It is worth noting that cryptocurrencies and trading are no longer an exotic phenomenon. Even conservative-minded politicians are beginning to realize that cryptocurrencies or their further development will somehow affect the economy of the future.

Every single day, we can see new laws and decrees aimed at providing cryptocurrencies and blockchain technology with greater freedom of use and application.

Despite the volatility of the main cryptocurrencies, this market is expanding, thus providing enthusiasts with opportunities to develop the industry or simply to make a profit.

The easiest way to make money on cryptocurrencies is to invest in any coin and speculate on the volatility of exchange rates. However, regardless of whether traders and investors will earn money or lose it, the cryptocurrency exchange will benefit in both cases, but this is possible only in one situation: When the founders of such a business take into account all possible nuances (technical, legal, and even related to user activity).

So, how to open a cryptocurrency exchange? What do you need to know to launch your own cryptocurrency exchange? What resources are required to create your own exchange to work with Bitcoin?

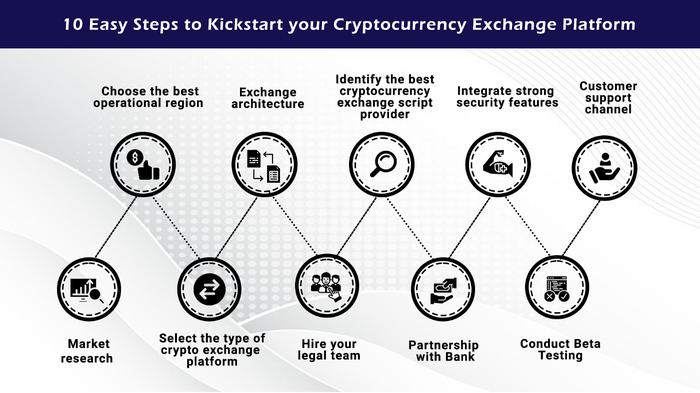

This article is a detailed guide on how to create your own cryptocurrency exchange and make sure that it has a chance of success in the Bitcoin or other digital assets trading market.

We are going to look at all the key steps that you need to take as a future owner of exchange business.

1. Choosing the type of exchange

Determining the type of exchange is the first and very important decision that must be made on the way to creating a cryptocurrency exchange.

Your next actions depend on this step, including licensing, software selection, hiring specialists, and interaction with commercial organizations.There are three ways of the exchange creation process in the field of cryptocurrencies: Centralized, decentralized, and hybrid.

Accordingly, there are three types of crypto exchanges: centralized (CEX), decentralized (DEX), and hybrid. Let us take a look at each of them

The Centralized Exchange (CEX) is a well-established solution in the cryptocurrency industry and is a centralized managed platform that brings buyers and sellers of digital currencies together. The CEX principle implies that the platform owner is responsible for the user's assets.

The biggest advantage of such an exchange is that CEX is easy to use. It offers a high level of performance, and also has perfect UI and UX. In order to start trading, one only needs to register via email and create a password. In the majority of cases, centralized exchanges offer high-quality customer support, a huge variety of trading pairs, and gateways for withdrawals and deposits of fiat currencies.

At the same time, by using CEX services, you have no way to own your personal keys. In other words, you trust your funds to the platform on which they are stored. Exchanges of this type are vulnerable to hacker attacks.

Some users may feel uncomfortable knowing that they have to share their personal data when going through the KYC procedure.

These are the main disadvantages of CEX.

First of all, the future owner of a CEX exchange has to ensure the security of the exchange, as well as the convenience for users and the processes of aggregation of liquidity.

Decentralized Exchanges (DEX) are an alternative to CEX.

In this case, the company or another person is not responsible for your assets, while all transactions are carried out by using smart contracts and decentralized applications.

Therefore, the main advantage of decentralized exchanges is the absence of security breaches, provided that smart contracts are written in compliance with all necessary procedures.

On the other hand, users will have to deal with the following disadvantages: low liquidity, poor user interface, limited transaction speed, lack of fiat gateways, and lack of customer support.

If are thinking about opening a DEX cryptocurrency exchange, you need to understand that your cryptocurrency exchange will be less attractive for beginning and inexperienced users due to the fact that it does not provide customer support, and also does not provide fiat gateways, unlike CEX.

Hybrid exchanges combine the advantages of the CEX and DEX approaches.

They offer high transaction speed and also provide a high level of security because the customer remains the owner of the private key.

This type of exchange is still in the development stage, and it may take several years to see how it will fit into the market and whether it will be able to replace the traditional DEX and CEX.

2. Choosing a jurisdiction

As we mentioned earlier, investing in cryptocurrencies and tokenization of assets is a trend that is unlikely to disappear in the foreseeable future, thus, regulation and government control over this area is likely to continue to develop.

Thus, anyone planning to open a cryptocurrency exchange should also think about the jurisdiction of the platform.

By choosing a jurisdiction to launch a crypto exchange, you are choosing a set of laws and trends, including taxation, accounting, and business management.

In different regions, regulatory conditions can greatly vary: From a clear set of rules to a total ban or a complete lack of regulation.

Even though the latter option may seem attractive, remember that sooner or later this legislative gap can be filled. It can affect you in a truly bad way regardless of the specifics of your business.

Such countries as Malta, Gibraltar, Switzerland, and Singapore are considered attractive for the crypto business.

However, any legislation tends to change, so it is necessary to monitor the situation in this area in order to be aware of any changes and register a company for cryptocurrency trading in the best location for your business.

The issue of integrating the payment system into the exchange is also related to jurisdiction.

Any cryptocurrency exchange should have a set of tools that allow exchanging cryptocurrencies for fiat currency to generate income. Therefore, before creating a cryptocurrency exchange, it is necessary to find out if it is going to be possible to cooperate with local banks to ensure the withdrawal and deposit of funds.

3. Software selection

The choice of software is one of the fundamental tasks that are critically important for launching a cryptocurrency business with the prospect of sustainable development.

Your software is responsible for executing transactions on your exchange, wallet operations, depositing and withdrawing funds, and many other vital processes.

Your choice determines the final cost of the technical solution and the time required to launch the exchange.

Crypto exchange architecture

The matching engine is the core of the exchange.

The matching engine is a system that collects all open buy and sell orders and compares them, thus ensuring the execution of transactions.

Crypto wallets allow you to store, deposit, and withdraw cryptocurrency.

There is a wide choice of wallets available: multi-currency wallets and those working with one type of cryptocurrency.

The functional model of the crypto business requires fiat gateways for depositing and withdrawing fiat money, as well as a security system that will ensure the safety of funds.

The key task of such a panel is to monitor the entire trading system, including wallets, and transactions.

This tool also serves to customize the website and add new features that may be required as your business grows.

A trading platform is software that allows traders to place orders and manage their trading accounts.

The popularity of the exchange among users largely depends on the convenience of using the platform.

The user's account is a portal where exchange customers can manage their funds.

The account allows you to register and check their balance, deposit and withdraw funds, as well as use available reporting and analytics tools.

Conclusion

In this article we tried to explain with the types of cryptocurrency exchanges and their structure, so opening your own cryptocurrency exchange is not an easy task according to the information given above, so everyone chooses the way based on the budget and team they have.

Alan Simao

Co-Founder at CCTech

https://cryptocurrency-exchange.software