strong free cash flow, which will enable deleveraging of the balance sheet while continuing to return capital to shareholders via dividends and share repurchases. We firmly believe that these are the appropriate steps to generate significant long-term sustainable value for our shareholders, our customers and our employees.

And now I will turn the call over to Chris for some remarks on the operations. Chris?

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

Thanks, Mike, and good morning, everyone. I'm very pleased to report another solid operational quarter. With that, let me share a few highlights. At Ingalls, let me first provide a brief update on the pending contracts awards of LHA 9, LPD 32 and 33. We still believe that a bundled acquisition of these critically important ships is the most cost-effective method of procurement and are pleased that the Navy and Congress have protected the ship schedules with a contract for long-lead material on LHA nine coupled with continued support for LPD 32 and 33. Shifting to program status. LHA eight Bougainville continues to achieve cost and schedule performance in line with our expectations while making steady progress through the structural erection and initial outfitting phases of construction.

On the DDG program, the team successfully completed acceptance trials for guided missile destroyer DDG 121 Frank E. Petersen Jr. and expects to deliver the ship to the Navy by the end of this year. In addition, DDG's 123 and 125 remain on track to complete sea trials next year as planned. On the LPD program, LPD 28 Fort Lauderdale was christened in August. This ship remains on track to complete sea trials during the fourth quarter with delivery to the Navy planned in the first quarter of next year. At Newport News, CVN 79 Kennedy is approximately 84% complete and the focus remains on compartment completion and key initial propulsion plant milestones.

Regarding definitization of the single-phase delivery contract modification, we have reached agreement on the cost and schedule impacts with the Navy and expect to execute the contract modification late this year or early next year. On the RCOH program, CVN 73 USS George Washington continues to achieve key propulsion plant milestones and is approximately 92% complete. In CVN 78 USS Gerald R. Ford returned to Newport News in August to begin a planned incremental availability following successful completion of full-ship shock trials. On the VCS program, SSN 794 Montana remains on track for delivery to the Navy later this year.

And the SSN 796 New Jersey float-off milestone has moved to early next year to ensure that we achieve the optimum build sequence from float-off to delivery, planned in 2022. And finally, on the submarine fleet support program, SSN 725 Helena, remains on track for redelivery to the Navy later this year. At Technical Solutions, the Alion transaction closed in mid-August, and the team announced new business groups and executive appointments that directly align with the strategic focus that we have previously articulated. We expect this very talented team to execute a successful integration of Alion and deliver unparalleled national security solutions to our customers while growing the business and producing returns in line with our expectations. Delays in contract awards in our unmanned business for critical new programs remains a watch item. We're expecting this to be resolved by the end of the year, but it appears that these awards are not likely until early to mid-2022.

Now I'll turn the call over to Tom for some remarks on the financials. Tom?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

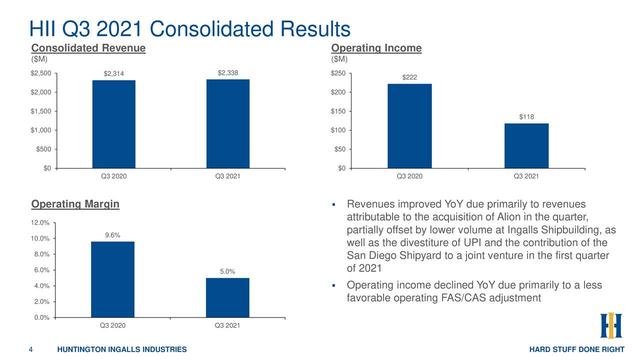

Thanks, Chris, and good morning. Today, I will briefly review our third quarter results and provide an update on our outlook for 2021. For more detail on the segment results, please refer to the earnings release issued this morning and posted to our website. Beginning with our consolidated results on slide four of the presentation, our third quarter revenues of $2.3 billion increased approximately 1% compared to the same period last year. This is due to growth at Technical Solutions driven by the Alion acquisition which was largely offset by a decline in revenue at Ingalls, primarily due to lower volumes on the NSC, DDG and LHA programs.

