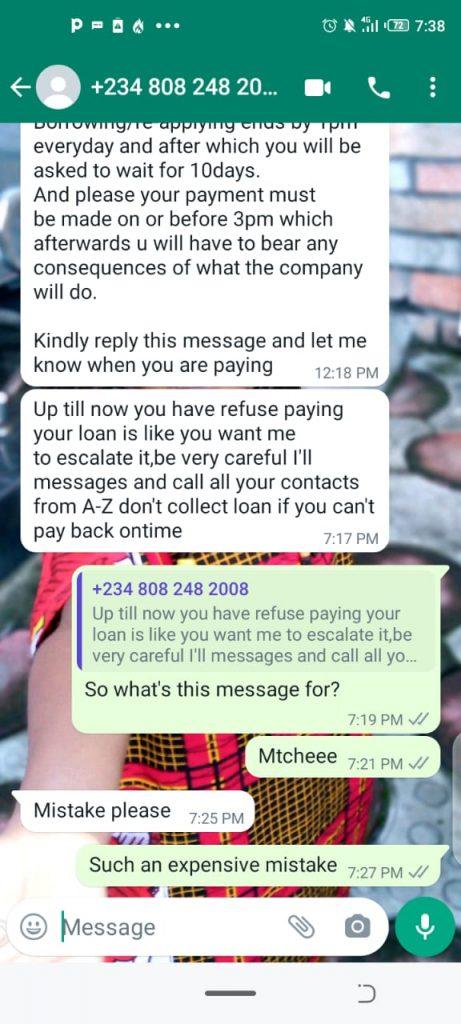

In December 2021, Ada Daniel*, a young Nigerian lady, received a message from an unknown number claiming to be a representative of LCredit, to remind her of a purported loan while also threatening legal actions against her.

The sender, however, acknowledged later that the WhatsApp message he sent was a mistake after Ada challenged him.

LCredit is an online loan lending platform that offers short-term loans to Nigerians who need quick cash.

The 29-year-old Abuja-based staff of a top newspaper company received the message after collecting her Android phone from a phone engineer, whom she patronised in December 2021.

Subsequently, Ada began to receive threats from unknown numbers and different financial technology companies both online and offline.

The messages were coming from financial technology companies, online loan lending platforms offering short-term loans.

They all were all alleging that Ada had borrowed money from them and was yet to repay her loans

They were all threatening to destroy the young lady’s reputation and later began to send all manner of vicious messages to her contacts, claiming that Ada was a debtor and a fraudster.

Her close friends, former schoolmates, and work colleagues all received the messages, some on a daily basis.

“I was looking for money to pay them. I was depressed. They were sending messages to my entire contacts, not only family members.

“All they did was constantly insult, threaten and curse. I tried explaining to everyone on my contact list, whom I could get in touch with,” Ada told DAILY POST.

But despite telling all the FinTech platforms and their agents that she did not borrow from them, they continued to harass Ada and her family.

In one of the texts sighted by DAILY POST, an agent of one of the FinTech companies made further threats on her family, friends, relationships and business associates.

The text read, “it will bring issues to your relationships, family affairs, business associates and working places. Those that know me know, I don’t have mercy,” the sender wrote.

In another text Ada received in January, another agent sent a fresh threat, saying, “you won’t only lose what you have laboured for but I will make sure I finish you in all ramifications. I won’t stop hurting you until you lose everything that is you.”

Another agent, this time from MintLoan FinTech, threatened that the company will withdraw money from Ada’s bank account or blacklist her BVN if no money was found in her account.

The agent further threatened that Ada would never be able to travel out of the country.

However, on investigations, it was found that someone had used Ada’s SIM cards to take loans from several online loan platforms including, LCredit, 9credit, Soko Loan, Ncash, Borrow Now, Palmcash, NowCash and many more which gave the fintech access to her contacts.

Breach of privacy, unprofessional conducts of fintech platforms

The unprofessional conduct of loan platforms has continued to be a source of concern to many Nigerians.

DAILY POST gathered that the companies aside from invading the privacy of customers using details submitted while seeking such loans also use questionable and illegal strategies in a bid to recover their monies.

Agents of such platforms go as far as threatening the life of clients, harassing them and their contacts and threatening the use of spiritual powers on debtors.

However, following the increased outcry over such breach of customers’ privacy and data invasion by online banks, especially digital loan providers, the federal government, in January, began a probe into the matter.

The Director-General, National Information Technology Development Agency, NITDA, Kashifu Inuwa in a recent media statement said his agency was working with the Nigeria Police and other relevant agencies to investigate some lending platforms. “We are working with relevant agencies to make sure we address that challenge because it is not only NITDA’s mandate that governs everything.

“When you talk about financial services, it is the CBN. When you talk about general complaints, there is a commission for that. But NITDA plays a critical role because of the breach of data privacy.

“We have sanctioned some of them. We are working with the Nigeria police, investigating many of them. We are working to address the challenge,” Inuwa said.

Meanwhile, NITDA had, in November, partnered with the Federal Competition and Consumer Protection Commission (FCCPC) to address the increasing rates of data privacy abuse by money lending organisations, particularly fintech firms.

In August 2021, NITDA imposed a sanction of N10 million on an online lending platform, Soko Lending Company Limited (Soko Loans), for data privacy invasion.

The key basis for the fine was the company’s ‘privacy-invading messages’ to defaulting customers’ contacts, their strategy of loan recovery violates Article 2.2 of the Nigeria Data Protection Regulation (NDPR), which bans illegal data sharing with third parties without a legal basis.

But these fintech companies still continue to invade the privacy of Nigerians.

The online loan apps, on their web pages, before disbursing loans to their customers, collect certain data, claiming the data would be used to provide the service, verifying identity and creating credit scoring models to determine what Loans can be offered to the user.

An investigation by DAILY POST showed that some fintech companies engage in social shaming strategies to recover debt from defaulters. They send embarrassing messages both online and offline to their contacts with the intention of shaming them.

In some cases, the names, phone numbers and pictures of the alleged loan defaulters are shared with their contacts and sometimes are declared wanted by the FinTechs.

Fintech platform declared defaulter dead

Many of the loan app users who spoke to DAILY POST recently lamented the unethical and dehumanizing strategies they employ.

Recently an alleged defaulter was declared dead. The Loan platform designed and circulated his supposed obituary with his family and friends.

On a public group on Facebook, a customer of a loan app, Oluwafeyinkemi Alademehin said, “My loan was just due yesterday from Mintloan and this was the message I received from Mintloan they even want to start doing obituary for the living.”

A customer, Azuwuike Chinedu Achiever recently shared his experience with a loan company on social media. He said he had defaulted in his repayment plan for five days and the next thing he saw was his obituary.

Another customer, Funmilayo Kalejaiye was allegedly cursed by an agent of a loan app who claimed to be a manager of the NextCredit app platform. He told her she would run mad.

The message shared to DAILY POST read, “I swear before god and man, I want you to mark today’s date, if you don’t run mad, because of this payment and your attitude, then am not the manager of this great company, inform all your family members, all about this attitude of yours, because I will face you both physically and spiritually I promise you that thanks.”

When DAILY POST spoke with the man who claimed to be the manager of NextCredit, who the Truecaller app identified as ‘Manager Godwin’, he confirmed sending the message to Kalejaiye due to her attitude towards him.

He told our reporter that the company was no longer asking for the money but further threatened Kalejaiye to await the repercussions of her actions.

Checks by DAILY POST on the database of the Corporate Affairs Commission (CAC) showed that the status of NextCredit was “inactive”. This according to a CAC agent means that the company has not been paying its annual returns to the Commission account.