Introduction

Huntington Ingalls Industries (HII) is one of the stocks in my portfolio that's currently underwater. I have frequently covered the stock in the past as I believe in its massive moat and ability to generate strong free cash flow. Right now, the stock is somewhat of a disappointment as its recent dividend hike was below what I expected and because its stock price is unable to keep up with both the market and industrial stocks, in general. However, that's where the bad news ends as the company is trading at an attractive valuation, offering an acceptable yield and because this stock lets me sleep very well at night. So, I'm going to use this article to update my investment case and to show you why I am adding shares.

Disappointing, But Not Bad

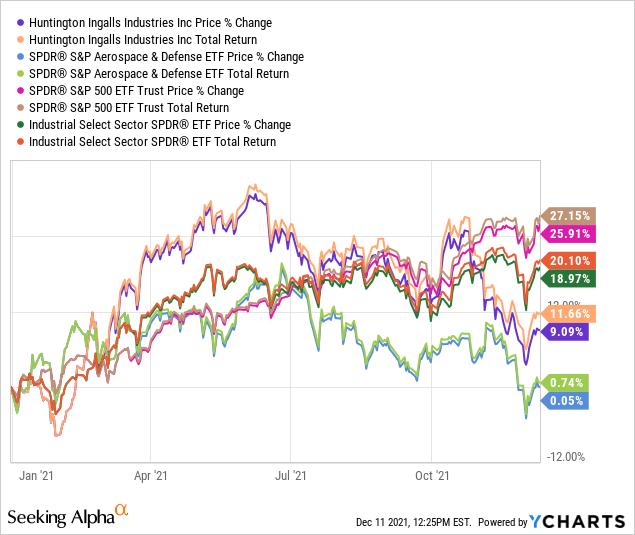

Let's start with the bad news. Since the start of the year, Huntington Ingalls has added 9.1% in capital gains. 12% including dividends (total return). This is below the Aerospace & Defense ETF (XAR) but well below the S&P 500 and Industrial ETF's (XLI) performances.

The problem is that defense companies are in a tough spot right now. As most are in a 'bucket' with other aerospace stocks, they are somewhat suffering because investors do not want aerospace exposure in times when COVID is far from over. The other factor is that supply chain issues are hurting capital- and labor-intensive companies like Huntington Ingalls and its peers. That's why most took a big dive after their 3Q21 earnings when companies had to shock investors with some pretty bad numbers.

For example, Huntington Ingalls missed 3Q21 revenue expectations by $170 million, which is almost 8% worse than expected. Nonetheless, the company beat EPS estimates as profitability and free cash flow generation were not an issue.

Regardless, the company hiked dividends by only 3.5% on November 3. That's not great given its history and a sign that management is playing it safe. It's disappointing as I think it's fair to say that people had higher expectations.

Far From Bad, Actually

One of the issues that contributed to supply chain issues was Biden's vaccine mandate. We can start an entire discussion on how ethical 'forced' vaccinations are, but I think everyone can agree that threatening people who refuse to get vaccinated with getting fired won't help already weak supply chains.

Hence, it was great news when a judge suspended the White House's vaccine mandate for contractors as Defense One reported.

With this in mind, the company is currently sitting on a backlog worth $50.1 billion. That's up from $45.3 billion in the prior-year quarter. Nonetheless, due to the vaccine mandate (prior to suspension) and labor issues, the company guided to $8.2 billion in revenues. That's at the low range of its prior outlook. Please keep in mind that technical solutions see $400 million more in sales due to the Alion acquisition. So, that's not organic.

Source: Huntington Ingalls 3Q21 Earnings Presentation

Based on that context, 2020 was disappointing as shareholder distributions fell below $300 million. Dividends made up almost 2/3rd of total distributions as buybacks hit the lowest level since the spin-off from Northrop Grumman (NOC). This continued in 2021 as the first three quarters saw a total buyback value of $94 million.

Source. Author

People who want to buy dividend growth and a 'good' yield do not have to buy HII. They go for common names like PepsiCo (PEP) or others. Hence, with buyback volume down and a slow dividend hike, I'm not blaming people for looking the other way.

What I like is the company's long-term outlook. HII dominates the market for the largest Navy ships and submarines with its competitor General Dynamics (GD). Now more than ever, a capable Navy is needed as global tensions are rising. China does have the world's largest Navy, but not the most powerful - but China isn't sleeping and looking for ways to increase its influence in Asia. The UK, Australia, and the US are now working together on new nuclear submarines for the country Down Under.

I'm not making the case for war and I'm not trying to put a number on future investments in HII's ships. What matters to me is that the companies I own are bulletproof. HII is getting more important.

Looking at 2022, we see that the company is likely doing $550 million in free cash flow. Free cash flow is basically net income adjusted for non-cash items and capital expenditures. It's what the company can distribute to shareholders without having to take on new debt. It's volatile in HII's case because the company is depending on a number of large projects - unlike other companies like Lockheed Martin (LMT) who have 'smoother' free cash flow. Using $550 million in free cash flow, we're dealing with a 7.5% free cash flow yield (based on a $7.3 billion market cap). The current dividend yield is 2.5%. So, there's a lot of room for buybacks and dividend hikes in the future. For 2023, expectations are that HII could do $740 million in FCF. That's a 10% FCF yield.

Source: Author

So, with that said, let's look at the valuation.

Valuation

Huntington Ingalls has a $7.3 billion market cap, roughly $1.2 billion in pension-related liabilities, and an expected net debt load of roughly $2.6 billion next year. That's up from $1.2 billion last year, as it includes the Alion acquisition.

In terms of EBITDA, we're likely going to see $1.0 billion next year. This year, it will be closer to $830 million. The peak was in 2019 at $1.2 billion.

All of this gives us an enterprise value of $11.1 billion and an EBITDA multiple of 11.1x. 2023 EBITDA is likely $1.2 billion again, which puts the valuation in the 9-11x range.

Bear in mind that the chart below does not include pensions. I included pensions. My multiple (adjusted for pensions) is 9-10x(ish), so that's far from overvalued.

The same goes for the company's yield. 2.5% is one of the highest in its short history as a stand-alone company. The same goes for the relative performance versus the S&P 500 (lower part of the graph below), which has hit lows not seen since 2013.

Needless to say, both its valuation and underperformance are making this a more attractive investment. We're not chasing a hot stock here.

Takeaway

Huntington Ingalls has a 3.0% weighting in my portfolio. Only Northrop Grumman is smaller (also too small, but I will get to that later). The only reason the stock is so small in my portfolio is that I didn't meaningfully add to its exposure and because its performance was slow - so far.

Source: Author

The reason I want to buy more HII is quality. The company has a fantastic business, which is bulletproof and a cornerstone of America's Navy. The company is negatively impacted by labor issues and related supply chain problems. Nonetheless, with the vaccine mandate off the table and a poor stock price performance, I am adding to this investment.

The company has a lot of upside potential to significantly boost dividends and buybacks without having to neglect balance sheet improvements.

The only thing I don't like is the fact that its yield is only 2.5%. Lockheed offers a 3.3% yield. However, its free cash flow yield is high, which makes this yield very acceptable on a long-term basis.

Long story short, it's a good fit for conservative dividend growth investors. Use weakness to initiative a position or to add to an existing one.

(Dis)agree? Let me know in the comments!