Segment operating income for the quarter of $163 million increased $1 million compared to the third quarter of 2020. And segment operating margin of 7% was in line with the results from the prior year period. Operating income for the quarter of $118 million decreased by $104 million from the third quarter of 2020, and operating margin of 5% decreased 455 basis points. These decreases were almost entirely due to a less favorable operating FAS/CAS adjustment compared to the prior year period. The tax rate in the quarter was a negative 4.3% compared to 1.8% in the third quarter of 2020. The decrease in the tax rate was primarily due to additional research and development tax credits for tax years 2016 through 2020 recorded in the third quarter of 2021.

Net earnings in the quarter were $147 million compared to $222 million in the third quarter of 2020. Diluted earnings per share in the quarter were $3.65 compared to $5.45 in the prior year period. Third quarter 2021 results include approximately $15 million of nonrecurring pre-tax transaction expenses related to the acquisition of Alion. Excluding the impacts of pension, diluted earnings per share in the quarter were $3.58 compared to $3.73 per share in the third quarter of 2020. Turning to slide five. Cash from operations was $350 million in the quarter and net capital expenditures were $73 million or 3.1% of revenues, resulting in free cash flow of $277 million.

This compares to cash from operations of $222 million and $62 million of net capital expenditures or free cash flow of $160 million in the prior year period. Cash contributions to our pension and other postretirement benefit plans were $10 million in the quarter, principally related to postretirement benefits. During the third quarter, we paid dividends of $1.14 per share or $46 million. Our Board of Directors recently approved a 3.5% increase in our quarterly dividend to $1.18 per share, and this will take effect in the fourth quarter of this year. We also repurchased approximately 83,000 shares during the quarter at an aggregate cost of approximately $17 million.

Moving on to slide six. Ingalls revenues in the quarter of $628 million decreased $47 million or 7% from the same period last year, driven primarily by lower revenues on the NSE, DDG and LHA programs. Ingalls operating income of $62 million and margin of 9.9% in the quarter compared to operating income of $62 million and margin of 9.2% in the third quarter of 2020. The operating margin improvement was driven by an incentive on the DDG program and higher risk retirement for the LPD program, partially offset by lower risk retirement on the NSC program. Turning to slide seven. Newport News revenues of approximately $1.4 billion in the quarter decreased $4 million or less than 1% from the same period last year, driven by lower revenues in naval nuclear support services partially offset by higher revenues in submarines and aircraft carriers.

Naval nuclear support services revenues decreased primarily as a result of lower volumes in submarine fleet support services and facility maintenance services partially offset by higher volumes in carrier fleet support services. Submarine revenues increased due to higher volumes in Block V boats of the Virginia-class submarine program, and submarine support services and Columbia-class submarine program, partially offset by lower volumes on Block IV boats of the Virginia-class submarine program. Aircraft carrier revenues increased primarily as a result of higher volumes on the RCOH of USS John C. Stennis CVN 74 and the construction of Doris Miller CVN 81 and enterprise CVN 80, partially offset by lower volumes on the RCOH of USS George Washington CVN 73 and the construction of John F. Kennedy CVN 79.

Newport News operating income of $88 million and margin of 6.5% in the quarter compares to operating income of $79 million and margin of 5.8% in the third quarter of 2020. The improvement was primarily due to higher risk retirement on the RCOH of the USS George Washington CVN 73 and Block IV boats of the VCS program, partially offset by lower risk retirement on the naval nuclear support services. Now to Technical Solutions on slide eight of the presentation. Technical Solutions revenues of $394 million in the quarter increased 23% from the same period last year, mainly due to revenue attributable to the acquisition of Alion in mid-August, partially offset by the divestiture of our oil and gas business and contribution of the San Diego shipyard to a joint venture in the first quarter of this year.

The acquisition of Alion closed on August 19, and third quarter results included approximately $163 million of revenue attributable to Alion. Technical Solutions operating income of $13 million and operating margin of 3.3% in the quarter compares to an operating income of $21 million and operating margin of 6.6% in the third quarter of 2020. These decreases were primarily driven by the inclusion of approximately $8 million of Alion related purchase intangible amortization as well as lower performance in Defense and Federal Solutions, the divestiture of our oil and gas business and the contribution of the San Diego shipyard to a joint venture I previously mentioned.

