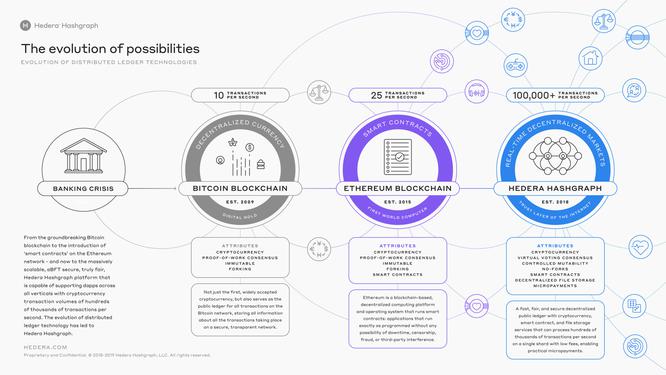

For the last 13 and a half years, since the launch of Bitcoin, blockchain technology has been captivating the minds of developers from all over the world. Even more so after 2015, with the launch of Ethereum. While Bitcoin did introduce the blockchain, for the next six years of its existence, it was only used for recording transactions.

Only after Ethereum’s launch and the discovery that blockchain can also record code did its development truly start. This led to the creation of smart contracts, and through them — every other product that blockchain has to offer today, including token models, dApps, DeFi, metaverse, and more.

Of course, this still did not perfect blockchain technology. Instead, some of the most pressing issues remained, such as the lack of scalability. Even Ethereum suffers from this problem. In fact, many would say that Ethereum is the prime example of this problem, with such a busy network and the inability to scale.

However, the blockchain industry could not survive with this issue troubling its blockchains, which is why developers started working on finding the solution, which led to the launch of projects such as Hedera Hashgraph. Today, we wanted to see what Hedera has to offer, and to compare it with Ethereum and see just how different the two projects really are.

About Ethereum

To start off, let’s talk about Ethereum first. Launched in 2015 as the crypto industry’s first development platform, rather than a simple digital ledger, Ethereum has introduced smart contracts which led to the creation of the crypto world’s largest ecosystem to date. With the introduction of the ability to build on it, the Ethereum network soon started attracting developers from all corners of the world.

The developers would use its technology to create new cryptocurrencies, develop decentralized applications, and over time, more complex products emerged. All of this made Ethereum’s network extremely rich, and extremely busy, which is why it definitely deserves to be the world’s largest altcoin, and the second-largest cryptocurrency.

However, while Bitcoin is, without a doubt, the slowest blockchain where scalability virtually doesn’t exist due to its 7 TPS, Ethereum is not much better with 15 TPS. In the early days while it only had a handful of users, everything was perfectly fine, as the network could handle their transactions. These days, however, with thousands, or even hundreds of thousands of users from all over the world, Ethereum simply can’t cope with demand.

Now, in the crypto industry, users need to pay a transaction fee when conducting transactions. But, they also get to choose how much they wish to pay. However, as they discovered after a while, the transactions with the largest fees tend to be processed first, so everyone who was in a hurry to have their payment verified would pay a high fee. This led to people increasing the fee that they were paying, so those who were in a hurry had to start paying even more, only for the rest of the community to follow.

This is how the average fee grew to the levels where it no longer makes sense to pay it, as it often exceeded the value of the transaction itself. In other words, users could no longer afford to even use Ethereum, which is why alternative chains started being created. Among them, we have Hedera Hashgraph.

About Hedera Hashgraph

Hedera Hashgrapsh was founded through an ICO in mid-2018, emerging as a sustainable, enterprise-grade public network meant to drive the decentralized economy that allows individuals and businesses alike to create powerful decentralized applications.

However, seeing the issues on Ethereum and Bitcoin, the project’s developers designed it to be a more efficient system that would eliminate the limitations of these older platforms, including instability and slow performance.

Originally, Hedera launched open access to its mainnet only a year after its ICO, in September 2019. Meanwhile, its native token, HBAR, is used for powering the network and its services, including smart contracts, file storage, regular transactions, and alike. HBAR is also used for securing the network through staking.

Ethereum vs Hedera Hashgraph

So, how do these two very similar, and yet very different chains compare?

To start with Ethereum — this blockchain has been the inception of modern blockchain technology. It emerged as a decentralized public ledger with two main components — a native cryptocurrency, Ether (ETH), and its own programming language called Solidity.

Ethereum introduced a variety of concepts that did not exist before, which makes it the first of its kind. Meanwhile, the project’s users from all over the world could access it, create, publish, monetize, and use dApps, and in doing so, enrich its entire ecosystem. Before long, Ethereum became a haven for creating and sharing applications, financial services, business, and more. In this sense, Hedera is not much different from Ethereum’s network. However, it does have several basic technical differences that make a huge difference in the long run.

The first major difference to note is that Hedera Hashgraph operates across the hashgraph consensus algorithm. It functions as a public distributed ledger, with a governing body created to support new and existing dApps at large scale.

Another major difference between the two projects is the hashgraph consensus algorithm. Hashgraph basically changes the concept of pruning in blockchain, and replaces it with weaving in the DLT sector. It controls the branches of the blocks and puts them back into the ledger’s body, ensuring that everything across the blockchain functions in perfect order.

This is already a significant improvement over Ethereum’s PoW algorithm that selects one single miner who will choose the next block. Hedera has significantly changed this entire concept with the hashgraph algorithm, as the project believes that the community of nodes needs to agree on which transactions should be allowed.

How to Buy Hedera (HBAR) and Ethereum (ETH)

Currently, Hedera (HBAR) and Ethereum (ETH) are each available for purchase on the following exchanges.

Uphold – This is one of the top exchanges for United States & UK residents that offers a wide range of cryptocurrencies. Germany & Netherlands are prohibited.

Uphold Disclaimer: Assets available on Uphold are subject to region. All investments and trading are risky and may result in the loss of capital. Cryptoassets are largely unregulated and are therefore not subject to protection.

Binance – Best for Australia, Canada, Singapore, UK and most of the world. USA residents are prohibited from purchasing most tokens. Use Discount Code: EE59L0QP for 10% cashback off all trading fees.

KuCoin – This exchange currently offers cryptocurrency trading of over 300 other popular tokens.It is often the first to offer buying opportunities for new tokens.This exchange currently accepts International & United States residents.

Conclusion

Ethereum is, without a doubt, the second most important crypto project that was ever invented, immediately after Bitcoin. Bitcoin started the crypto industry, but Ethereum and its products are responsible for the crypto/blockchain world that we have today, with all the different trends and products available to us today.

Without it, we would simply have a bunch of copies of BTC, and nothing else — no DeFi, no metaverse, no NFTs, or even dApps. However, even with that said, Ethereum has its flaws, and while it is working towards resolving them, it is still questionable how much success it can have.

Hedera and other chains that offer greater scalability have already eliminated all of these issues permanently, and we know for a fact that they have adequate levels of scalability. In other words, while we have a lot to be thankful for when it comes to Ethereum, its role in the future of crypto has yet to be decided.