Third quarter 2021 results include approximately $4 million of operating income attributable to Alion. Third quarter Technical Solutions EBITDA was approximately $30.3 million or an EBITDA margin of 7.7%. Moving on to slide nine of the presentation. We've updated our outlook for 2021 and 2022 pension and postretirement benefits. For 2022, FAS is now projected to be a benefit rather than an expense, primarily due to higher asset returns. Consequently, the FAS/CAS adjustment has increased from the prior outlook and is now projected to total $52 million in 2022. Please remember that pension-related numbers are subject to year-end performance and measurement criteria.

We will provide a multiyear update of pension estimates on our fourth quarter earnings call in February. Finally, on slide 10, a perspective on the outlook for the remainder of the year for both shipbuilding and Technical Solutions inclusive of Alion. Regarding shipbuilding, we now expect 2021 revenue to be approximately $8.2 billion at the low end, but within our initial guidance range. Third quarter shipbuilding revenue was modestly impacted by material timing, which may persist in the near term. Additionally, we continue to navigate through a challenging labor market as well as the potential impact of COVID-19 vaccine mandate. Given all of that, we think it's best to be prudent and temper near-term expectations.

We continue to expect that shipbuilding operating margin will finish the year in the 7.5% to 8% range. We expect that the fourth quarter shipbuilding operating margin will be roughly consistent with the third quarter results as we were able to recognize some key retirement events in the third quarter, including the completion of sea trials for DDG 121. Regarding Technical Solutions, I've noted that Alion acquisition closed in mid-August and our updated expectations for 2021 now include Alion from the date of acquisition, inclusive of incremental purchase intangible amortization that impacts our segment operating margin expectation.

Turning to free cash flow. We now expect 2021 free cash flow to be between $300 million and $350 million as the repayment of the accelerated progress payments which was initially expected in 2021 has now moved out to 2022. Additionally, on slide 10, we have provided an updated outlook for a number of other discrete items to assist with your modeling. Regarding our longer-term targets, we continue to believe that the 3% CAGR for shipbuilding revenue is appropriate. Additionally, we remain comfortable with our free cash flow target of $3.2 billion from 2020 through 2024. We plan to provide a more detailed view of 2022 on our fourth quarter call in February.

Now I'll turn the call back over to Dwayne for Q&A.

Dwayne B. Blake -- Corporate Vice President of Investor Relations

Thanks, Tom. [Operator Instructions]

Operator, I'll turn it over to you to manage the Q&A.

Questions and Answers:

Operator

[Operator Instructions] Our first question comes from Myles Walton with UBS.

Myles Walton -- UBS -- Analyst

Thanks, good morning. Good morning Miles. I was hoping I could just start with the shipbuilding revenue outlook and maybe less specific to the revenue outlook, more specific to what you're seeing in the labor workforce.

And moving to the low end of this range, is that anticipating things that you haven't seen yet as it relates to the COVID mandate and what it could do to attendance and workforce? Or is it more what you saw in the third quarter, if you kind of get where I'm going.

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Hey, good morning Miles. It's Tom. I'll start with that one. So from an outlook perspective, yes, we did go to the bottom end of the range. As you recall, we gave you $8.2 billion and $8.4 billion at the beginning of the year. As we see how the quarter played out right now, what's left in front of us right now. We now move the shipbuilding revenue expectation at $8.2 billion.

A couple of points on that right now. We're a little light on material, specifically at Ingalls. If you look from a Newport News perspective, net revenues were flat. Obviously, I'll look back from a TSD perspective. But when we're talking about shipbuilding, the material lag behind roughly about $40 million in the quarter. And as we look forward into Q4, that could persist.

We don't see significant labor pressures at this time that's going to impact our revenue. We have a keynote right now with the DEO and the mandate and how that's changing very dynamic situation there as well as keeping an eye on our supply chain to see how the material flows here. But it's just timing right now as we see the outlook. And as I said, it's still in the range that we gave you at the beginning of the year.

Myles Walton -- UBS -- Analyst

Okay. Okay. And what is the percent of the workforce that's currently vaccinated? And if there were pervasions, is it covered in your contracts because it's a new requirements being placed upon you?

Mike Petters -- President and Chief Executive Officer

Right. Myles, this is Mike. Right now, we're, I'd say, roughly around 75%. We've seen a tremendous uptick in the last 30 days in folks getting the vaccine. I think the breaking news right now, it looks like the executive orders being moved out into January and the -- and they're talking about having your shot by January, not completely through the quarantine.

So we're going to have to interpret how all of that plays out. We're working very closely with our customers on how do you implement the executive order. I mean the executive order is -- we've been -- we have been -- from a policy standpoint, we have been directly aligned with what the White House put out. But as you -- as you kind of hinted out there, the executive order is not contractual.

And so working with our customers on all of our contracts to figure out how best to implement that executive orders, what we're doing, and we're doing that across the board. So we're continuing to move ahead. Our ambition is to get as many of our employees vaccinated as we possibly can because we are committed to a safe workplace, and we think that's the best way to do it.

Operator

Our next question comes from Doug Harned with Bernstein.

Doug Harned -- Bernstein -- Analyst

Good morning thank you. Right now, you're in the transition on Virginia-class from Block IV to Block V. Could you comment on how Block V looks in terms of the amount of content you have on that? And how would you describe any risks in the transition relative to the one you did when you moved to Block IV?

Mike Petters -- President and Chief Executive Officer

Well, I'll start and then let Chris pick it up. The transition -- when we kicked off Block IV, the contract took quite a while to negotiate that contract. And we -- and as a result, there was some late material procurement that kind of helped us get off to a rocky start relative to that program as well as the ramp-up in production.

So we had a lot of things moving -- a lot of parts moving on the beginning of Block IV. We don't have any of those partners moving at the beginning of Block V And so we're -- the transition for us is moving basically seamlessly from Block IV into Block V. Pretty excited about that and pretty optimistic about where that's going to go.

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

Yes. No, I think that's right. And when you think through VCS and Block IV, getting back to a cadence where we're floating off one boat a year and delivering one boat a year and then transitioning that workforce right into Block V makes great sense. So we have high hopes for performance on Block V because of the lessons we're learning through Block IV when you get to a two per year sort of cadence.

Doug Harned -- Bernstein -- Analyst

And then also on submarines, you commented this time that your services revenues were down a little bit. Can you comment on where the three Los Angeles class ships stand in their process? And how you see services revenues at Newport News trending over the next couple of years here?

Operator

Sure. So Helena will -- this is Chris, Doug. Helena will deliver this year. Columbus is in process and moving through the cycle in their contract and then Boise is really in their prompt start period. So we're going to get into a place here.

And I think in communication with our customer where it makes great sense to have sort of a consistent stream work and revenue, it probably will not be as high as it's been going forward, and we need to create that plan with our customer. But that's the status of the three that are in Newport News now. And as I said, we're working with a customer to ensure we have a steady cadence of repair activity going forward. Our next question comes from Seth Seifman with JPMorgan.

Seth Seifman -- JPMorgan -- Analyst

Hey, Thanks for answering good morning.I wanted to start off. I think you mentioned a bit earlier that you were looking to finalize the single-phase delivery agreement for the carrier with the Navy either late this year or early in 1Q. I guess can you tell us, is there any kind of margin or cash impact that you should think about once that's finalized?

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

Yes. Yes, Seth, this is Chris. We will definitize that, if not this year, beginning of next, don't anticipate a significant margin, cash impact. It's obviously an increase in the top line for that ship, but it also extends the risk retirement events out a couple of years because of extensive test program. So nothing significant from -- or material from a sales margin or cash impact at this point.

Seth Seifman -- JPMorgan -- Analyst

Okay. Okay. And then, I mean, it seems like it's mostly a timing issue, but just wanted to ask about the cash flow guidance increase this year. Should we think about that increasing your kind of 5-year expectation? Or is it mainly having to do with the timing of when those progress payments go back to the government?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Seth, yes, it's Tom here. Yes, The progress payments is the predominance of the change that we have right now. Obviously, another quarter with risk retirement, and we have actual -- through Q3, we have a line of sight for the end of the year.

But predominantly, the change there was because of the progress payments is not going to -- kept into the 2022 time frame. Keep in mind too at year-end, we have to pay back half of the payroll by the tax that we did not pay in 2020. So that's baked into the numbers. So it's timing. And within the $3.2 billion, it still holds.

Operator

Our next question comes from Ron Epstein with Bank of America.

Ron Epstein -- Bank of America -- Analyst

Yeah, good morning. I was wondering if you could give us just some more color maybe just following up on Myles' question about what's going on in your supply chain? Where you're seeing some material shortages? And is it just being driven by delays in transportation or what is it?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Sure. Yes, it's Tom here. I'll take that one. So we've had this conversation on the last couple of calls, and we're watching that intently. I regularly touch base with the supply chain offices that we have at each of the yards, some of to be exactly on where they stand right now. As we've given in the past, because of the nature of our long-term contracts, long-term material orders that start ahead of the construction of these contracts.

And then obviously, with the backlog that we have to spend on contract, and we have line of sight of the work that's going to be performed in the yards. A significant amount of those requirements have already been put on order, and we're managing them aggressively to make sure that the material flows in and it hits the in-yard need dates.

The preponderance of the material is coming in on time and meeting the contractual needs that we have within the yard. I would tell you that recently, the last three to six months that as we have spot orders, what we're seeing is a little bit of volatility in pricing and the validity dates are shrinking a little bit on things that we have to spot by.

But from a perspective of execution of the existing contracts we have, we don't see a significant impact at this time. Obviously, we're watching how the DEO mandate impacts the supply chain. And the pressures that we do hear our second and third tier who are dependent on the raw materials. So copper cabling, things of that nature. But again, as you stand here today, the supply chain that we need because of how we've contracted that work in advance has us maintaining schedule at this time.

Ron Epstein -- Bank of America -- Analyst

Okay. Got it. Got it. All right. And then on the Technical Services business, if we just open up the aperture a little bit and think about when we walk out two, three four years from now, where do you see the margin in that business, right?

I mean, presumably, it's going to be much better than where it is today. And I'm just curious, I mean, if you can just give us -- I know you're not giving forward guidance is -- it's something most companies don't do. So I'm not asking for that. But just if you can put a little framework around how we should think about the margin in that business as we think longer term.

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Yes. So because of how we put that division together with the acquisitions, the purchase intangibles and things of that nature, if you noticed we've been guiding and driving toward an EBITDA relationship against the performance and where we see. You've noticed from the announcement we had in the July time frame and then with the Alion close in August, we've guided you on how that was going to cause a lift there.

From a RCOH perspective, we were at 4% to 5%. We dialed in from an EBITDA perspective to be in the 8% to 10% range by 2024. Both the initial guidance we gave you in the July timeframe of Alion supported that. As we sit today after the close in August, and now we've closed the quarter with Alion cranked into our financials, they're hovering on the low end of the range right now.

So that's good news because that's more than 50% of that portfolio. And I think kind of going forward, as we see those purchase intangibles get burned off in the next three,four, five years going forward, obviously, that's going to be an improvement. I would tell you that the PI is baked into the ROS, although the ROS even for this quarter at TSD is 2.6%, with $8 million of purchased intangibles. When you roll that out, it's a 5.3% ROS quarter and the EBITDA is at 7.7% right now. So that's a new term perspective and how I see it kind of evolving in the out years.

Operator

Our next question comes from George Shapiro with Shapiro Research.

George Shapiro -- Shapiro Research-George Shapiro-Shapiro Research -- Analyst

I guess you had mentioned that the margin in shipbuilding in Q4 will be similar to Q3 because some items moved to Q3. Can you just list what moved to Q3? And I thought you mentioned some might have moved to Q1 or so of next year. So what do we expect in Q2 -- in Q4 for incentives versus what we had thought before?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

George, it's Tom here. Yes, I'll take that. So just a couple of moving parts there. We kind of guided in Q2 going into Q3 would be light and Q4 would be a little bit heavier than that. We have pulled a couple of incentives, Newport News on the RCOH one hundred seventy three to the left as well as at Ingalls, taking DDG one hundred twenty one to trials was a risk retirement evaluation and event. So just a couple of moving parts there from Q3 to Q4.

But we're still in the lane there of the 7.5%, 8% ROS that we gave you for shipbuilding for year-end. I didn't mention anything moving into next year in my remarks. We do have LPD twenty eight moving or staying on contract in the beginning of 2022.

George Shapiro -- Shapiro Research-George Shapiro-Shapiro Research -- Analyst

Okay. And then just a separate one probably more for Mike. I noticed that Newport News, you got like the Union contract with affecting 50% of the workers up in November here now. So if you could kind of give us what you think about the status there? I mean, it's -- I guess it's more in the news given the contract we've all seen end of the year.

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

George, I'll start. This is Chris. We're in process with the Newport News Union working through that contract. We have a very good relationship with them. And I fully expect we can come to a reasonable agreement on a contract. I know Mike ran Newport News for a while. So he probably has -- for a long time, actually, he probably has better comments on that. But we're working with them every day to try to get to a resolution.

Mike Petters -- President and Chief Executive Officer

We pride ourselves on having very constructive relationships with our labor partners, and I don't think this will be any different than that.

Operator

Our next question comes from Richard Safran with Seaport Research.

Richard Safran -- Seaport Research -- Analyst

Thanks good morning everybody. So on the Navy's new destroyer cruiser class, the ship doesn't appear to be slated to rise until very late in the decade. Correct me if I'm wrong, but I think that represents a bit of a slide to the right in terms of schedule. Could you discuss a time line for competition? And following up on your opening remarks, I'm wondering how you think that, that the Navy strategy with the new ship now impacts by the new flight of DDG 51s. Since the new ship isn't arriving now for close to 1ten years down the line, I'm thinking that really reinforces the idea of a new flight of DDGs, but that's my view. I was wondering what you think of that.

Mike Petters -- President and Chief Executive Officer

It's Mike. I don't think you're too far off there, just in general. I think general principles are, it's really hard to pin down the development path and time line for a new program like this, this early in the process. They're trying to work through how do they fund the design, how they fund the project, when are they going to have it? What are the requirements going to be? That's a pretty dynamic thing. And so trying to pin that down precisely is a bit of a challenge. And our general view is that you don't really want to stop production of a line until you're ready to move to a mature design product going forward.

So as that product matures, it will interact. The construction work that's going on, on the DDGs today, the Flight III ships will -- my -- we certainly will advocate and believe that the best prudent course ahead will be to continue to build Flight IIIs until that design is maturing and you're ready to go into production on that. And if that happens to be twenty something else, then it's twenty something else and then we'll be ready. As far as the competition for that goes, that will just lay in.

As that program matures, we'll get more visibility into what the competition, when it might be, what it would look like and that sort of thing. I think it would be a mistake, though, for there to be any sort of curtailment in the destroyer program, anticipating some kind of maturation path. We kind of went down that path in a couple of programs during my career. We've done that with submarines. We did that actually with DDGs and trying to transition over to the 1,000s and then transition back.

So we had a gap in the destroyer program. Our industry is full of people who have seen gaps in production become tremendous problems for restart of production. So let's keep the production line moving. And when the production line -- when they decided to turn off the transition, we will transition it.

Richard Safran -- Seaport Research -- Analyst

Okay. And more general, I thought you could talk a little bit about efficiency initiatives. A while back, we had things like digital transformation, but I thought you might discuss efforts to reduce cost. And in your answer, maybe you could talk about how much that might contribute to margin improvement and the objective of eventually getting to 9% margins?

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

Yes. Richard, this is Chris. Yes, I won't discuss the contribution to the margin rate and when we expect to get to 9%, we'll talk a lot more about that on the year-end call. But the capital investments we've made and the technology investments we've made both at Ingalls and Newport News are going very well.

In the most simple form at Ingalls getting all the work under cover, really drives efficiency if you've ever been in Mississippi in August. And then the digital shipbuilding products are becoming more mature and helping the manufacturing of CVN Eighty and the Columbia-class. So we're very encouraged by the technology investments and the capital investments we've made and we hope to continue to drive cost out of our products.

Operator

Our next question comes from Pete Skibitski with Alembic Global

Pete Skibitski -- Alembic Global -- Analyst

Hey good morning guys. Just a follow-on to Seth's question on the Kennedy. Chris, I think you said you're going to get the contract definitization that's going to maybe move the risk registers to the right a little bit. I just want to make sure I'm in line with -- I think I've been assuming that the Kennedy retirement opportunities -- risk retirement opportunities will be 2022, 2023. Is that still the case? Or have they shifted to the right at 2024 or 2025. I just want to level set that.

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

No, no, 2023 and 2024 make a lot of sense. We're really in volume when it comes to Seventy nine right now, getting two compartments and work packages, starting localized testing but it's 2023, 2024 time frame.

Pete Skibitski -- Alembic Global -- Analyst

Okay. Great. I appreciate that. And maybe one for you, Mike. I always like to ask, any hope left on -- with NSC Twelve, it seems like all the committees have reported. I wasn't sure if anyone stuck in any language or funding at all with regard to that?

Mike Petters -- President and Chief Executive Officer

Well, I think you're reading that right. We are -- we have a great product line there, and we're very excited about what we've done. But right now, there's -- in the contest for resources, it's not faring very well. So we'll probably just leave it at that.

Pete Skibitski -- Alembic Global -- Analyst

Yes, the coast guard always seems to come up short. I know. It's too bad.

Operator

Our next question comes from David Strauss with Barclays

David Strauss -- Barclays -- Analyst

Thanks good morning. I wanted to ask about Alion. I think when you announced the deal, you talked about $1.6 billion in kind of annualized revenue. Based on what you did in the quarter and when you're applying for the year-end, it would seem like either it's running well below that? Or you're expecting big growth in 2022. Can you just comment on that?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Sure, yes. It's Tom here. So for the quarter, I think in my remarks, you'll see $163 million in Q3 is from Alion's perspective. You kind of run that out for another quarter, for Q4 that's the run rate, a little over $300 million there. So collectively, it's about $450 million.

On an annualized basis, that's like $1.4 billion and change, right? And then to get to the $160 million the growth rate of a little bit higher than 11.5%, 12%. So that's the math of it. Right now, we still stand by the guidance that we provided in the July time frame.

We're coming through our annual plans this time of the year right now and [Indecipherable] draft, and we're working ourselves through Executive Management Board. We still stand by those projections of $1.6 billion in revenue and the $135 million of adjusted EBITDA.

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

David, this is Chris. I'd also add that the integration of the front end of that business has gone very well in business development and capture. We have a $60 billion total pipeline that we're working through and prioritizing a number of significant competition over the next 12 to 18 months and a book-to-bill at one point eight in the quarter. So all indications are positive for that business.

David Strauss -- Barclays -- Analyst

Okay. As a follow-up, I wanted to ask about the -- Tom, the long-term free cash flow profile. Obviously, you're sticking with the $3.2 billion. I think previously, you had said that 2022,2023, 2024, that time frame would be fairly -- free cash flow over that period would be fairly ratable across those years. Is that still the view? Or is there -- is it going to ramp during that period?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Yes. So as we said, the $3.2 billion is still good, right? We have $757 million behind us. I've given you the outlook for this year, that's about $1.1 billion and that leaves $2.1 billion last over the last three years. So straight math would be about $700 million. We do have next year, as I mentioned, we have to pay back the FICA payment, that's $66 million.

We have the progress payment that have to be paid back at around $160 million. So you can do some math on that, but there is a ramp to it. So between those two payments and just a slight ramp, I mean you can just model those three years out, but we still feel it's comfortable and it's appropriate to guide to $3.2 billion over these five years.

Operator

[Operator Instructions] Our next question comes from Noah Poponak with Goldman Sachs.

Noah Poponak -- Goldman Sachs -- Analyst

Hi, good morning everyone. Tom, just with these outside of the normal course of business items, supply chain, logistics, material labor, and then also combining that with the -- with how the growth compares shake out? Should we be thinking of next year the shipbuilding growth rate being fairly back-end loaded versus the first half? And then just following up on that Alion discussion there, are you seeing -- we've seen those headwinds across hardware. And outside of hardware, are you seeing some of those same challenges outside of the business in Alion or not as much?

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Sure. So for the first part, from a shipbuilding perspective, I highlighted a little bit earlier, I didn't hit the backlog piece of the outlook, right? So unlike, say, requiring the new awards or funding, we have a line of sight of the work that we have in-house. So I look at it from an outlook perspective from shipbuilding, still the 3% CAGR is good. I would tell you that although it looks like we're at the same point we were through the first three quarters of this year compared to last year, last year was an exceptional year, 2019 to -- 2018 to 2019 with a 6% growth and then 2019 to 2020 was another 6% growth.

And even specifically, Q4 last year, was a 19% growth over the quarter previously there. So some material, as I highlighted -- actually, Chris highlighted, moved into the end of Q4 of 2020 and made that year look kind of big, which now makes 2021 look flat. So I'm not concerned right now because we have the backlog. We have the work. We have the labor force right now. We are watching material, as I said, and we're watching [DEO] mandate impacts our workforce. But I don't -- I'm not concerned with how 2021 is shaking out from a revenue perspective.

And I would think kind of going forward that it's pretty linear in 2022 for shipbuilding. Relative to your Alion question, I don't see, obviously, their contracts are different, more service oriented. We're excited with them on board. Andy's put his leadership team in play. As Chris had mentioned earlier, the initial assessments that we had going into the purchase and now to close, we've had a good six weeks run rate in the financial that look under the hood there. So we're comfortable with what's in front of them, the items that they're bidding and how they're executing on the existing contracts.

We're evaluating the revenue synergies between Alion making us better, the DFS and MDIS and vice versa. So I feel comfortable with that going forward there. I don't see today again, the DEO mandate significantly impacting our revenue expectations from Alion perspective. We have highlighted from a TSD perspective. We're eager to watch the funding come about and the unmanned portfolio evolving growth kind of going forward, so that's a watch on for us.

Operator

I'm not showing any further questions at this time. I would now like to hand the call back over to Mr. Petters with any closing remarks.

Mike Petters -- President and Chief Executive Officer

Well, thank you, and I want to thank everyone for joining us on today's call. Before I close, I wanted to pass on to you that Dwayne Blake has informed me that he wishes to retire.

Dwayne B. Blake -- Corporate Vice President of Investor Relations

You made that request, Mike, so...

Mike Petters -- President and Chief Executive Officer

Yes, I've already turned it down a couple of times. But Dwayne and his family, they've been parts of our family here for thirty seven years. His personal support for all of us here at Huntington -- throughout his career, but especially in his last position here, had just been extraordinary. So you call today to harass Dwayne about the filing or the call, just remember, he's a short timer now.

And so he might have some leverage in that call. So with that, we wish Dwayne and his family well, and we wish them all the best as they move forward with the next chapter of their lives. And with that, we appreciate your interest in HII, and we welcome your continued engagement and your feedback. Thank you very much.

Operator

[Operator Closing Remarks]

Duration: 49 minutes

Call participants:

Dwayne B. Blake -- Corporate Vice President of Investor Relations

Mike Petters -- President and Chief Executive Officer

Christopher D. Kastner -- Executive Vice President and Chief Operating Officer

Thomas E. Stiehle -- Executive Vice President and Chief Financial Officer

Myles Walton -- UBS -- Analyst

Doug Harned -- Bernstein -- Analyst

Seth Seifman -- JPMorgan -- Analyst

Ron Epstein -- Bank of America -- Analyst

George Shapiro -- Shapiro Research-George Shapiro-Shapiro Research -- Analyst

Richard Safran -- Seaport Research -- Analyst

Pete Skibitski -- Alembic Global -- Analyst

David Strauss -- Barclays -- Analyst

Noah Poponak -- Goldman Sachs -- Analyst

More HII analysis

All earnings call transcripts